Question

Presented below are condensed financial statements adapted from those of two actual companies competing in the pharmaceutical industryJohnson and Johnson (J&J) and Pfizer, Inc. ($

Presented below are condensed financial statements adapted from those of two actual companies competing in the pharmaceutical industryJohnson and Johnson (J&J) and Pfizer, Inc. ($ in millions, except per share amounts).

| Balance Sheets ($ in millions, except per share data) | |||||||

| J&J | Pfizer | ||||||

| Assets: | |||||||

| Cash | $ | 8,877 | $ | 4,597 | |||

| Short-term investments | 4,791 | 11,047 | |||||

| Accounts receivable (net) | 7,299 | 9,500 | |||||

| Inventories | 4,248 | 6,977 | |||||

| Other current assets | 4,085 | 3,950 | |||||

| Current assets | 29,300 | 36,071 | |||||

| Property, plant, and equipment (net) | 11,626 | 20,067 | |||||

| Intangibles and other assets | 16,702 | 70,027 | |||||

| Total assets | $ | 57,628 | $ | 126,165 | |||

| Liabilities and Shareholders' Equity: | |||||||

| Accounts payable | $ | 5,641 | $ | 3,276 | |||

| Short-term notes | 2,294 | 9,973 | |||||

| Other current liabilities | 7,968 | 12,863 | |||||

| Current liabilities | 15,903 | 26,112 | |||||

| Long-term debt | 3,580 | 6,380 | |||||

| Other long-term liabilities | 5,606 | 22,601 | |||||

| Total liabilities | 25,089 | 55,093 | |||||

| Capital stock (par and additional paid-in capital) | 3,870 | 67,800 | |||||

| Retained earnings | 36,128 | 34,907 | |||||

| Accumulated other comprehensive income (loss) | (690 | ) | 220 | ||||

| Less: Treasury stock and other equity adjustments | (6,769 | ) | (31,855 | ) | |||

| Total shareholders' equity | 32,539 | 71,072 | |||||

| Total liabilities and shareholders' equity | $ | 57,628 | $ | 126,165 | |||

| Income Statements | |||||||

| Net sales | $ | 44,537 | $ | 47,863 | |||

| Cost of goods sold | 12,806 | 10,462 | |||||

| Gross profit | 31,731 | 37,401 | |||||

| Operating expenses | 20,373 | 29,096 | |||||

| Other (income) expensenet | (460 | ) | 3,685 | ||||

| Income before taxes | 11,818 | 4,620 | |||||

| Tax expense | 3,545 | 1,386 | |||||

| Net income | $ | 8,273 | $ | 3,234 | * | ||

| Basic net income per share | $ | 2.67 | $ | 0.47 | |||

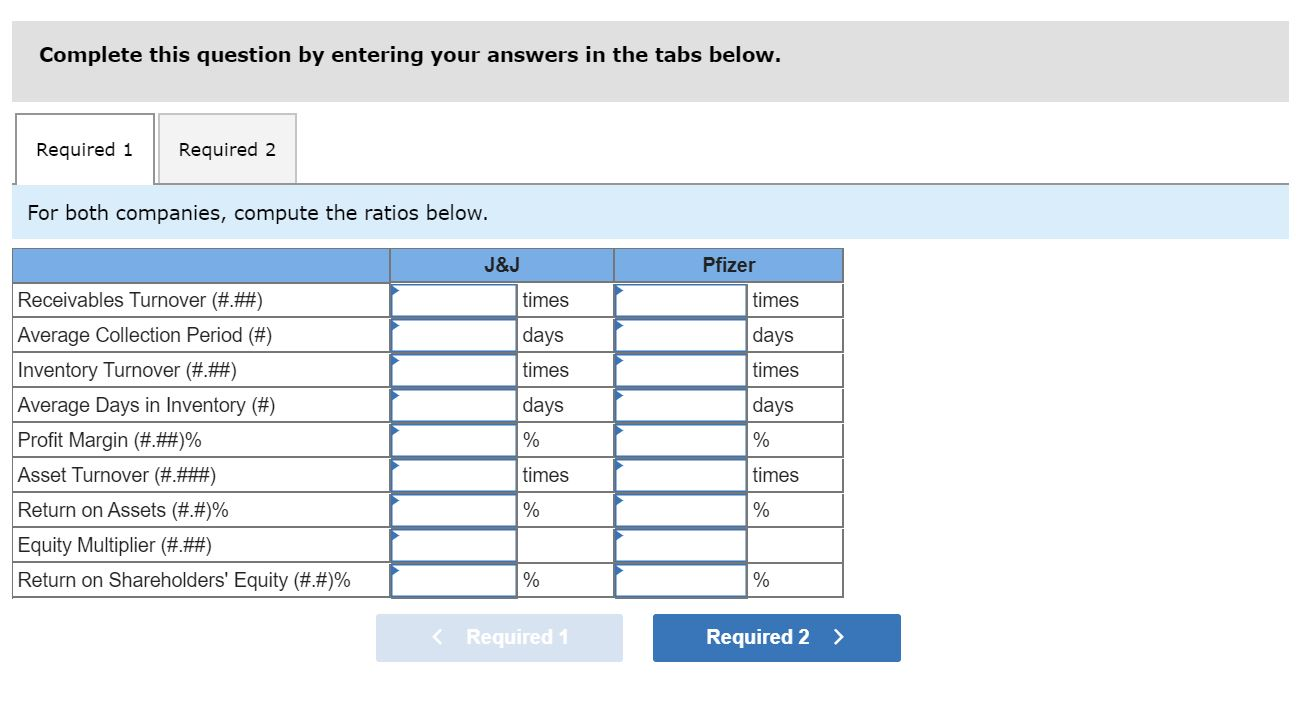

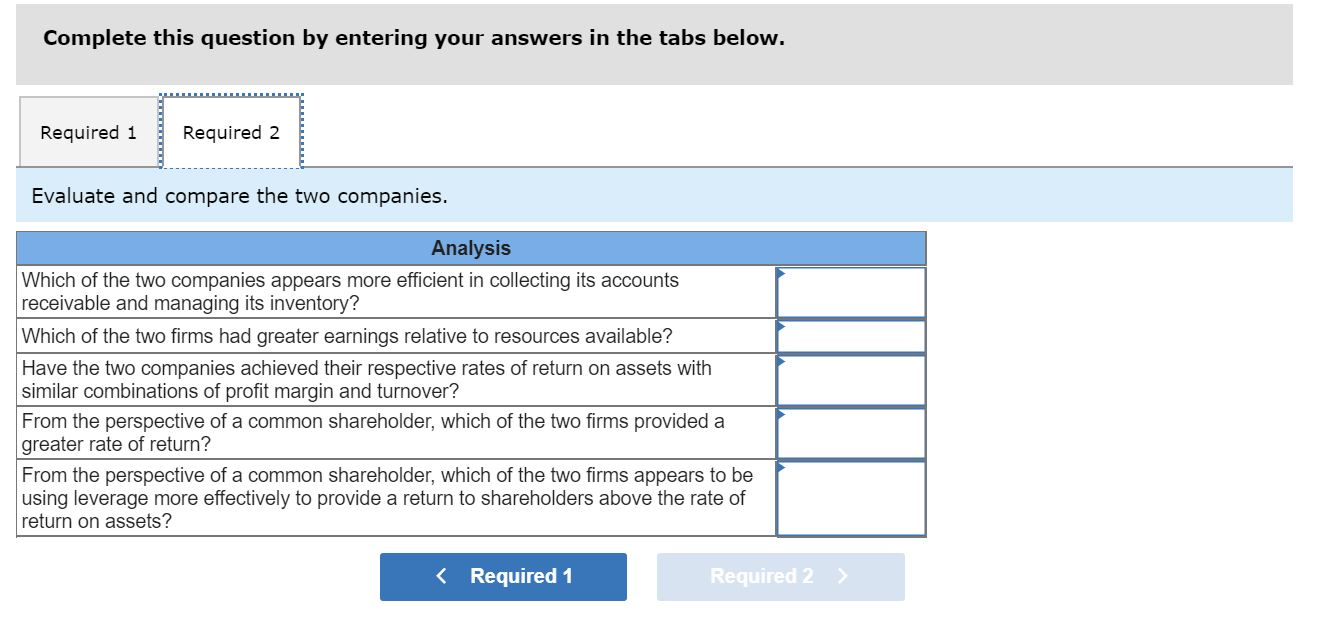

* This is before income from discontinued operations. Evaluate and compare the two companies by responding to the following questions. Note: Because two-year comparative statements are not provided, you should use year-end balances in place of average balances as appropriate. Required: 1. For both companies, compute the ratios below. 2. Evaluate and compare the two companies.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started