Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Presented below is information related to Marian Company for 2022: Note: All amounts listed are before taxes. During 2022: Marian Company sold its Restaurant

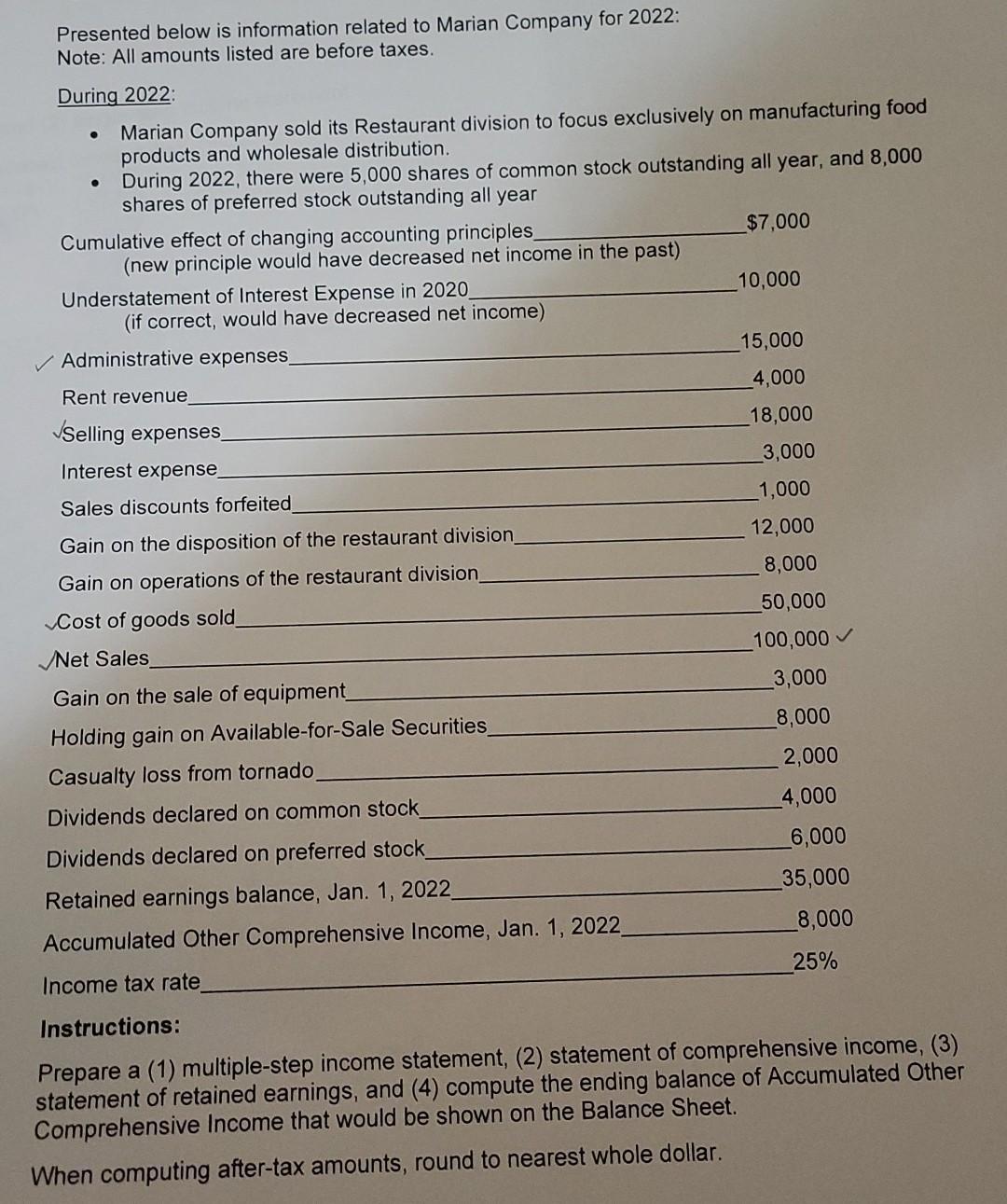

Presented below is information related to Marian Company for 2022: Note: All amounts listed are before taxes. During 2022: Marian Company sold its Restaurant division to focus exclusively on manufacturing food products and wholesale distribution. During 2022, there were 5,000 shares of common stock outstanding all year, and 8,000 shares of preferred stock outstanding all year Cumulative effect of changing accounting principles $7,000 (new principle would have decreased net income in the past) Understatement of Interest Expense in 2020 10,000 (if correct, would have decreased net income) V Administrative expenses 15,000 Rent revenue 4,000 Selling expenses. 18,000 Interest expense 3,000 Sales discounts forfeited 1,000 Gain on the disposition of the restaurant division 12,000 Gain on operations of the restaurant division 8,000 Cost of goods sold 50,000 Net Sales 100,000 Gain on the sale of equipment 3,000 Holding gain on Available-for-Sale Securities 8,000 Casualty loss from tornado 2,000 Dividends declared on common stock_ 4,000 Dividends declared on preferred stock 6,000 Retained earnings balance, Jan. 1, 2022 35,000 Accumulated Other Comprehensive Income, Jan. 1, 2022_ 8,000 Income tax rate 25% Instructions: Prepare a (1) multiple-step income statement, (2) statement of comprehensive income, (3) statement of retained earnings, and (4) compute the ending balance of Accumulated Other Comprehensive Income that would be shown on the Balance Sheet. When computing after-tax amounts, round to nearest whole dollar.

Step by Step Solution

★★★★★

3.64 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Answer Explanation Particulars Amount Amount2 1Computat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started