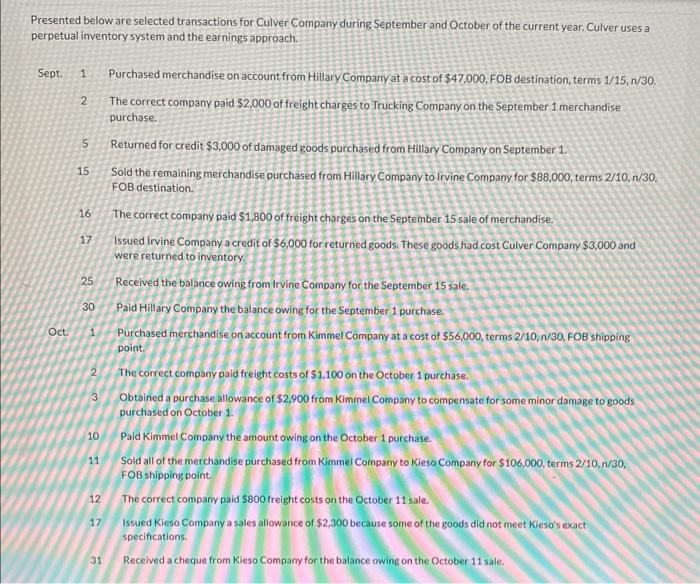

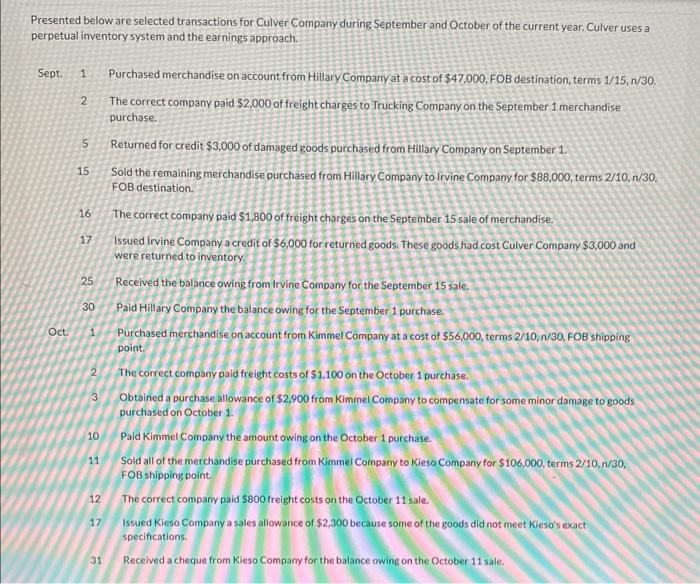

Presented below are selected transactions for Culver Company during September and October of the current year. Culver uses a perpetual inventory system and the earnings approach. Sept. 1 Purchased merchandise on account from Hillary Company at a cost of $47,000. FOB destination, terms 1/15,n/30. 2 The correct company paid $2,000 of freight charges to Trucking Company on the September 1 merchandise purchase. 5 Returned for credit $3,000 of damaged goods purchased from Hillary Company on September 1. 15 Sold the remaining merchandise purchased from Hillary Company to Irvine Company for $88,000, terms 2/10,n/30, FOB destination. 16 The correct company paid $1,800 of freight charges on the September 15 sale of merchandise. 17 Issued Irvine Company a credit of $6,000 for returned goods. These goods had cost Culver Company $3,000 and were returned to inventory. 25 Recelved the balance owing from Irvine Company for the September 15 sale. 30 Paid Hillary Company the balance owing for the September 1 purchase. Oct. 1 Purchased merchandise on account from Kimmel Company at a cost of $56,000, terms 2/10,n/30, FOB shipping point. 2. The correct company paid freight costs of $1,100 on the October 1 purchase. 3 Obtained a purchase allowance of $2,900 from Kimmel Company to compensate for some minor damage to goods purchased on October 1. 10 Paid Kimmel Company the amount owing on the October 1 purchase. 11 Sold all of the merchandise purchased from Kimme Company to Kieso Company for $106,000, terms 2/10,n/30, FOB shipping point. 12 The correct company paid $800 freight costs on the October 11 sate. 17 Issued Kieso Company a sales allowance of $2,300 because some of the goods did not meet Kieso's exact specifications. 31 Received a cheque from Kieso Company for the balance owing on the October 11 sale. Presented below are selected transactions for Culver Company during September and October of the current year. Culver uses a perpetual inventory system and the earnings approach. Sept. 1 Purchased merchandise on account from Hillary Company at a cost of $47,000. FOB destination, terms 1/15,n/30. 2 The correct company paid $2,000 of freight charges to Trucking Company on the September 1 merchandise purchase. 5 Returned for credit $3,000 of damaged goods purchased from Hillary Company on September 1. 15 Sold the remaining merchandise purchased from Hillary Company to Irvine Company for $88,000, terms 2/10,n/30, FOB destination. 16 The correct company paid $1,800 of freight charges on the September 15 sale of merchandise. 17 Issued Irvine Company a credit of $6,000 for returned goods. These goods had cost Culver Company $3,000 and were returned to inventory. 25 Recelved the balance owing from Irvine Company for the September 15 sale. 30 Paid Hillary Company the balance owing for the September 1 purchase. Oct. 1 Purchased merchandise on account from Kimmel Company at a cost of $56,000, terms 2/10,n/30, FOB shipping point. 2. The correct company paid freight costs of $1,100 on the October 1 purchase. 3 Obtained a purchase allowance of $2,900 from Kimmel Company to compensate for some minor damage to goods purchased on October 1. 10 Paid Kimmel Company the amount owing on the October 1 purchase. 11 Sold all of the merchandise purchased from Kimme Company to Kieso Company for $106,000, terms 2/10,n/30, FOB shipping point. 12 The correct company paid $800 freight costs on the October 11 sate. 17 Issued Kieso Company a sales allowance of $2,300 because some of the goods did not meet Kieso's exact specifications. 31 Received a cheque from Kieso Company for the balance owing on the October 11 sale