Answered step by step

Verified Expert Solution

Question

1 Approved Answer

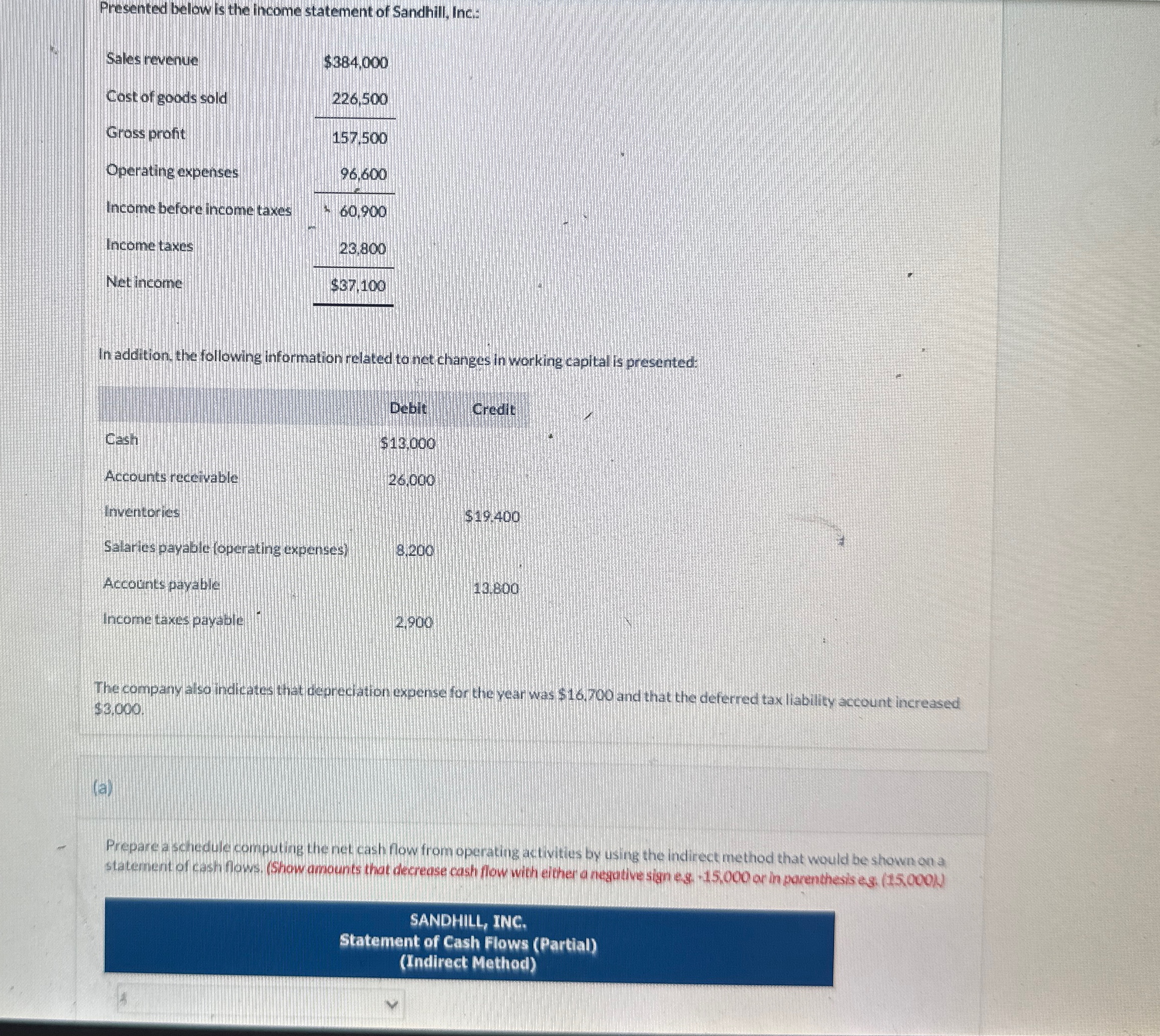

Presented below is the income statement of Sandhill, Inc.: Sales revenue $384.000 Cost of goods sold 226,500 Gross profit 157.500 Operating expenses 96,600 Income

Presented below is the income statement of Sandhill, Inc.: Sales revenue $384.000 Cost of goods sold 226,500 Gross profit 157.500 Operating expenses 96,600 Income before income taxes 60,900 Income taxes 23.800 Net income $37.100 In addition, the following information related to net changes in working capital is presented. Debit Credit Cash $13,000 Accounts receivable 26.000 Inventories $19.400 Salaries payable (operating expenses) 8.200 Accounts payable 13.800 Income taxes payable 2,900 The company also indicates that depreciation expense for the year was $16.700 and that the deferred tax liability account increased $3,000. (a) Prepare a schedule computing the net cash flow from operating activities by using the indirect method that would be shown on a statement of cash flows. (Show amounts that decrease cash flow with either a negative sign es-15,000 or in parenthesis eg. (15,000)) SANDHILL, INC. Statement of Cash Flows (Partial) (Indirect Method)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started