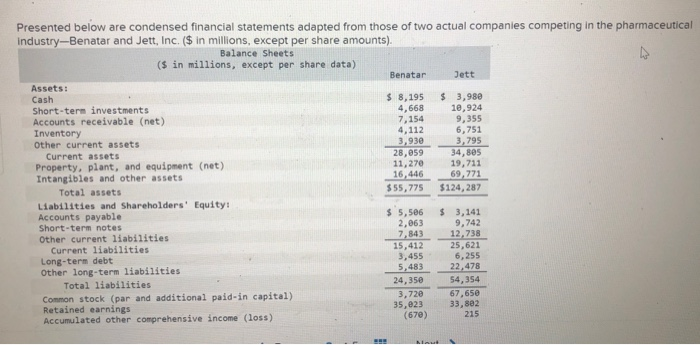

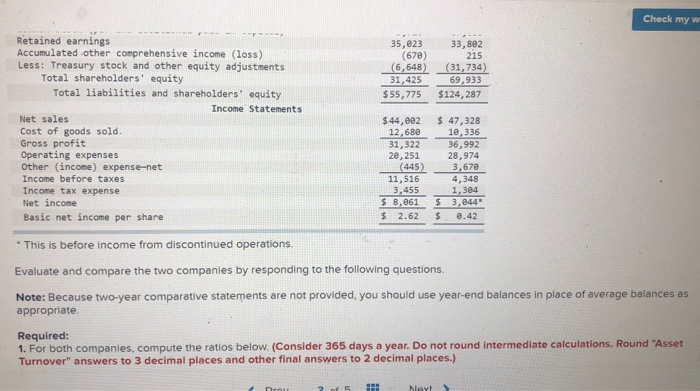

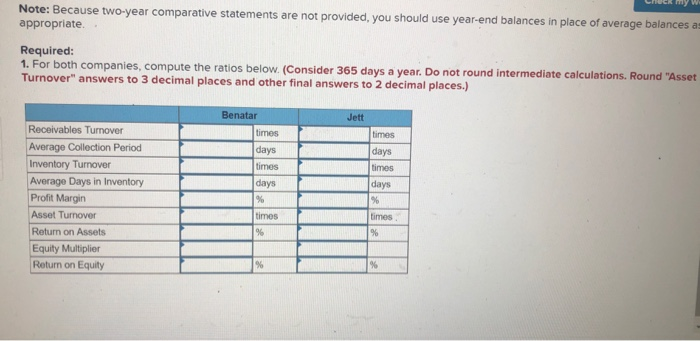

Presented below are condensed financial statements adapted from those of two actual companies competing in the pharmaceutical industry-Benatar and Jett, Inc. ($ in millions, except per share amounts). Balance Sheets ($ in millions, except per share data) Benatar Jett Assets: Cash $ 8,195 $ 3,980 Short-term investments 4,668 10,924 Accounts receivable (net) 7.154 9,355 Inventory 4.112 6,751 Other current assets 3,930 3,795 Current assets 28,059 34,805 11,270 19.711 Property, plant, and equipment (net) Intangibles and other assets 16,446 69,771 Total assets $55,775 $124,287 Liabilities and Shareholders' Equity! Accounts payable $ 5,586 $ 3,141 Short-term notes 2.063 9.742 Other current liabilities 7,843 12,738 Current liabilities 15,412 25,621 Long-term debt 3,455 6,255 Other long-term liabilities 5,483 22,478 Total liabilities 24,350 54,354 Common stock (par and additional paid-in capital) 3,720 67,650 Retained earnings 35,823 33,882 (670) 215 Accumulated other comprehensive income (loss) Check my w 35,023 (670) (6,648) 31,425 $ 55,775 33,892 215 (31,734) 69,933 $124,287 Retained earnings Accumulated other comprehensive income (loss) Less: Treasury stock and other equity adjustments Total shareholders' equity Total liabilities and shareholders' equity Income Statements Net sales Cost of goods sold. Gross profit Operating expenses Other (income) expense-net Income before taxes Income tax expense Net income Basic net income per share $44,092 12,680 31,322 20, 251 (445) 11,516 3.455 $ 3,061 $ 2.62 $ 47,328 10,336 36,992 28,974 3,670 4,348 1,304 $ 3,844 $ 0.42 * This is before income from discontinued operations Evaluate and compare the two companies by responding to the following questions. Note: Because two-year comparative statements are not provided, you should use year-end balances in place of average balances as appropriate Required: 1. For both companies, compute the ratios below. (Consider 365 days a year. Do not round Intermediate calculations. Round "Asset Turnover" answers to 3 decimal places and other final answers to 2 decimal places.) Nevt Note: Because two-year comparative statements are not provided, you should use year-end balances in place of average balances a appropriate. Required: 1. For both companies, compute the ratios below. (Consider 365 days a year. Do not round intermediate calculations. Round "Asset Turnover" answers to 3 decimal places and other final answers to 2 decimal places.) Jett times Benatar times days timos days times days Receivables Turnover Average Collection Period Inventory Turnover Average Days in Inventory Profit Margin Asset Turnover Return on Assets Equity Multiplier Return on Equity days I times 1 the times %