Answered step by step

Verified Expert Solution

Question

1 Approved Answer

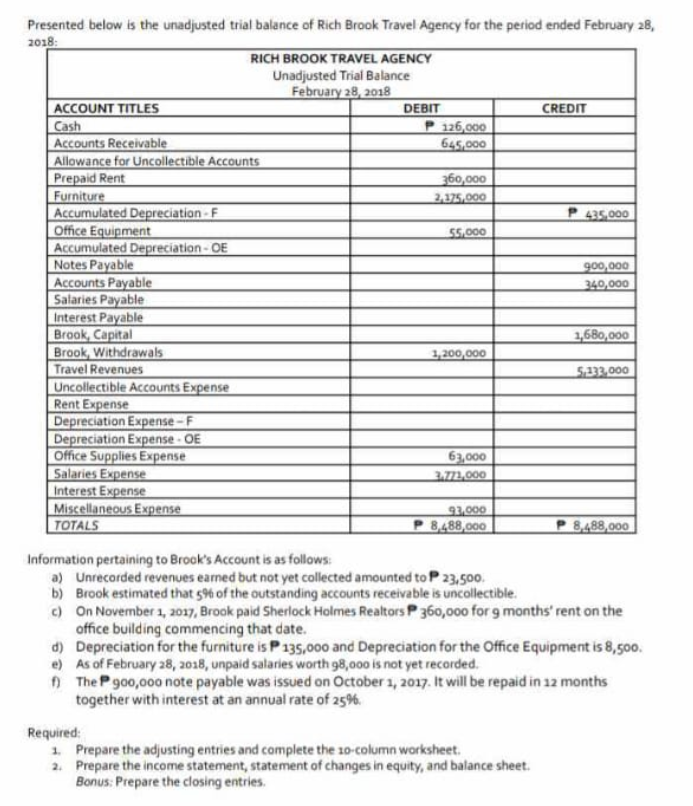

Presented below is the unadjusted trial balance of Rich Brook Travel Agency for the period ended February 2 8 , 2 0 1 8 :

Presented below is the unadjusted trial balance of Rich Brook Travel Agency for the period ended February

:

Information pertaining to Brook's Account is as follows:

a Unrecorded revenues earned but not yet collected amounted to

b Brook estimated that of the outstanding accounts receivable is uncollectible.

c On November Brook paid Sherlock Holmes Realtors for months' rent on the

office building commencing that date.

d Depreciation for the furniture is and Depreciation for the Office Equipment is

e As of February unpaid salaries worth is not yet recorded.

f The note payable was issued on October It will be repaid in months

together with interest at an annual rate of

Required:

Prepare the adjusting entries and complete the socolumn worksheet.

Prepare the income statement, statement of changes in equity, and balance sheet.

Bonus: Prepare the closing entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started