Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Presented below is information related to the purchases of common stock by Marigold Company during 2025. Cost (at purchase date) Fair Value (at December

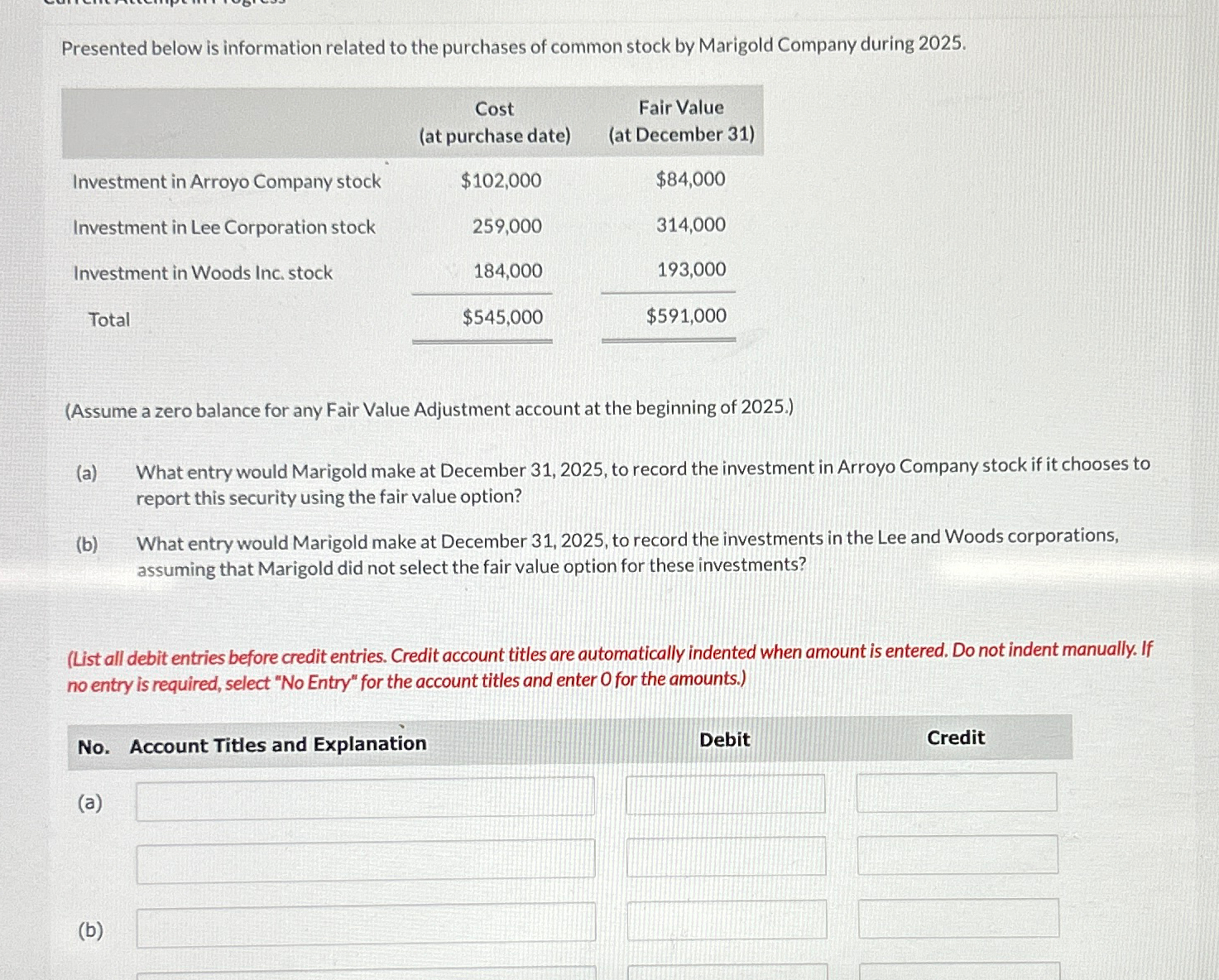

Presented below is information related to the purchases of common stock by Marigold Company during 2025. Cost (at purchase date) Fair Value (at December 31) Investment in Arroyo Company stock $102,000 $84,000 Investment in Lee Corporation stock 259,000 314,000 Investment in Woods Inc. stock 184,000 193,000 Total $545,000 $591,000 (Assume a zero balance for any Fair Value Adjustment account at the beginning of 2025.) (a) (b) What entry would Marigold make at December 31, 2025, to record the investment in Arroyo Company stock if it chooses to report this security using the fair value option? What entry would Marigold make at December 31, 2025, to record the investments in the Lee and Woods corporations, assuming that Marigold did not select the fair value option for these investments? (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Account Titles and Explanation Debit Credit (a) (b)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To answer the questions in the image we need to consider the details provided about the investments ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started