Answered step by step

Verified Expert Solution

Question

1 Approved Answer

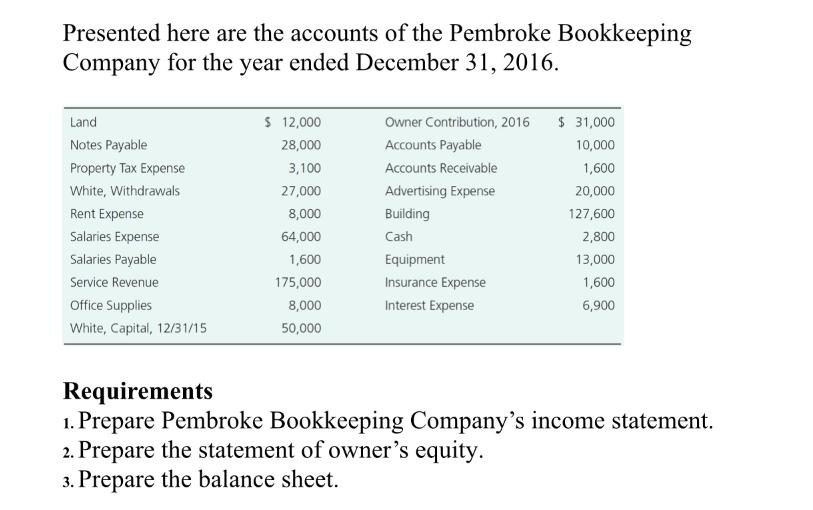

Presented here are the accounts of the Pembroke Bookkeeping Company for the year ended December 31, 2016. Land Notes Payable Property Tax Expense White,

Presented here are the accounts of the Pembroke Bookkeeping Company for the year ended December 31, 2016. Land Notes Payable Property Tax Expense White, Withdrawals Rent Expense Salaries Expense Salaries Payable Service Revenue Office Supplies White, Capital, 12/31/15 $ 12,000 28,000 3,100 27,000 8,000 64,000 1,600 175,000 8,000 50,000 Owner Contribution, 2016 Accounts Payable Accounts Receivable Advertising Expense Building Cash Equipment Insurance Expense Interest Expense $ 31,000 10,000 1,600 20,000 127,600 2,800 13,000 1,600 6,900 Requirements 1. Prepare Pembroke Bookkeeping Company's income statement. 2. Prepare the statement of owner's equity. 3. Prepare the balance sheet.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Apologies for the confusion Lets perform the calculations using the values given and prepare the income statement statement of owners equity and balan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started