Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PRESENT VALUE OF ANNUITIES AND ANNUITY PAYMENTS (ANSWER ALL PLEASE) Multiple Choice (Answer all, first question is wrong i think..) Here are the selections for

PRESENT VALUE OF ANNUITIES AND ANNUITY PAYMENTS (ANSWER ALL PLEASE)

PRESENT VALUE OF ANNUITIES AND ANNUITY PAYMENTS (ANSWER ALL PLEASE)

Multiple Choice (Answer all, first question is wrong i think..)

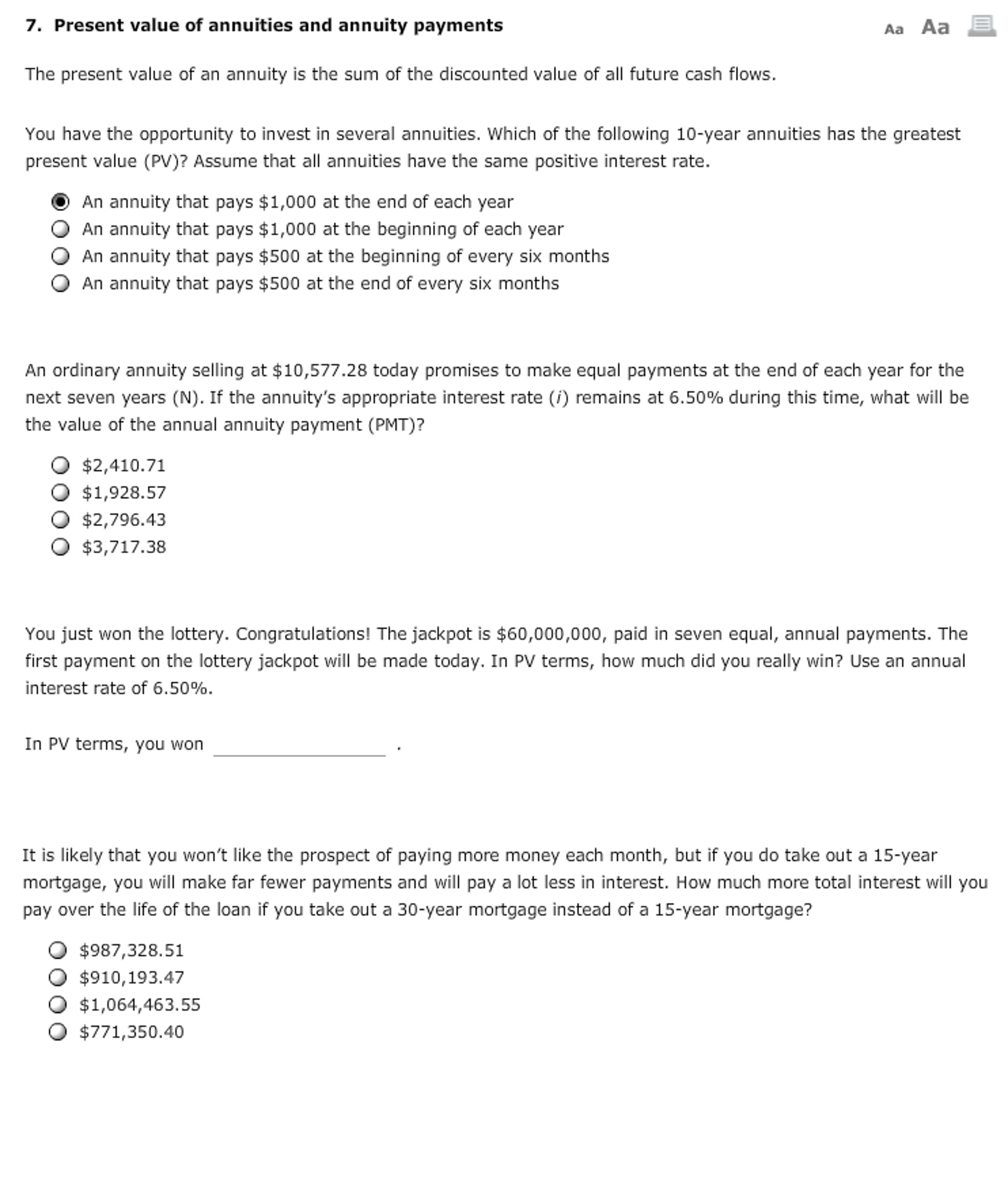

Here are the selections for fill in the Blank - 47,010,169.46 , 73,053,170.864 , 77,801,626.970 , or 50,065,830.49

7. Present value of annuities and annuity payments Aa Aa The present value of an annuity is the sum of the discounted value of all future cash flows You have the opportunity to invest in several annuities, which of the following 10-year annuities has the greatest present value (PV)? Assume that all annuities have the same positive interest rate. O An annuity that pays $1,000 at the end of each year O An annuity that pays $1,000 at the beginning of each year O An annuity that pays $500 at the beginning of every six months O An annuity that pays $500 at the end of every six months An ordinary annuity selling at $10,577.28 today promises to make equal payments at the end of each year for the next seven years (N). If the annuity's appropriate interest rate (i) remains at 6.50% during this time, what will be the value of the annual annuity payment (PMT)? O $2,410.71 O $1,928.57 O $2,796.43 O $3,717.38 You just won the lottery. Congratulations! The jackpot is $60,000,000, paid in seven equal, annual payments. The first payment on the lottery jackpot will be made today. In PV terms, how much did you really win? Use an annual interest rate of 6.50% In PV terms, you won It is likely that you won't like the prospect of paying more money each month, but if you do take out a 15-year mortgage, you will make far fewer payments and will pay a lot less in interest. How much more total interest will you pay over the life of the loan if you take out a 30-year mortgage instead of a 15-year mortgage? O $987,328.51 O $910,193.47 O $1,064,463.55 O $771,350.40Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started