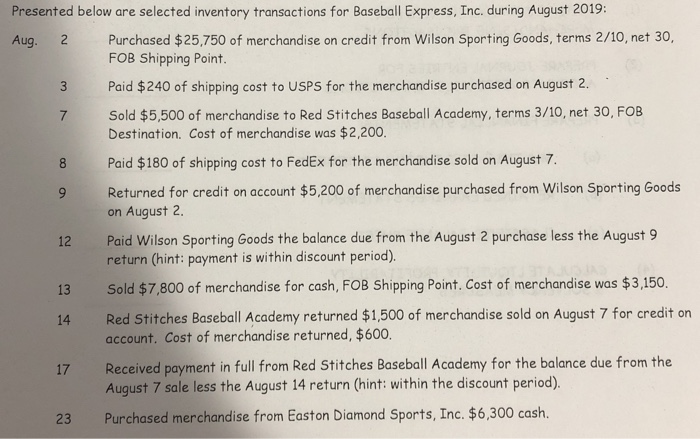

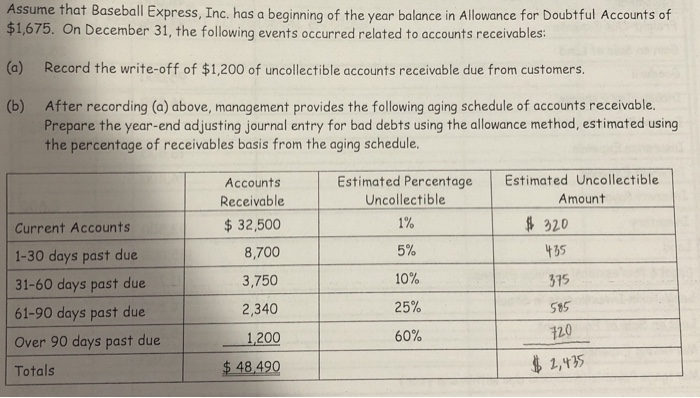

Presented below are selected inventory transactions for Baseball Express, Inc, during August 2019: Aug. 2 Purchased $25,750 of merchandise on credit from Wilson Sporting Goods, terms 2/10, net 30, FOB Shipping Point. Paid $240 of shipping cost to USPS for the merchandise purchased on August 2. Sold $5,500 of merchandise to Red Stitches Baseball Academy, terms 3/10, net 30, FOB Destination. Cost of merchandise was $2,200. Paid $180 of shipping cost to FedEx for the merchandise sold on August 7. Returned for credit on account $5,200 of merchandise purchased from Wilson Sporting Goods on August 2 Paid Wilson Sporting Goods the balance due from the August 2 purchase less the August 9 return (hint: payment is within discount period). Sold $7,800 of merchandise for cash, FOB Shipping Point. Cost of merchandise was $3,150. Red Stitches Baseball Academy returned $1,500 of merchandise sold on August 7 for credit on account. Cost of merchandise returned, $600. Received payment in full from Red Stitches Baseball Academy for the balance due from the August 7 sale less the August 14 return (hint: within the discount period). Purchased merchandise from Easton Diamond Sports, Inc. $6,300 cash. 23 Assume that Baseball Express, Inc. has a beginning of the year balance in Allowance for Doubtful Accounts of $1,675. On December 31, the following events occurred related to accounts receivables: (a) Record the write-off of $1,200 of uncollectible accounts receivable due from customers. (b) After recording (a) above, management provides the following aging schedule of accounts receivable, Prepare the year-end adjusting journal entry for bad debts using the allowance method, estimated using the percentage of receivables basis from the aging schedule, Accounts Receivable $ 32,500 8,700 Estimated Percentage Uncollectible 1% Estimated Uncollectible Amount $ 320 5% 435 3,750 375 Current Accounts 1-30 days past due 31-60 days past due 61-90 days past due Over 90 days past due Totals 2,340 10% 25% 60% 585 720 1,200 $ 48,490 $ 2,435 DATE 2019 GENERAL JOURNAL ACCOUNT TITLES REQUIREMENT (1) JOURNAL ENTRIES: DEBIT CREDIT GENERAL JOURNAL ACCOUNT TITLES DEBIT CREDIT DATE 2019 REQUIREMENT (2) JOURNAL ENTRIES: (a) Dec. 31 (b) Dec 31