Answered step by step

Verified Expert Solution

Question

1 Approved Answer

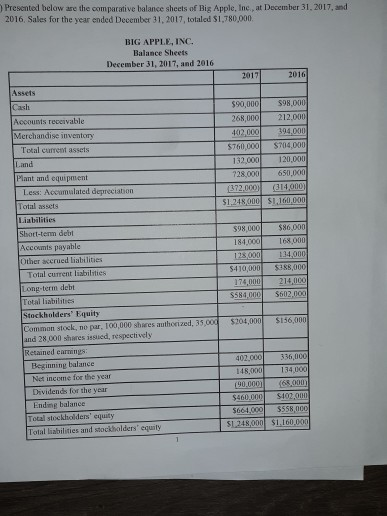

) Presented below are the comparative balance sheets of Big Apple, Ine, at December 31, 2017, and 2016, Sales for the year ended December 31,

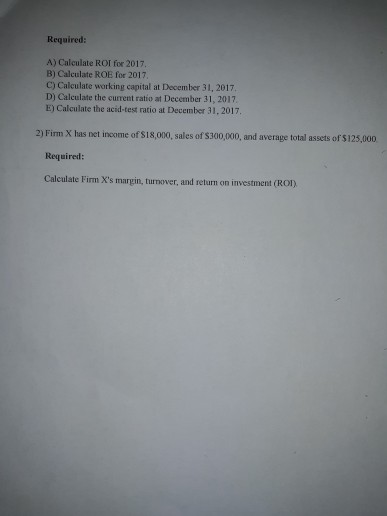

) Presented below are the comparative balance sheets of Big Apple, Ine, at December 31, 2017, and 2016, Sales for the year ended December 31, 2017, totaled $1,780,000 BIG APPLE, INC Balance Sheets December 31, 2017, and 2016 201 2016 Assets ash Accounts receivable Merchandise inventory 90,000 268,000 $98,000 Total current assets and Plant and equipment 394.000 $760,000 704,000 120,000 132.000 28,000 Less: Accumulated depreciation 172.0 (314,000) 1.248000 s1.16 Liabilities Shott-tenm debt Accoumts payable Other acerued liabilities $98,000 $86,000 184.0 410,000$388,000 Total current liabilities Long-term debt Total liabilities Stockholders Equity Common stock, no par, 100,000 shares authoized, 35 and 28,000 shares issied, respectively Retained earnings 584,000 $602,0 $204,000 $156,000 Beginning balance Nes income for the year Dividends for the year Ending balance 402.000 148,000 190.000 S40 5664,00 $558 Total stockholders' equity Total liabilities and stockholders' equity 1.248000 $1160,0 Required: A) Calculate ROI for 2017 B) Calculate ROE for 2017 C) Calculate working capital at December 31, 2017 D) Calculate the current ratio at December 31, 2017 E) Calculate the acid-test ratio at December 31, 2017. 2) Firm X has net income of $18,000, sales of $300,000, and average total assets of $125,000 Required: Calculate Firm X's margin, turnover, and return on investment (ROD

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started