Answered step by step

Verified Expert Solution

Question

1 Approved Answer

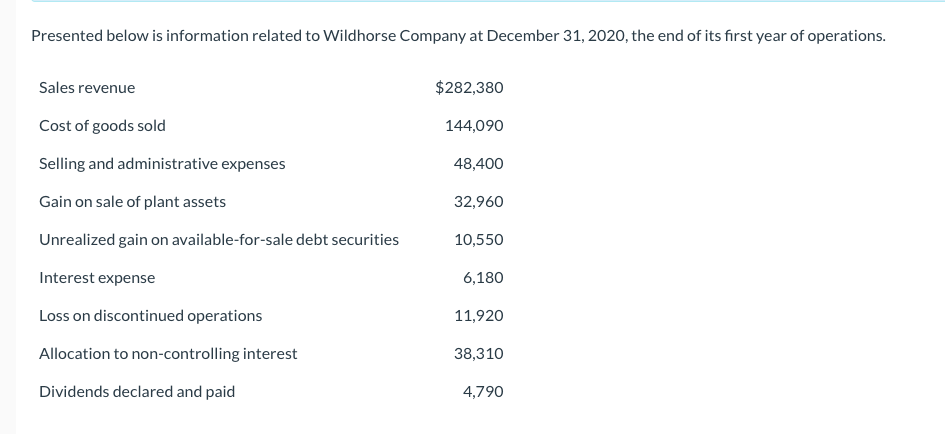

Presented below is information related to Wildhorse Company at December 31, 2020, the end of its first year of operations. Sales revenue $282,380 Cost

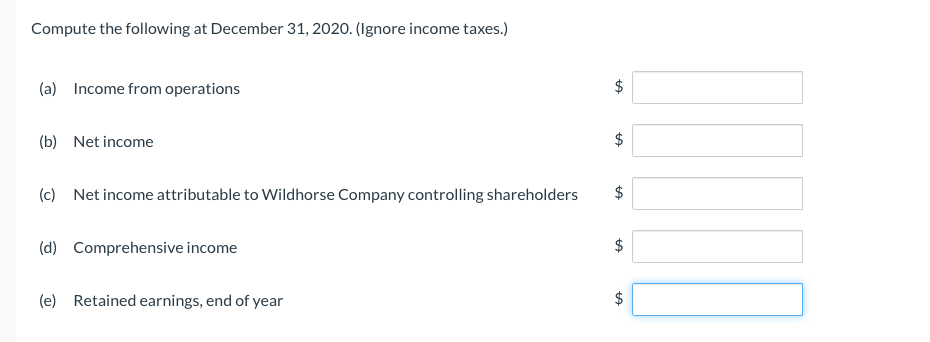

Presented below is information related to Wildhorse Company at December 31, 2020, the end of its first year of operations. Sales revenue $282,380 Cost of goods sold 144,090 Selling and administrative expenses 48,400 Gain on sale of plant assets 32,960 Unrealized gain on available-for-sale debt securities 10,550 Interest expense 6,180 Loss on discontinued operations 11,920 Allocation to non-controlling interest 38,310 Dividends declared and paid 4,790 Compute the following at December 31, 2020. (Ignore income taxes.) (a) Income from operations $ (b) Net income (c) Net income attributable to Wildhorse Company controlling shareholders (d) Comprehensive income $ (e) Retained earnings, end of year %24 %24 %24 %24

Step by Step Solution

★★★★★

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Description Amount in Sales 282380 Cost of goods sold 144090 Income from operations a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started