Answered step by step

Verified Expert Solution

Question

1 Approved Answer

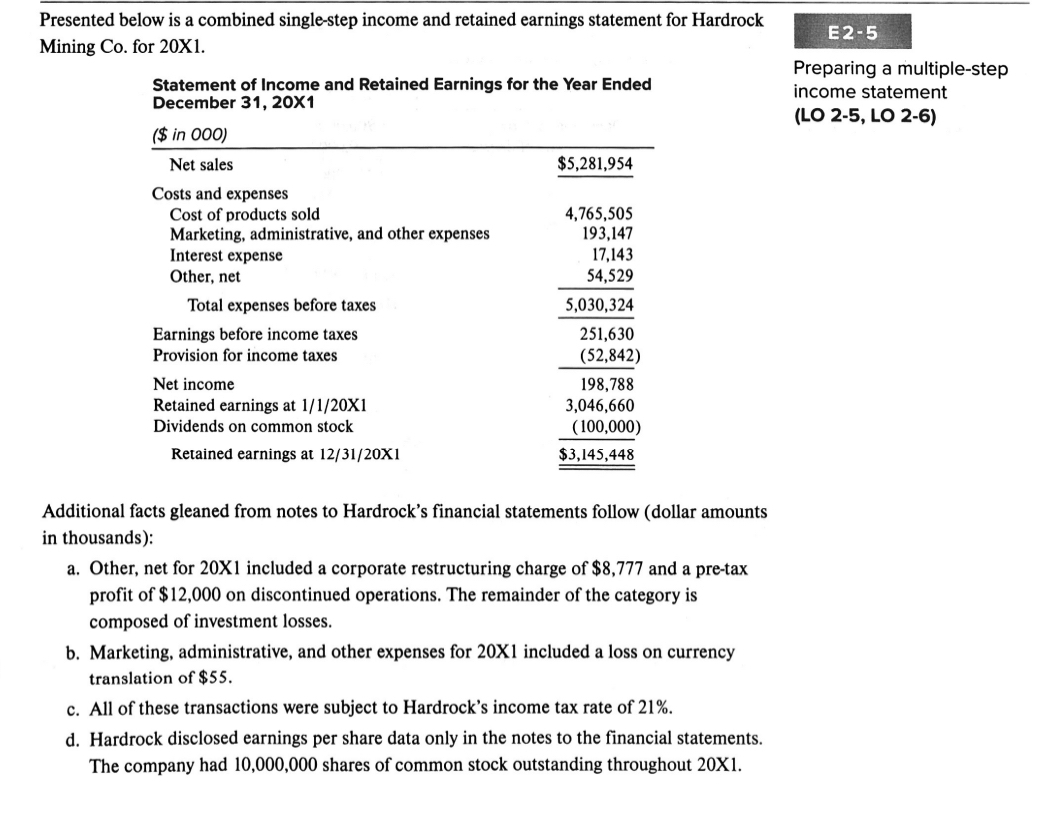

Presented below is a combined single - step income and retained earnings statement for Hardrock Mining Co . for 2 0 X 1 . Additional

Presented below is a combined singlestep income and retained earnings statement for Hardrock

Mining Co for X

Additional facts gleaned from notes to Hardrock's financial statements follow dollar amounts

in thousands:

a Other, net for X included a corporate restructuring charge of $ and a pretax

profit of $ on discontinued operations. The remainder of the category is

composed of investment losses.

b Marketing, administrative, and other expenses for X included a loss on currency

translation of $

c All of these transactions were subject to Hardrock's income tax rate of

d Hardrock disclosed earnings per share data only in the notes to the financial statements.

The company had shares of common stock outstanding throughout X

PrepaRe a multiplestep

income statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started