Answered step by step

Verified Expert Solution

Question

1 Approved Answer

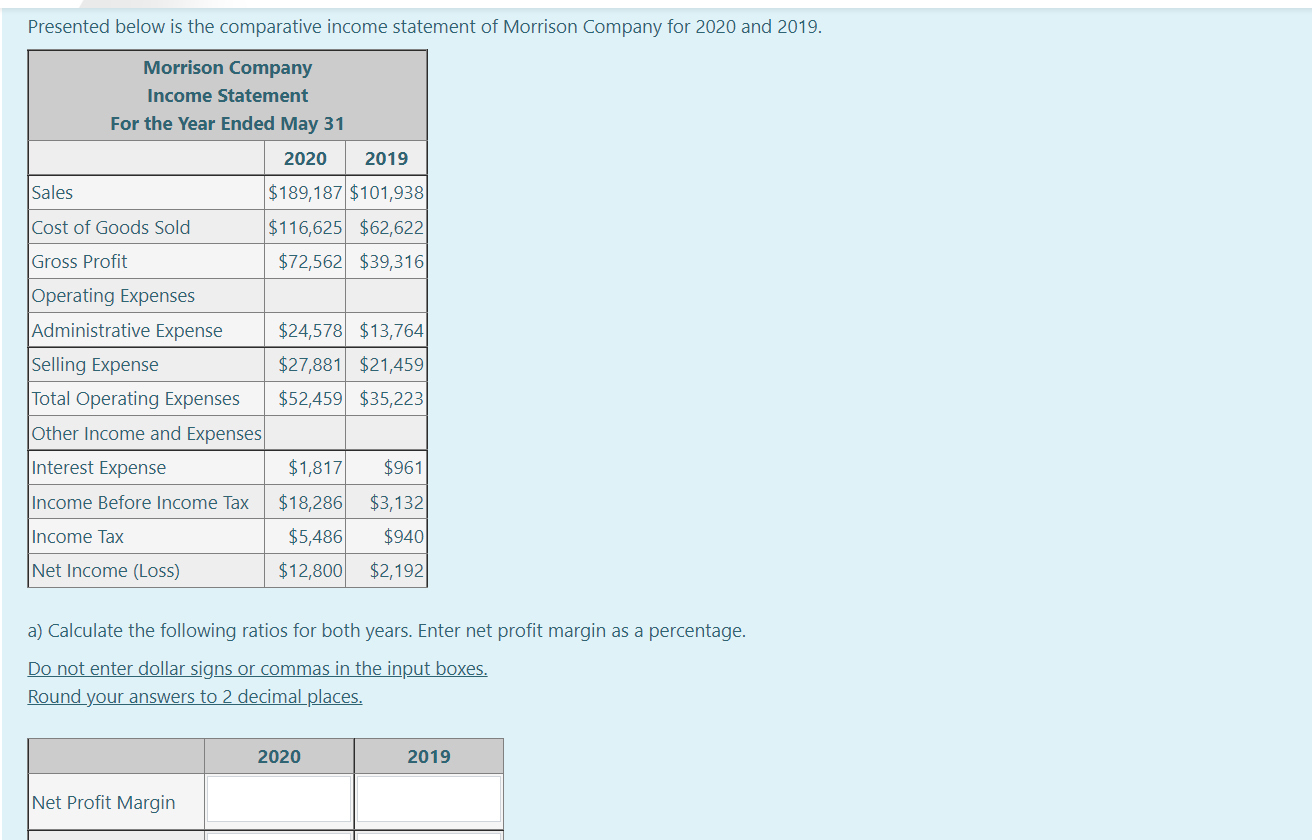

Presented below is the comparative income statement of Morrison Company for 2020 and 2019. Morrison Company Income Statement For the Year Ended May 31

Presented below is the comparative income statement of Morrison Company for 2020 and 2019. Morrison Company Income Statement For the Year Ended May 31 2020 2019 Sales $189,187 $101,938 Cost of Goods Sold $116,625 $62,622 Gross Profit $72,562 $39,316 Operating Expenses Administrative Expense $24,578 $13,764 Selling Expense Total Operating Expenses $27,881 $21,459 $52,459 $35,223 Other Income and Expenses Interest Expense $1,817 $961 Income Before Income Tax $18,286 $3,132 $5,486 $12,800 Income Tax $940 Net Income (Loss) $2,192 a) Calculate the following ratios for both years. Enter net profit margin as a percentage. Do not enter dollar signs or commas in the input boxes. Round your answers to 2 decimal places. 2020 2019 Net Profit Margin Total Operating Expenses $52,459 $35,223 Other Income and Expenses Interest Expense $1,817 $961 $18,286 $5,486 Income Before Income Tax $3,132 Income Tax $940 Net Income (Loss) $12,800 $2,192 a) Calculate the following ratios for both years. Enter net profit margin as a percentage. Do not enter dollar signs or Commas in the input boxes. Round your answers to 2 decimal places. 2020 2019 Net Profit Margin Time Interest Earned b) In which year does the company have a better performance with respect to the net profit margin calculated in part a)? Year: Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Net Profit Margin Net IncomeSales 100 a For 2020 Net Pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started