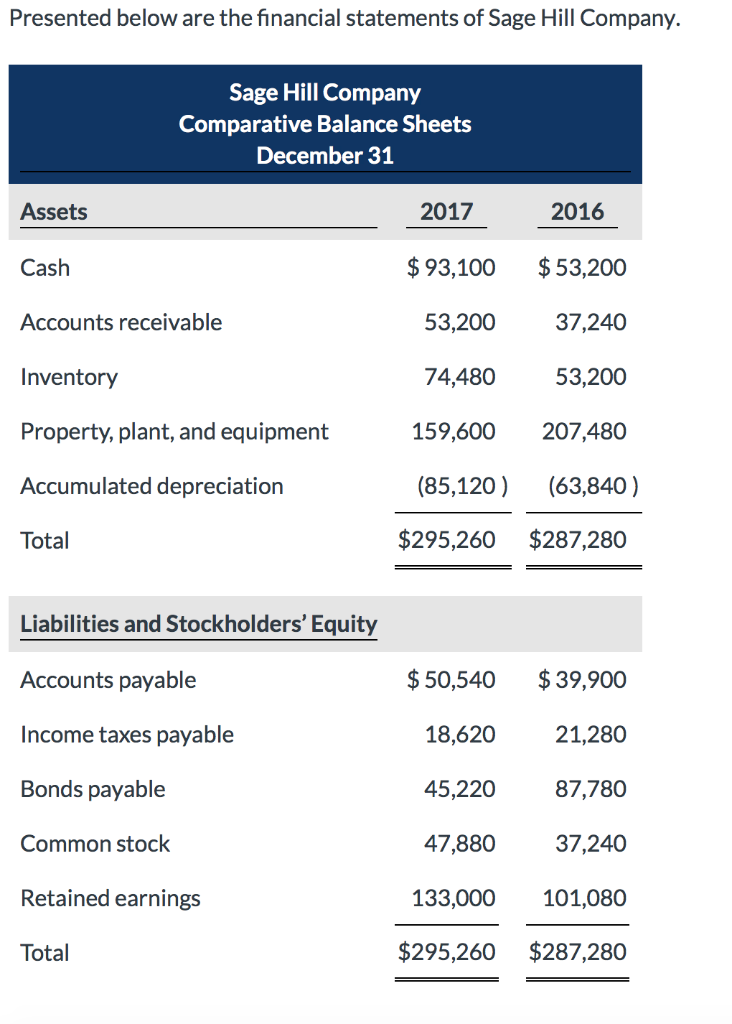

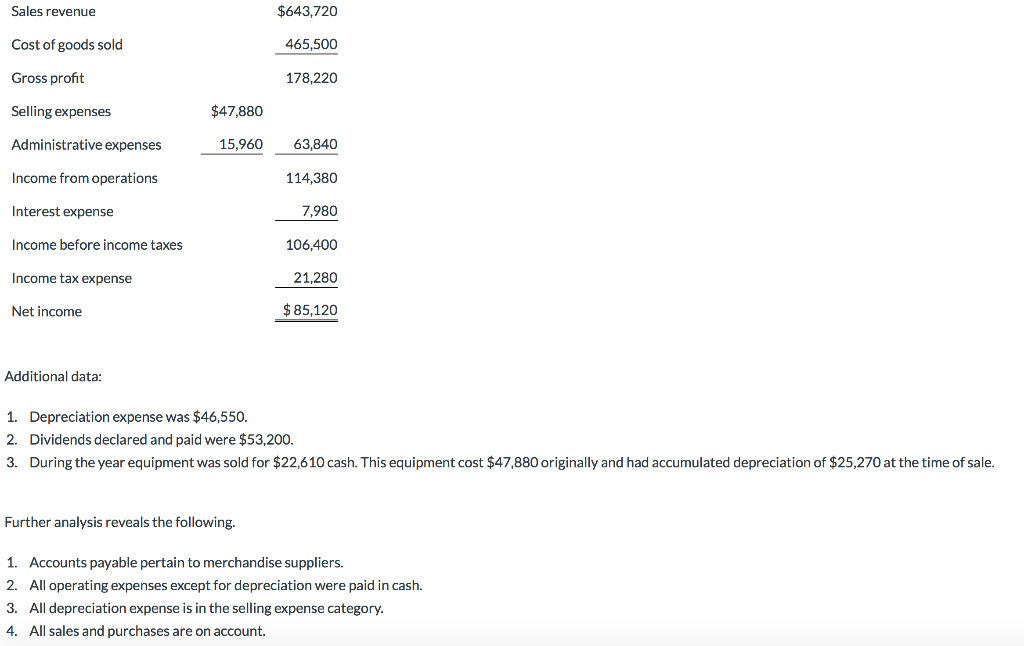

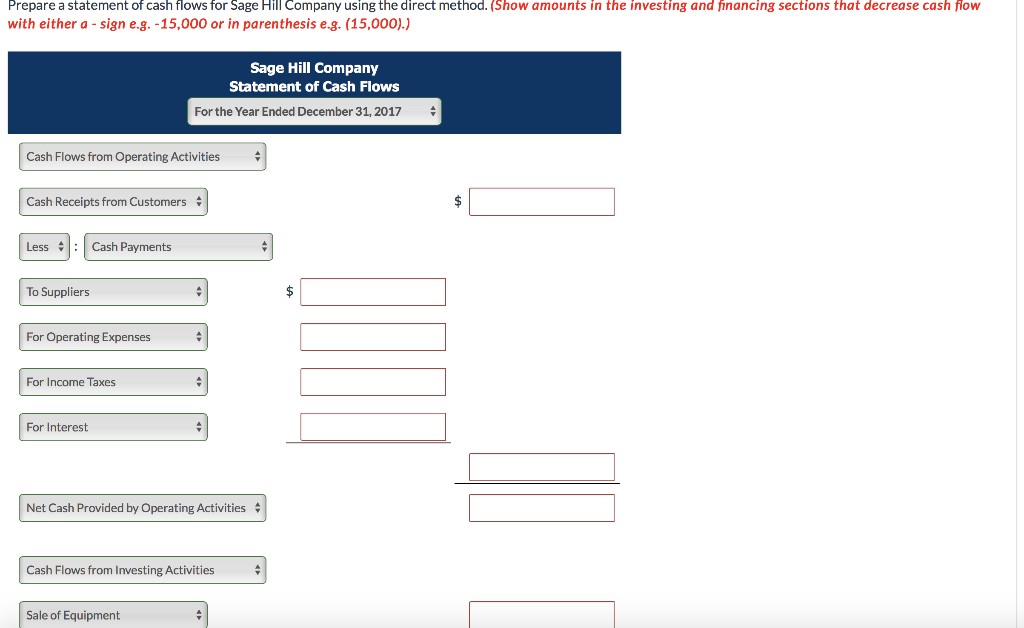

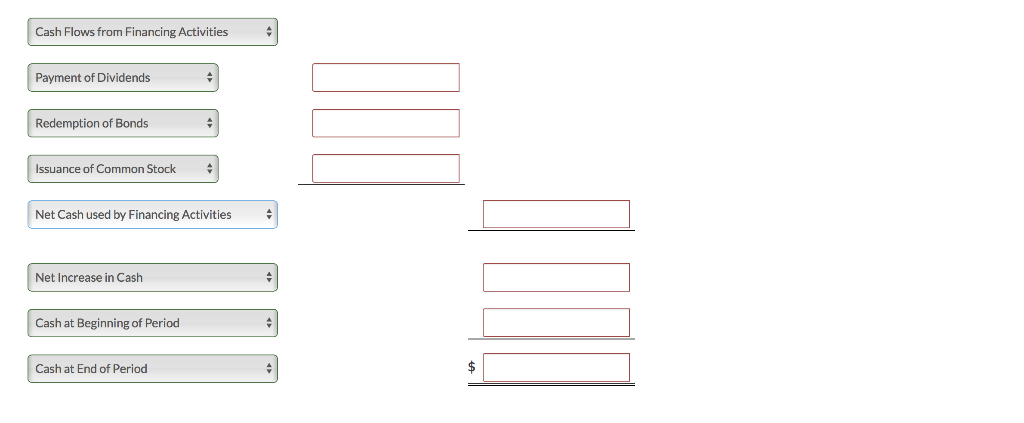

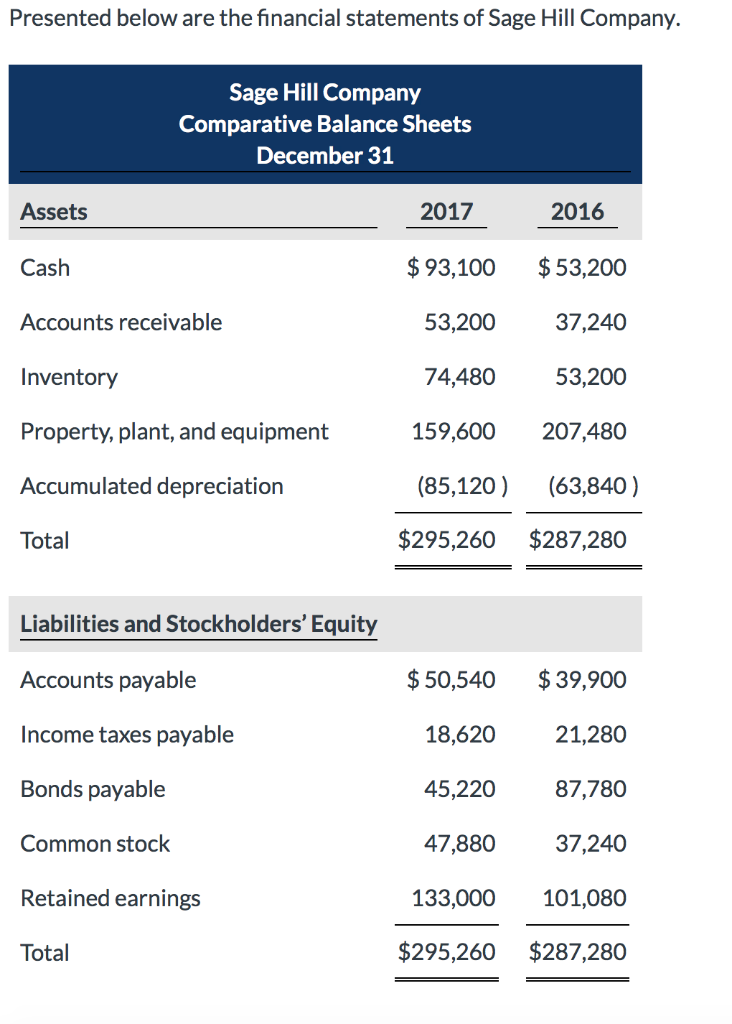

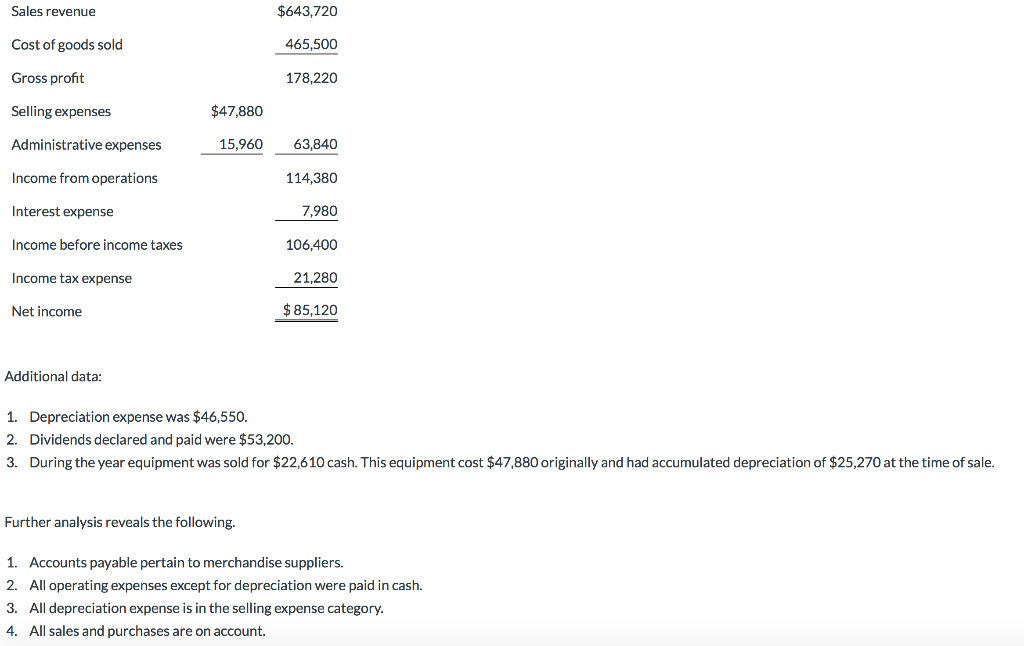

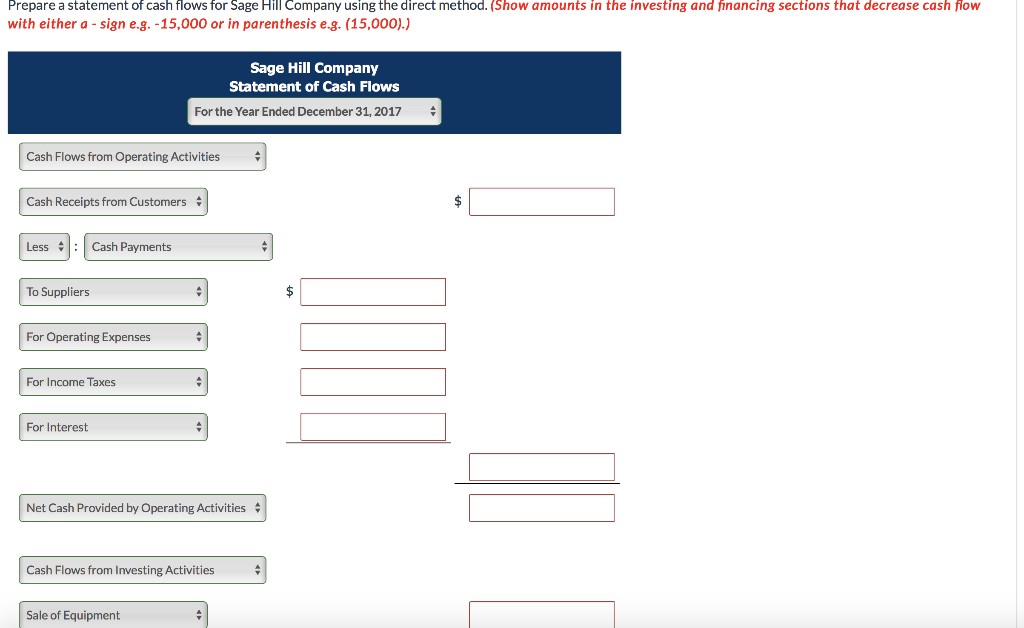

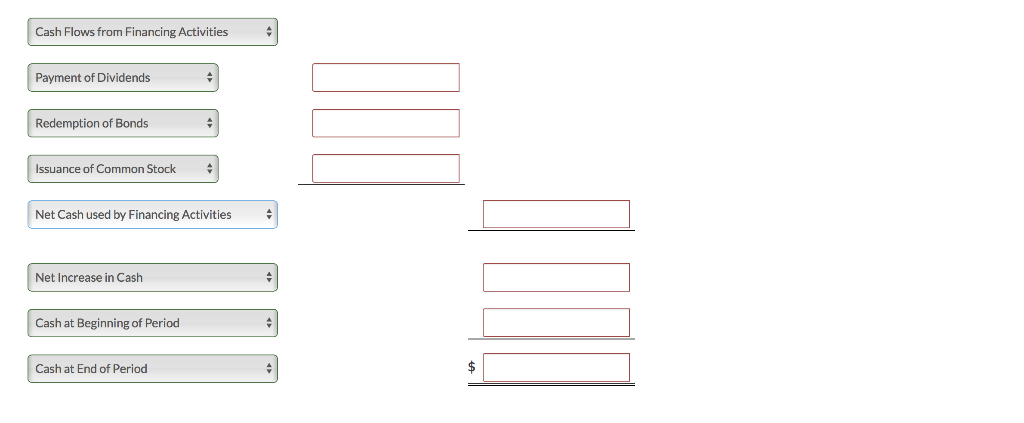

Presented below are the financial statements of Sage Hill Company. Sage Hill Company Comparative Balance Sheets December 31 2017 93,100 $53,200 53,200 74,480 159,600 207,480 (85,120) (63,840) 2016 Assets Cash Accounts receivable Inventory Property, plant, and equipment Accumulated depreciation Total 37,240 53,200 $295,260 $287,280 Liabilities and Stockholders' Equity Accounts payable Income taxes payable Bonds payable Common stock Retained earnings Total 50,540 $39,900 21,280 87,780 37,240 133,000 101,080 $295,260 $287,280 18,620 45,220 47,880 $643,720 465,500 178,220 Sales revenue Cost of goods sold Gross profit Selling expenses Administrative expenses Income from operations Interest expense Income before income taxes Income tax expense Net income $47,880 15,960 63,840 114,380 7,980 106,400 21,280 $85,120 Additional data: 1. Depreciation expense was $46,550 2. Dividends declared and paid were $53,200 3. During the year equipment was sold for $22,610 cash. This equipment cost $47,880 originally and had accumulated depreciation of $25,270 at the time of sale. Further analysis reveals the following. 1. 2. 3. 4. Accounts payable pertain to merchandise suppliers. All operating expenses except for depreciation were paid in cash. All depreciation expense is in the selling expense category All sales and purchases are on account. Prepare a statement of cash flows for Sage Hill Company using the direct method. (Show amounts in the investing and financing sections that decrease cash flow with either a -sign e.g. 15,000 or in parenthesis e.g. (15,000).) Sage Hill Company Statement of Cash Flows For the Year Ended December 31, 2017 Cash Flows from Operating Activities Cash Receipts from Customers LessCash Payments To Suppliers For Operating Expenses For Income Taxes For Interest Net Cash Provided by Operating Activities Cash Flows from Investing Activities Sale of Equipment Cash Flows from Financing Activities Payment of Dividends Redemption of Bonds Issuance of Common Stock Net Cash used by Financing Activities Net Increase in Cash Cash at Beginning of Period Cash at End of Period X Your answer is incorrect. Compute free cash flow. (Show a negative free cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Free cash flow$ eTextbook and Media