Answered step by step

Verified Expert Solution

Question

1 Approved Answer

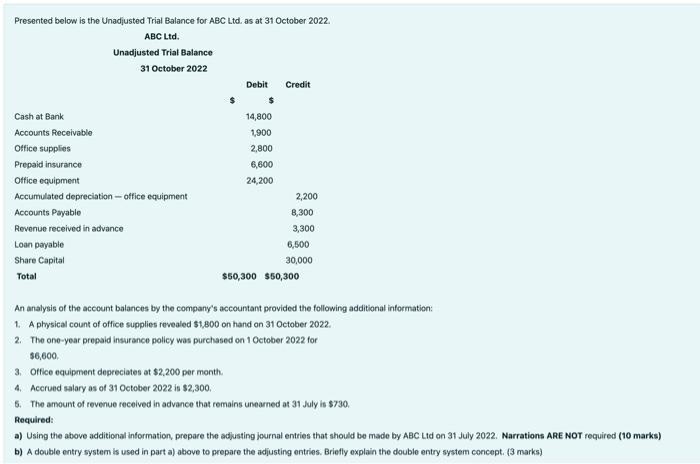

Presented below is the Unadjusted Trial Balance for ABC Ltd. as at 31 October 2022. ABC Ltd. Unadjusted Trial Balance 31 October 2022 Cash

Presented below is the Unadjusted Trial Balance for ABC Ltd. as at 31 October 2022. ABC Ltd. Unadjusted Trial Balance 31 October 2022 Cash at Bank Accounts Receivable Office supplies Prepaid insurance Office equipment Accumulated depreciation-office equipment Accounts Payable Revenue received in advance Loan payable Share Capital Total $ Debit Credit $ 14,800 1,900 2,800 6,600 24,200 2,200 8,300 3,300 6,500 30,000 $50,300 $50,300 An analysis of the account balances by the company's accountant provided the following additional information: 1. A physical count of office supplies revealed $1,800 on hand on 31 October 2022. 2. The one-year prepaid insurance policy was purchased on 1 October 2022 for $6,600, 3. Office equipment depreciates at $2,200 per month. 4. Accrued salary as of 31 October 2022 is $2,300. 5. The amount of revenue received in advance that remains unearned at 31 July is $730. Required: a) Using the above additional information, prepare the adjusting journal entries that should be made by ABC Ltd on 31 July 2022. Narrations ARE NOT required (10 marks) b) A double entry system is used in part a) above to prepare the adjusting entries. Briefly explain the double entry system concept. (3 marks)

Step by Step Solution

★★★★★

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

a Office Supplies Adjustment Debit Office Supplies 1800 Credit Supplies Expense 1800 Prepaid Insuran...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started