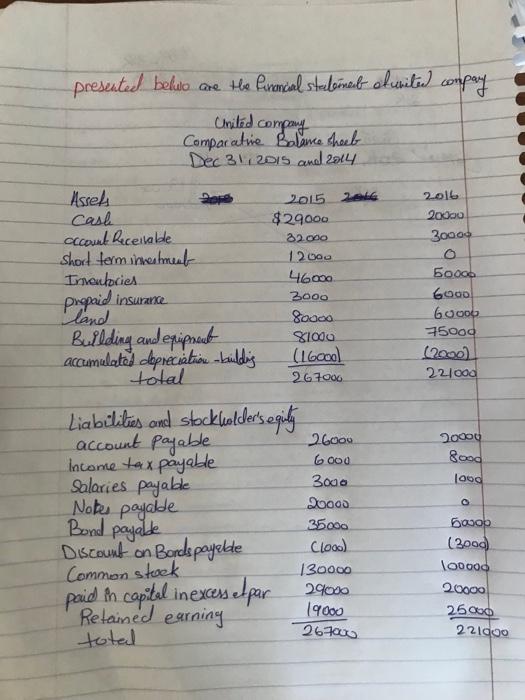

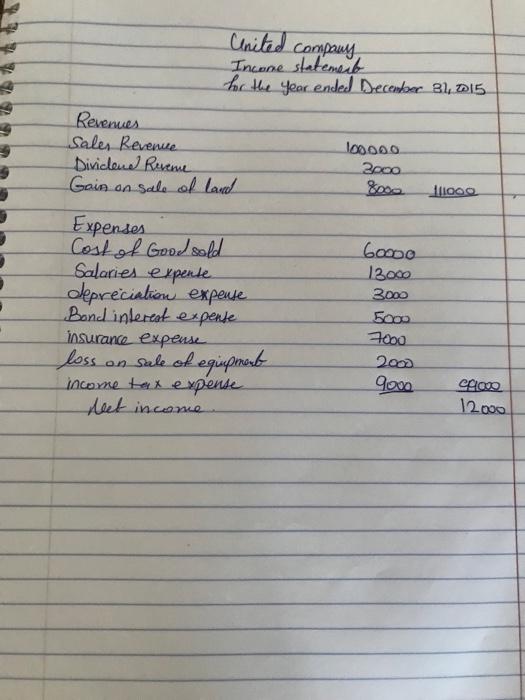

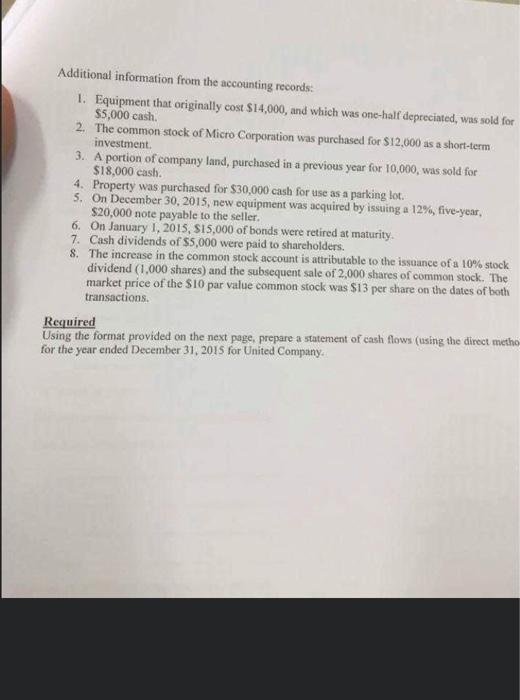

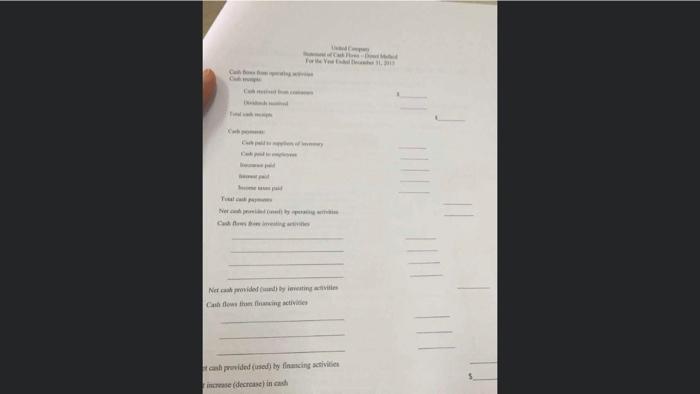

presented beluio are the financial stealsiaub odwrite] company United company Comparative Balance sheet Dec 31, 2015 and 2014 2016 2016 20000 3000 2015 AL $29000 22.000 12000 46000 2000 800cc 81000 (16oool 26 7006 600D 6000 75000 (2000) 221000 Assets Cash occount Receivable short term investment Iriondociel Pingpaid insurance land Building and epipment accumulated depreciation building total Liabilities and stockholder's eqida account payable income tax payable Salaries payable Notes payable Discount on Bords payalde Common stock paid in capital inexcess elpar Retained earning toted 2670 26009 6 000 20000 Rood lood Bond payable 3000 20000 35000 Clooo) 130000 2900 19000 (2000) looooo 20000 25000 221000 United company , Income statement for the year ended December 31, 2015 Revenues Sales Revenue 100000 Diviclen Revenue 2000 Gain on sale of land % Togo . Expenses Cost of Good sold Salaries expente depreciation expense Band incercat expende insurance expense loss on sale of equipment income tax expense Meet income Goooo 13.000 3000 5000 7000 2000 900 CAO 12.000 Additional information from the accounting records: 1. Equipment that originally cost $14,000, and which was one-half depreciated, was sold for $5,000 cash. 2. The common stock of Micro Corporation was purchased for $12,000 as a short-term investment 3. A portion of company land, purchased in a previous year for 10,000, was sold for $18,000 cash. 4. Property was purchased for $30,000 cash for use as a parking lot. 5. On December 30, 2015, new equipment was acquired by issuing a 12%, five-year, $20,000 note payable to the seller. 6. On January 1, 2015, S15,000 of bonds were retired at maturity. 7. Cash dividends of $5,000 were paid to shareholders. 8. The increase in the common stock account is attributable to the issuance of a 10% stock dividend (1,000 shares) and the subsequent sale of 2,000 shares of common stock. The market price of the $10 par value common stock was $13 per share on the dates of both transactions Required Using the format provided on the next page, prepare a statement of cash flows (using the direct metho for the year ended December 31, 2015 for United Company w - Necided timing Cathothing Acties and provided (asy financing activities e decrease in