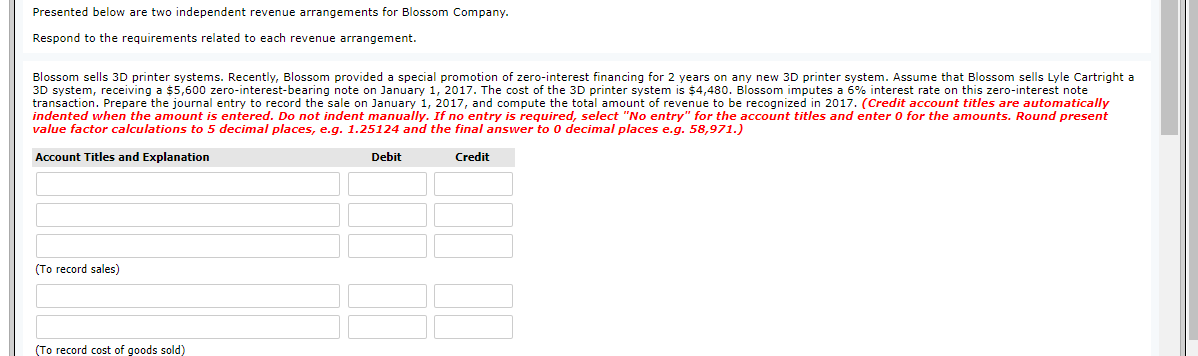

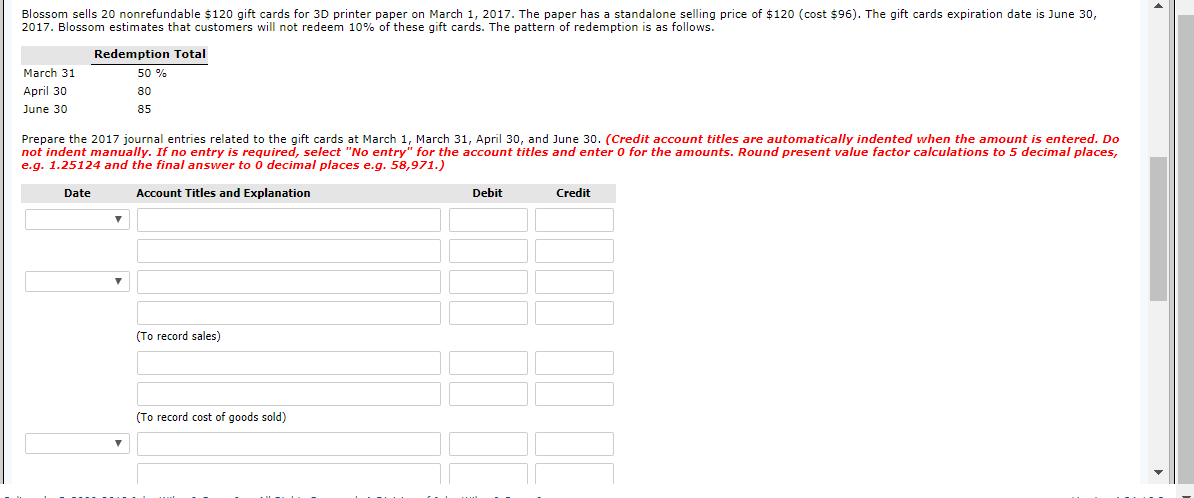

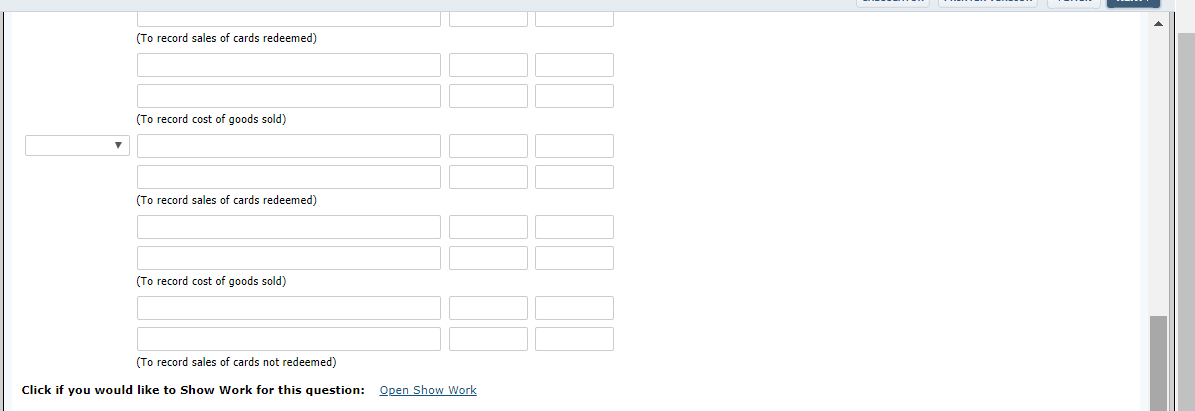

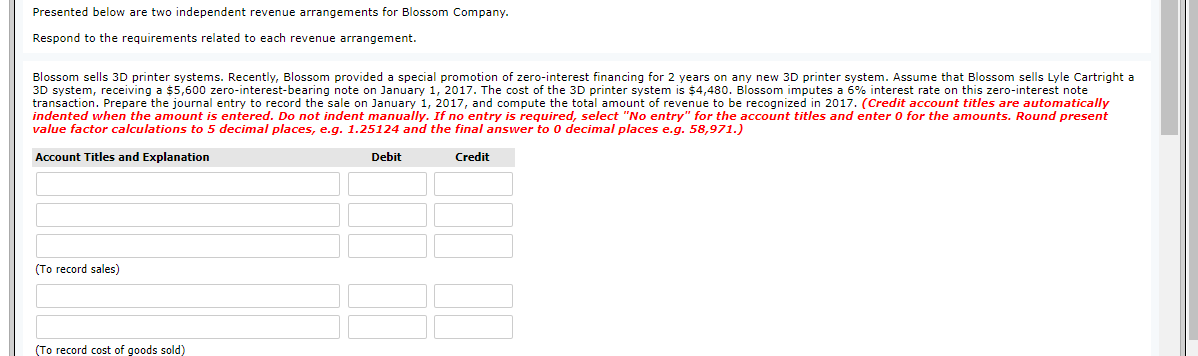

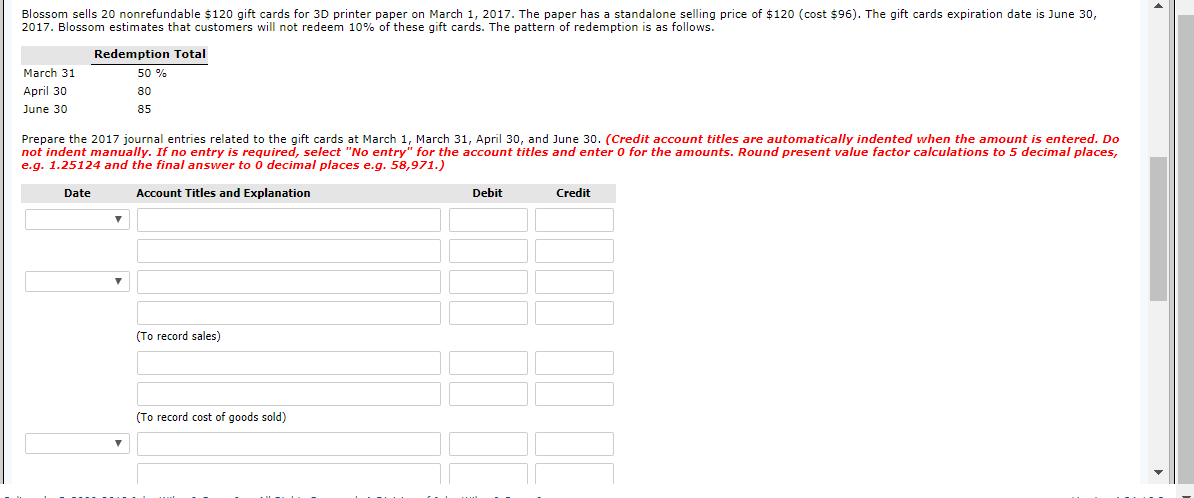

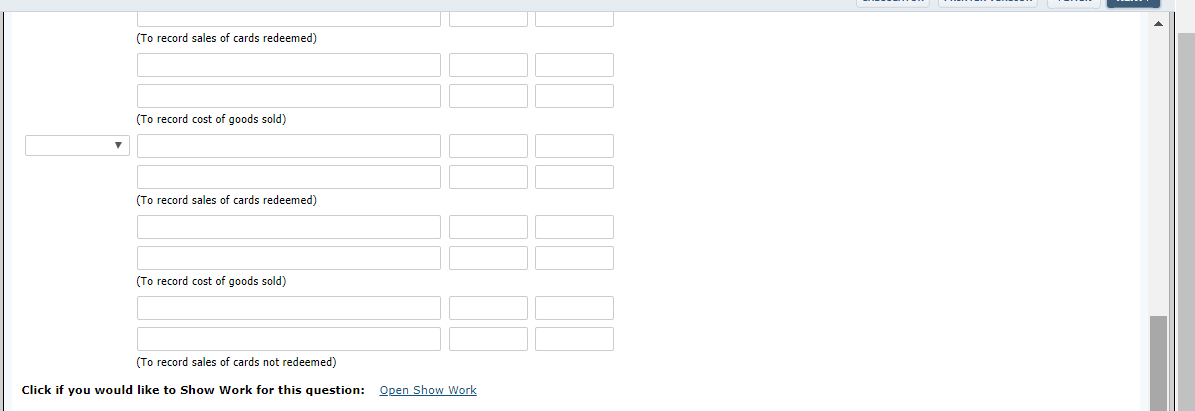

Presented below are two independent revenue arrangements for Blossom Company. Respond to the requirements related to each revenue arrangement. Blossom sells 3D printer systems. Recently, Blossom provided a special promotion of zero-interest financing for 2 years on any new 3D printer system. Assume that Blossom sells Lyle Cartright a 3D system, receiving a $5,600 zero-interest-bearing note on January 1, 2017. The cost of the 3D printer system is $4,480. Blossom imputes a 6% interest rate on this zero-interest note transaction. Prepare the journal entry to record the sale on January 1, 2017, and compute the total amount of revenue to be recognized in 2017. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter o for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to o decimal places e.g. 58,971.) Account Titles and Explanation Debit Credit (To record sales) (To record cost of goods sold) Blossom sells 20 nonrefundable $120 gift cards for 3D printer paper on March 1, 2017. The paper has a standalone selling price of $120 (cost $96). The gift cards expiration date is June 30, 2017. Blossom estimates that customers will not redeem 10% of these gift cards. The pattern of redemption is as follows. Redemption Total 50 % March 31 April 30 June 30 80 85 Prepare the 2017 journal entries related to the gift cards at March 1, March 31, April 30, and June 30. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter o for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to o decimal places e.g. 58,971.) Date Account Titles and Explanation Debit Credit Credit (To record sales) (To record cost of goods sold) (To record sales of cards redeemed) (To record cost of goods sold) (To record sales of cards redeemed) (To record cost of goods sold) (To record sales of cards not redeemed) Click if you would like to Show Work for this question: Open Show Work Presented below are two independent revenue arrangements for Blossom Company. Respond to the requirements related to each revenue arrangement. Blossom sells 3D printer systems. Recently, Blossom provided a special promotion of zero-interest financing for 2 years on any new 3D printer system. Assume that Blossom sells Lyle Cartright a 3D system, receiving a $5,600 zero-interest-bearing note on January 1, 2017. The cost of the 3D printer system is $4,480. Blossom imputes a 6% interest rate on this zero-interest note transaction. Prepare the journal entry to record the sale on January 1, 2017, and compute the total amount of revenue to be recognized in 2017. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter o for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to o decimal places e.g. 58,971.) Account Titles and Explanation Debit Credit (To record sales) (To record cost of goods sold) Blossom sells 20 nonrefundable $120 gift cards for 3D printer paper on March 1, 2017. The paper has a standalone selling price of $120 (cost $96). The gift cards expiration date is June 30, 2017. Blossom estimates that customers will not redeem 10% of these gift cards. The pattern of redemption is as follows. Redemption Total 50 % March 31 April 30 June 30 80 85 Prepare the 2017 journal entries related to the gift cards at March 1, March 31, April 30, and June 30. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter o for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to o decimal places e.g. 58,971.) Date Account Titles and Explanation Debit Credit Credit (To record sales) (To record cost of goods sold) (To record sales of cards redeemed) (To record cost of goods sold) (To record sales of cards redeemed) (To record cost of goods sold) (To record sales of cards not redeemed) Click if you would like to Show Work for this question: Open Show Work