Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have just completed your post-graduation in Finance from Tribhuvan University and have been appointed as financial consultant to the Chief Financial Officer in

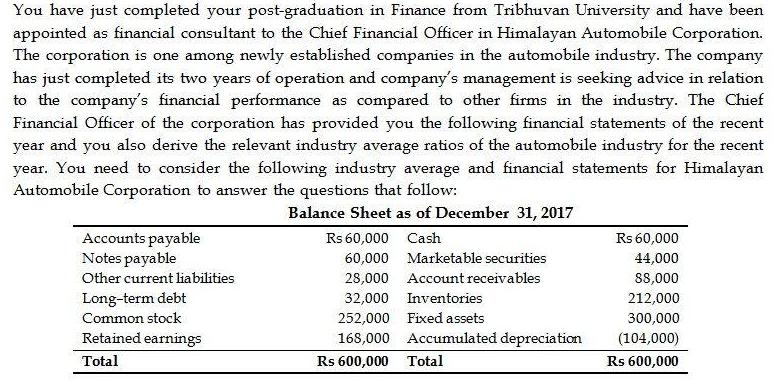

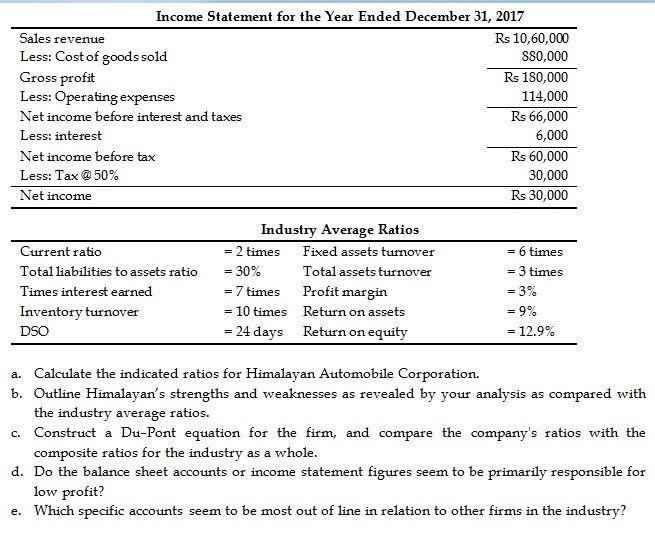

You have just completed your post-graduation in Finance from Tribhuvan University and have been appointed as financial consultant to the Chief Financial Officer in Himalayan Automobile Corporation. The corporation is one among newly established companies in the automobile industry. The company has just completed its two years of operation and company's management is seeking advice in relation to the company's financial performance as compared to other firms in the industry. The Chief Financial Officer of the corporation has provided you the following financial statements of the recent year and you also derive the relevant industry average ratios of the automobile industry for the recent year. You need to consider the following industry average and financial statements for Himalayan Automobile Corporation to answer the questions that follow: Balance Sheet as of December 31, 2017 Accounts payable Notes payable Other current liabilities Long-term debt Common stock Retained earnings Total Rs 60,000 Cash 60,000 Marketable securities 28,000 Account receivables 32,000 Inventories 252,000 Fixed assets 168,000 Accumulated depreciation Rs 600,000 Total Rs 60,000 44,000 88,000 212,000 300,000 (104,000) Rs 600,000 Income Statement for the Year Ended December 31, 2017 Sales revenue Less: Cost of goods sold Gross profit Less: Operating expenses Net income before interest and taxes Less: interest Net income before tax Less: Tax @ 50% Net income Current ratio Total liabilities to assets ratio Times interest earned Inventory turnover DSO Industry Average Ratios = 2 times = 30% = 7 times = 10 times = 24 days Fixed assets turnover Total assets turnover Profit margin Return on assets Return on equity Rs 10,60,000 $80,000 Rs 180,000 114,000 Rs 66,000 6,000 Rs 60,000 30,000 Rs 30,000 6 times = 3 times = 3% = 9% = 12.9% = a. Calculate the indicated ratios for Himalayan Automobile Corporation. b. Outline Himalayan's strengths and weaknesses as revealed by your analysis as compared with the industry average ratios. c. Construct a Du-Pont equation for the firm, and compare the company's ratios with the composite ratios for the industry as a whole. d. Do the balance sheet accounts or income statement figures seem to be primarily responsible for low profit? e. Which specific accounts seem to be most out of line in relation to other firms in the industry?

Step by Step Solution

★★★★★

3.54 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

a Fixed Assets Turnover Himalayan Automobile Corporations fixed assets turnover ratio is calculated by dividing sales revenue by the value of fixed assets Fixed Assets Turnover Sales Revenue Fixed Ass...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started