Answered step by step

Verified Expert Solution

Question

1 Approved Answer

.. Presented below are selected transactions for Grouper Company during September and October of the current year. Grouper uses a perpetual inventory system and the

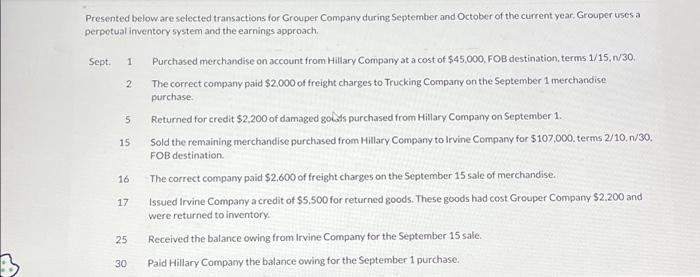

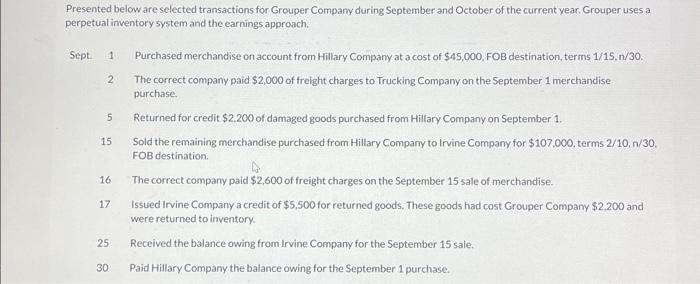

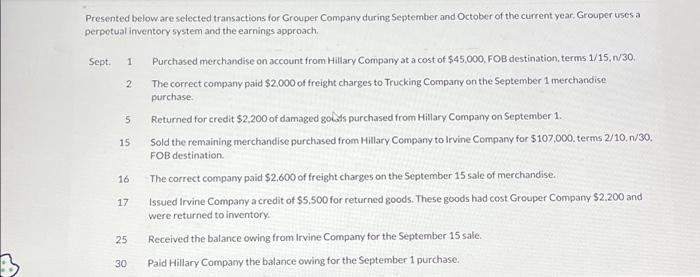

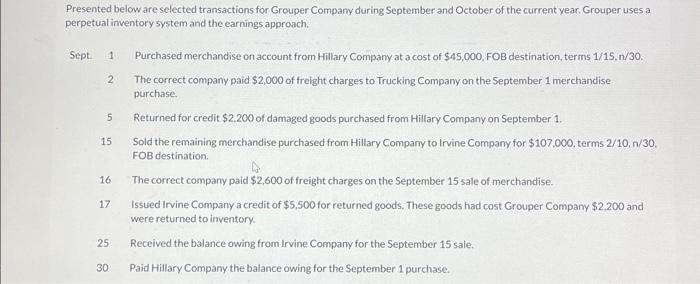

.. Presented below are selected transactions for Grouper Company during September and October of the current year. Grouper uses a perpetual inventory system and the earnings approach. Sept. 1 Purchased merchandise on account from Hillary Company at a cost of $45,000, FOB destination, terms 1/15, n/30. The correct company paid $2,000 of freight charges to Trucking Company on the September 1 merchandise purchase. Returned for credit $2,200 of damaged golds purchased from Hillary Company on September 1. Sold the remaining merchandise purchased from Hillary Company to Irvine Company for $107,000, terms 2/10, n/30, FOB destination. 2 5 15 16 17 25 30 The correct company paid $2,600 of freight charges on the September 15 sale of merchandise. Issued Irvine Company a credit of $5,500 for returned goods. These goods had cost Grouper Company $2,200 and were returned to inventory. Received the balance owing from Irvine Company for the September 15 sale. Paid Hillary Company the balance owing for the September 1 purchase.

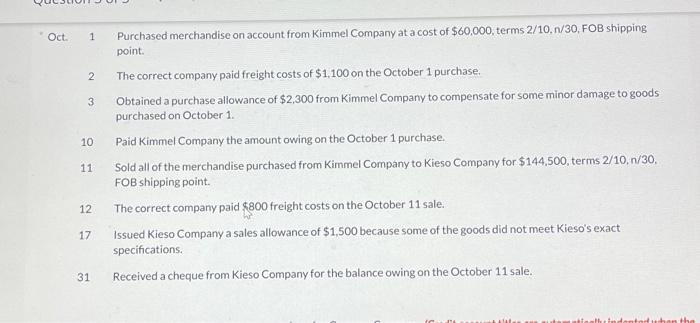

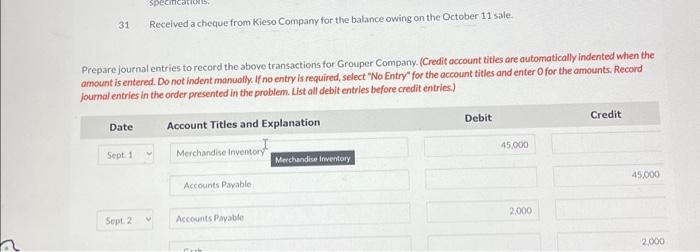

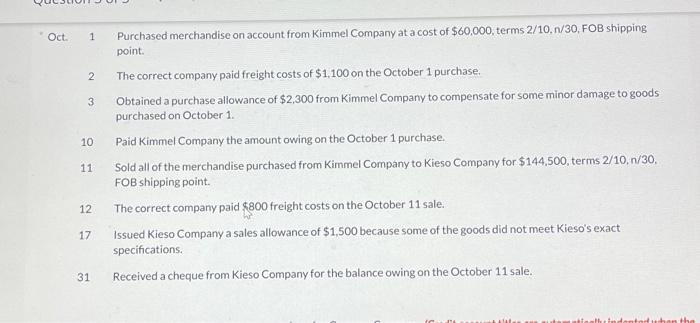

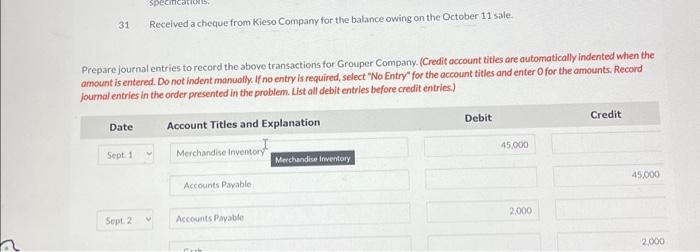

Presented below are selected transactions for Grouper Company during September and October of the current year. Grouper uses a perpetual inventory system and the earnings approach. Sept. 1 Purchased merchandise on account from Hillary Company at a cost of $45,000, FOB destination, terms 1/15,N/30. 2. The correct company paid $2,000 of freight charges to Trucking Company on the September 1 merchandise purchase. 5 Returned for credit $2,200 of damaged gols s purchased from Hillary Company on September 1. 15 Sold the remaining merchandise purchased from Hillary Company to Irvine Company for $107,000, terms 2/10,n/30. FOB destination. 16 The correct company paid $2,600 of freight charges on the September 15 sale of merchandise. 17 Issued Irvine Company a credit of $5,500 for returned goods. These goods had cost Grouper Company $2,200 and were returned to inventory. 25 Received the balance owing from Irvine Company for the September 15 sale. 30 Paid Hillary Compary the balance owing for the September 1 purchase. Presented below are selected transactions for Grouper Company during September and October of the current year. Grouper uses a perpetual inventory system and the earnings approach. Sept. 1 Purchased merchandise on account from Hillary Company at a cost of $45,000, FOB destination, terms 1/15,n/30. 2. The correct company paid $2,000 of freight charges to Trucking Company on the September 1 merchandise purchase. 5 Returned for credit \$2.200 of damaged goods purchased from Hillary Company on September 1. 15 Sold the remaining merchandise purchased from Hillary Company to Irvine Company for $107,000, terms 2/10,n/30. FOB destination. 16 The correct company paid $2,600 of freight charges on the September 15 sale of merchandise. 17. Issued Irvine Company a credit of $5,500 for returned goods. These goods had cost Grouper Company $2,200 and were returned to inventory. 25. Received the balance owing from Irvine Company for the September 15 sale. 30. Paid Hillary Company the balance owing for the September 1 purchase. Oct. 1 Purchased merchandise on account from Kimmel Company at a cost of $60,000, terms 2/10,n/30,FOB shipping point. 2 The correct company paid freight costs of $1,100 on the October 1 purchase. 3 Obtained a purchase allowance of $2,300 from Kimmel Company to compensate for some minor damage to goods purchased on October 1. 10 Paid Kimmel Company the amount owing on the October 1 purchase. 11 Sold all of the merchandise purchased from Kimmel Company to Kieso Company for $144,500, terms 2/10,n/30. FOB shipping point. 12. The correct company paid $800 freight costs on the October 11 sale. 17 Issued Kieso Company a sales allowance of $1,500 because some of the goods did not meet Kieso's exact specifications. 31 Received a cheque from Kieso Company for the balance owing on the October 11 sale. 31 Received a cheque from Kieso Company for the balance owing on the October 11 sale. Prepare journal entries to record the above transactions for Grouper Company. (Credit occount tities are outomatically indented when the amount is entered. Do not indent manualh. If no entry is required, select "No Entry' for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries)

Presented below are selected transactions for Grouper Company during September and October of the current year. Grouper uses a perpetual inventory system and the earnings approach. Sept. 1 Purchased merchandise on account from Hillary Company at a cost of $45,000, FOB destination, terms 1/15,N/30. 2. The correct company paid $2,000 of freight charges to Trucking Company on the September 1 merchandise purchase. 5 Returned for credit $2,200 of damaged gols s purchased from Hillary Company on September 1. 15 Sold the remaining merchandise purchased from Hillary Company to Irvine Company for $107,000, terms 2/10,n/30. FOB destination. 16 The correct company paid $2,600 of freight charges on the September 15 sale of merchandise. 17 Issued Irvine Company a credit of $5,500 for returned goods. These goods had cost Grouper Company $2,200 and were returned to inventory. 25 Received the balance owing from Irvine Company for the September 15 sale. 30 Paid Hillary Compary the balance owing for the September 1 purchase. Presented below are selected transactions for Grouper Company during September and October of the current year. Grouper uses a perpetual inventory system and the earnings approach. Sept. 1 Purchased merchandise on account from Hillary Company at a cost of $45,000, FOB destination, terms 1/15,n/30. 2. The correct company paid $2,000 of freight charges to Trucking Company on the September 1 merchandise purchase. 5 Returned for credit \$2.200 of damaged goods purchased from Hillary Company on September 1. 15 Sold the remaining merchandise purchased from Hillary Company to Irvine Company for $107,000, terms 2/10,n/30. FOB destination. 16 The correct company paid $2,600 of freight charges on the September 15 sale of merchandise. 17. Issued Irvine Company a credit of $5,500 for returned goods. These goods had cost Grouper Company $2,200 and were returned to inventory. 25. Received the balance owing from Irvine Company for the September 15 sale. 30. Paid Hillary Company the balance owing for the September 1 purchase. Oct. 1 Purchased merchandise on account from Kimmel Company at a cost of $60,000, terms 2/10,n/30,FOB shipping point. 2 The correct company paid freight costs of $1,100 on the October 1 purchase. 3 Obtained a purchase allowance of $2,300 from Kimmel Company to compensate for some minor damage to goods purchased on October 1. 10 Paid Kimmel Company the amount owing on the October 1 purchase. 11 Sold all of the merchandise purchased from Kimmel Company to Kieso Company for $144,500, terms 2/10,n/30. FOB shipping point. 12. The correct company paid $800 freight costs on the October 11 sale. 17 Issued Kieso Company a sales allowance of $1,500 because some of the goods did not meet Kieso's exact specifications. 31 Received a cheque from Kieso Company for the balance owing on the October 11 sale. 31 Received a cheque from Kieso Company for the balance owing on the October 11 sale. Prepare journal entries to record the above transactions for Grouper Company. (Credit occount tities are outomatically indented when the amount is entered. Do not indent manualh. If no entry is required, select "No Entry' for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries)

.. Presented below are selected transactions for Grouper Company during September and October of the current year. Grouper uses a perpetual inventory system and the earnings approach. Sept. 1 Purchased merchandise on account from Hillary Company at a cost of $45,000, FOB destination, terms 1/15, n/30. The correct company paid $2,000 of freight charges to Trucking Company on the September 1 merchandise purchase. Returned for credit $2,200 of damaged golds purchased from Hillary Company on September 1. Sold the remaining merchandise purchased from Hillary Company to Irvine Company for $107,000, terms 2/10, n/30, FOB destination. 2 5 15 16 17 25 30 The correct company paid $2,600 of freight charges on the September 15 sale of merchandise. Issued Irvine Company a credit of $5,500 for returned goods. These goods had cost Grouper Company $2,200 and were returned to inventory. Received the balance owing from Irvine Company for the September 15 sale. Paid Hillary Company the balance owing for the September 1 purchase.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started