Answered step by step

Verified Expert Solution

Question

1 Approved Answer

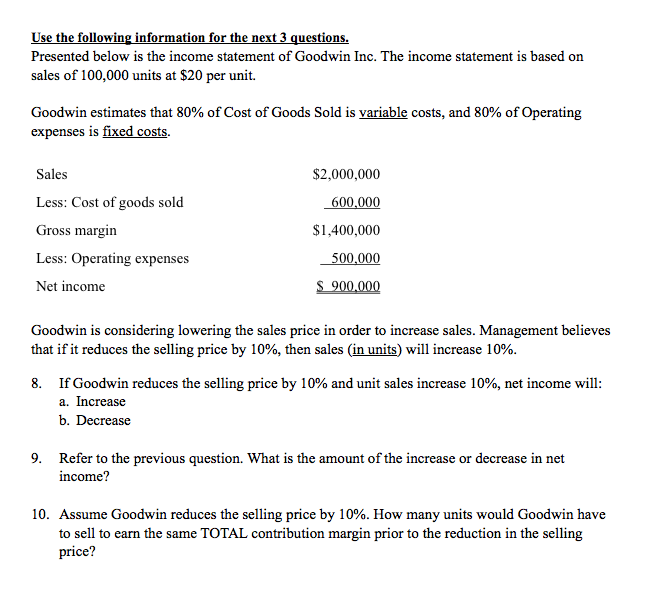

Presented below is the income statement of Goodwin Inc. The income statement is based on sales of 100,000 units at $20 per unit. Goodwin estimates

Presented below is the income statement of Goodwin Inc. The income statement is based on sales of 100,000 units at $20 per unit.

Goodwin estimates that 80% of Cost of Goods Sold is variable costs, and 80% of Operating expenses is fixed costs.

9.Refer to the previous question. What is the amount of the increase or decrease in net income?

10.Assume Goodwin reduces the selling price by 10%. How many units would Goodwin have to sell to earn the same TOTAL contribution margin prior to the reduction in the selling price?

Use the following information for the next 3 questions Presented below is the income statement of Goodwin Inc. The income statement is based on sales of 100,000 units at $20 per unit. Goodwin estimates that 80% of Cost of Goods Sold is variable costs, and 80% of Operating expenses is fixed costs Sales $2,000,000 Less: Cost ofgoods sold 600,000 Gross margin $1,400,000 Less: Operating expenses 500,000 S 900,000 Net income Goodwin is considering lowering the sales price in order to increase sales. Management believes that if it reduces the selling price by 10%, then sales (in units) will increase 10%. 8. If Goodwin reduces the selling price by 10% and unit sales increase 10%, net income will a. Increase b. Decrease 9. Refer to the previous question. What is the amount of the increase or decrease in net income? 10. Assume Goodwin reduces the selling price by 10%. How many units would Goodwin have to sell to earn the same TOTAL contribution margin prior to the reduction in the selling priceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started