Answered step by step

Verified Expert Solution

Question

1 Approved Answer

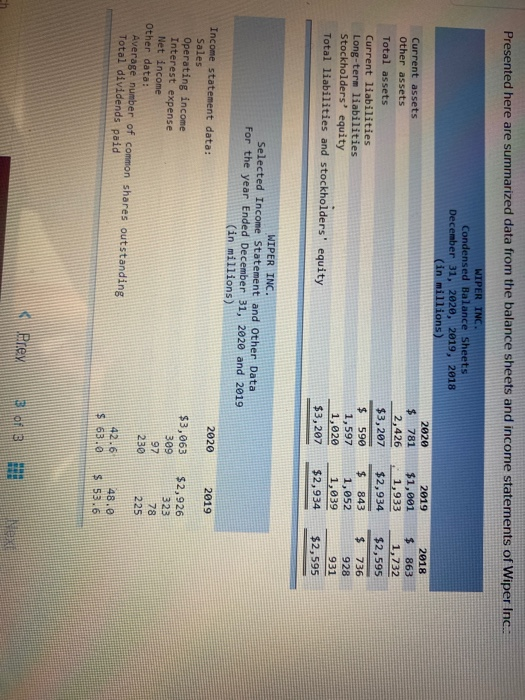

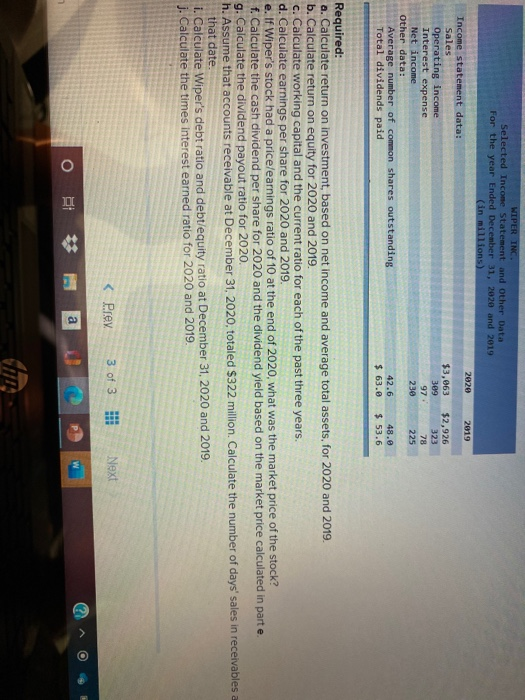

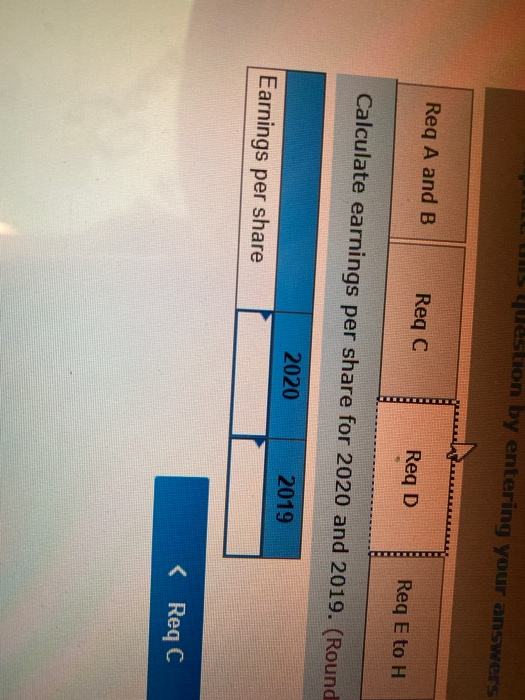

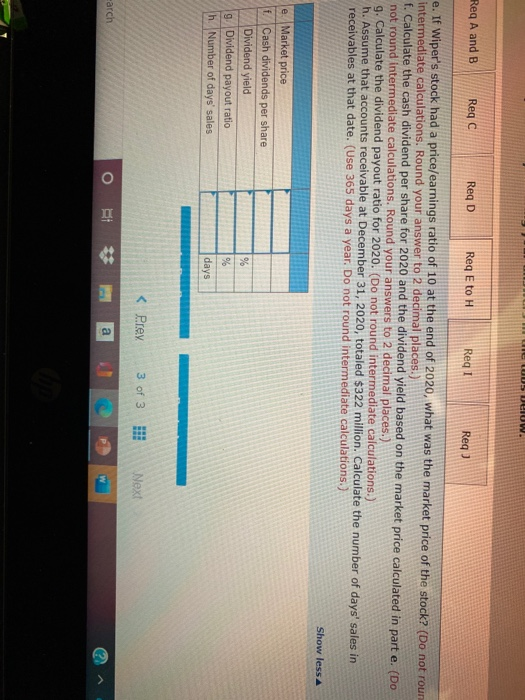

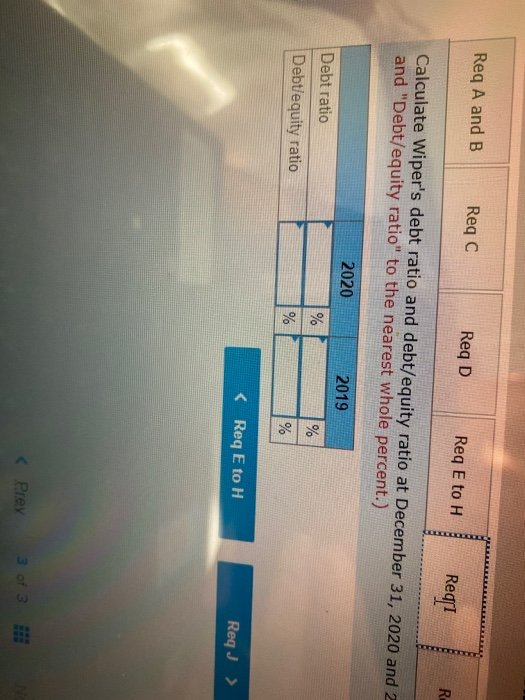

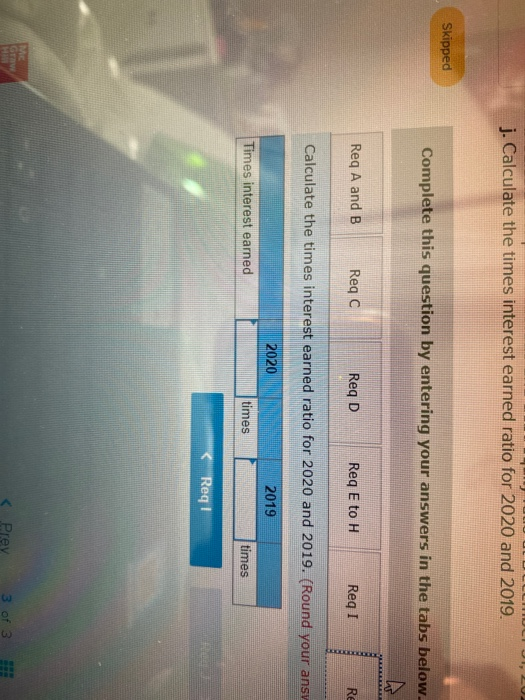

Presented here are summarized data from the balance sheets and income statements of Wiper Inc.. WIPER INC. Condensed Balance Sheets December 31, 2020, 2019, 2018

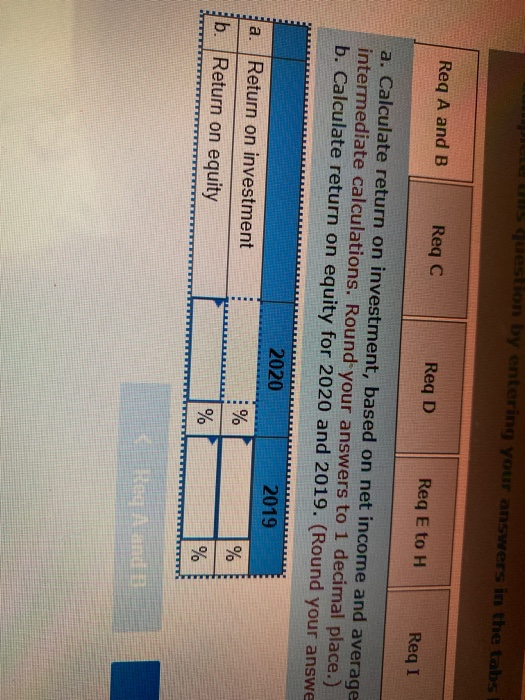

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

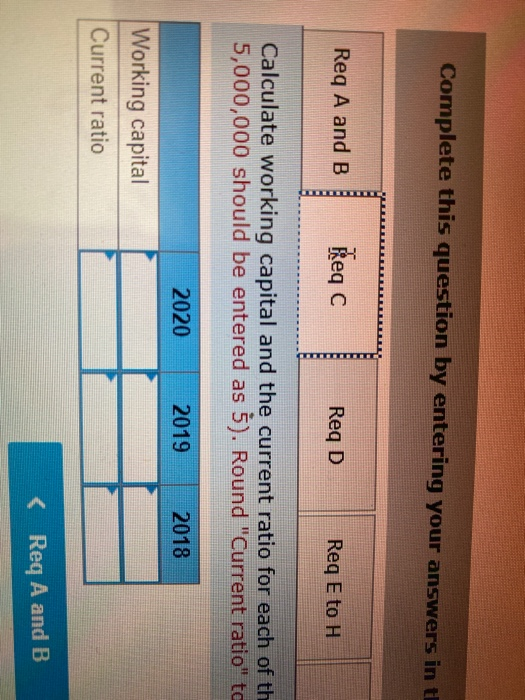

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started