Question

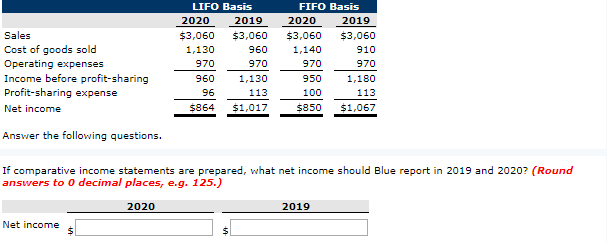

Presented below are income statements prepared on a LIFO and FIFO basis for Blue Company, which started operations on January 1, 2019. The company presently

Presented below are income statements prepared on a LIFO and FIFO basis for Blue Company, which started operations on January 1, 2019. The company presently uses the LIFO method of pricing its inventory and has decided to switch to the FIFO method in 2020. The FIFO income statement is computed in accordance with the requirements of GAAP. Blues profit-sharing agreement with its employees indicates that the company will pay employees 10% of income before profit-sharing. Income taxes are ignored.

Assume that Blue has a beginning balance of retained earnings at January 1, 2020, of $1,017 using the LIFO method. The company declared and paid dividends of $510 in 2020. Prepare the retained earnings statement for 2020, assuming that Blue has switched to the FIFO method. (Round answers to 0 decimal places, e.g. 125.)

Sales Cost of goods sold Operating expenses Income before profit-sharing Profit-sharing expense Net income LIFO Basis 2020 2019 $3,060 $3,060 1,130 960 970 970 960 1,130 FIFO Basis 2020 2019 $3,060 $3,060 1,140 910 970 970 950 1,180 113 - 100 113 $864 $1,017 $350 $1,067 Answer the following questions. If comparative income statements are prepared, what net income should Blue report in 2019 and 2020? (Round answers to O decimal places, e.g. 125.) 2020 2019 Net incomes BLUE COMPANY Retained Earnings Statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started