Answered step by step

Verified Expert Solution

Question

1 Approved Answer

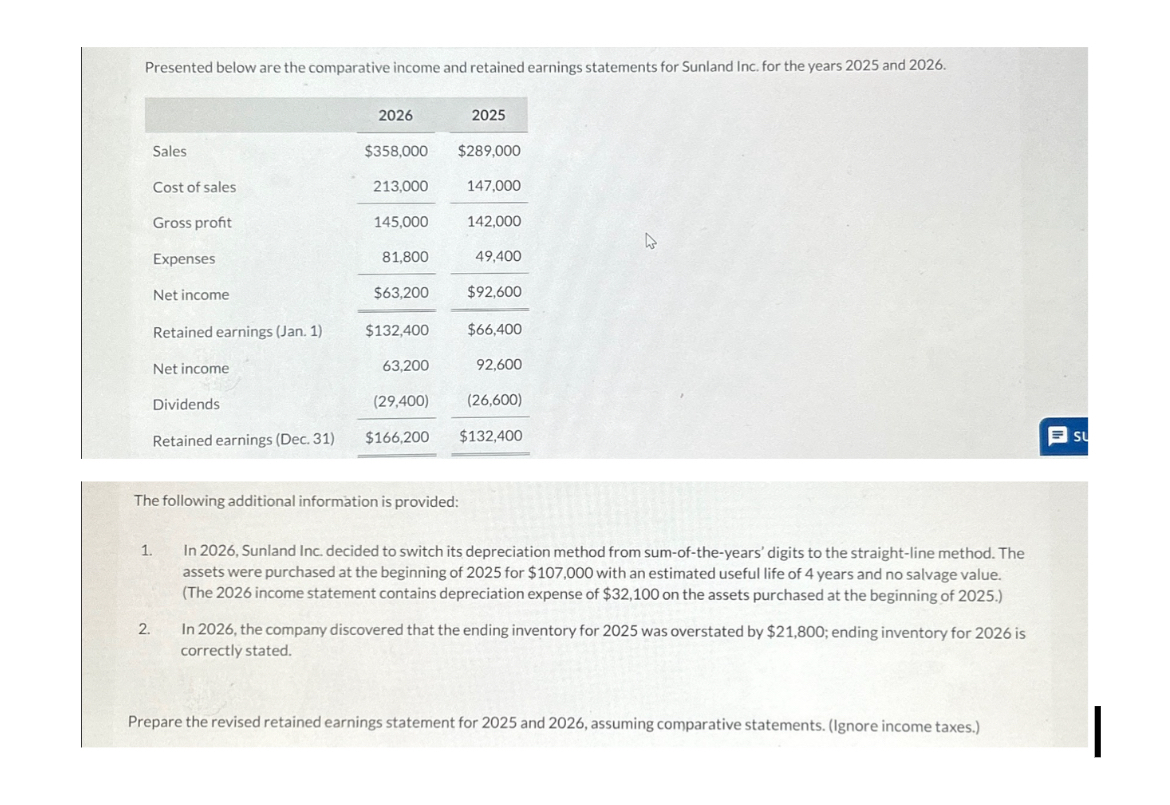

Presented below are the comparative income and retained earnings statements for Sunland Inc. for the years 2025 and 2026. 2026 2025 Sales $358,000 $289,000

Presented below are the comparative income and retained earnings statements for Sunland Inc. for the years 2025 and 2026. 2026 2025 Sales $358,000 $289,000 Cost of sales 213,000 147,000 Gross profit 145,000 142,000 B Expenses 81,800 49,400 Net income $63,200 $92,600 Retained earnings (Jan. 1) $132,400 $66,400 Net income 63,200 92,600 Dividends (29,400) (26,600) Retained earnings (Dec. 31) $166,200 $132,400 The following additional information is provided: 1. 2. In 2026, Sunland Inc. decided to switch its depreciation method from sum-of-the-years' digits to the straight-line method. The assets were purchased at the beginning of 2025 for $107,000 with an estimated useful life of 4 years and no salvage value. (The 2026 income statement contains depreciation expense of $32,100 on the assets purchased at the beginning of 2025.) In 2026, the company discovered that the ending inventory for 2025 was overstated by $21,800; ending inventory for 2026 is correctly stated. Prepare the revised retained earnings statement for 2025 and 2026, assuming comparative statements. (Ignore income taxes.) su

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the revised retained earnings statements for 2025 and 2026 we need to adjust for the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started