Answered step by step

Verified Expert Solution

Question

1 Approved Answer

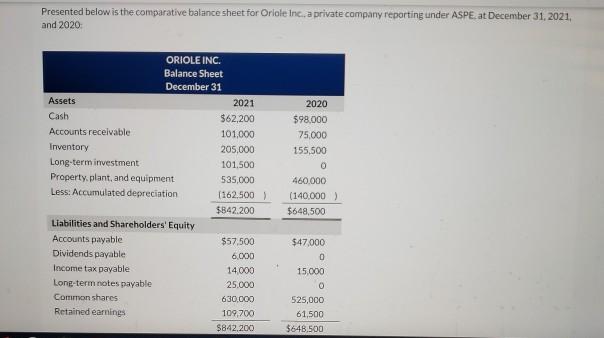

Presented below is the comparative balance sheet for Oriole Inc., a private company reporting under ASPE. at December 31, 2021, and 2020 ORIOLE INC. Balance

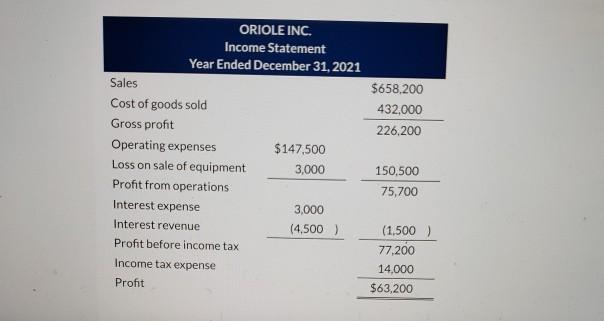

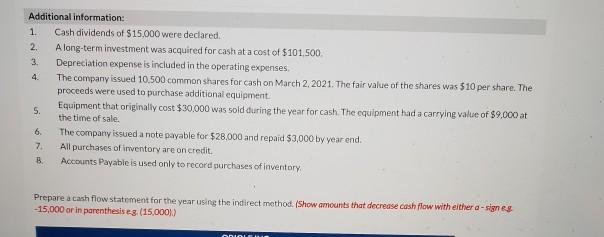

Presented below is the comparative balance sheet for Oriole Inc., a private company reporting under ASPE. at December 31, 2021, and 2020 ORIOLE INC. Balance Sheet December 31 Assets 2021 Cash $62,200 Accounts receivable 101,000 Inventory 205,000 Long-term investment 101.500 Property, plant, and equipment 535,000 Less: Accumulated depreciation (162,500) $842.200 Liabilities and Shareholders' Equity Accounts payable $57,500 Dividends payable 6,000 Income tax payable 14.000 Long-term notes payable 25.000 Common shares 630,000 Retained earnings 109,700 $842.200 2020 $98,000 75,000 155,500 0 460,000 (140,000) $648,500 $47,000 0 15,000 0 525,000 61.500 $648.500 $658,200 432,000 226,200 ORIOLE INC. Income Statement Year Ended December 31, 2021 Sales Cost of goods sold Gross profit Operating expenses $147.500 Loss on sale of equipment 3,000 Profit from operations Interest expense 3,000 Interest revenue (4.500) Profit before income tax Income tax expense Profit 150,500 75,700 (1.500) 77,200 14,000 $63,200 Additional information: 1. Cash dividends of $15.000 were declared. 2. Along-term investment was acquired for cash at a cost of $101.500 3. Depreciation expense is included in the operating expenses The company issued 10.500 common shares for cash on March 2.2021. The fair value of the shares was $10 per share. The proceeds were used to purchase additional equipment 5. Equipment that originally cost $30.000 was sold during the year for cash. The equipment had a carrying value of $9,000 at the time of sale. 6 The company issued a note payable for $28,000 and repaid $3,000 by year end. 7 All purchases of inventory are on credit. B. Accounts Payable is used only to record purchases of inventory Prepare a cash flow statement for the year using the indirect method. (Show amounts that decrease cash flow with either a signes -15,000 or in parenthesis es (15,000)) Prepare a cash flow statement for the year using the indirect method. (Show amounts that decrease cash flow with either a - signes. -15,000 or in parenthesis es. (15,000).) ORIOLE INC. Cash Flow Statement - Indirect Method $ Adjustments to reconcile profitto $ C A , > $ eTextbook and Media

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started