Question

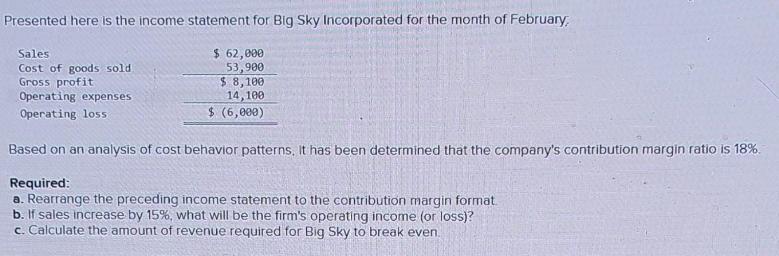

Presented here is the income statement for Big Sky Incorporated for the month of February, $ 62,000 53,900 $ 8,100 14,100 $ (6,000) Sales

Presented here is the income statement for Big Sky Incorporated for the month of February, $ 62,000 53,900 $ 8,100 14,100 $ (6,000) Sales Cost of goods sold Gross profit Operating expenses Operating loss Based on an analysis of cost behavior patterns. It has been determined that the company's contribution margin ratio is 18%. Required: a. Rearrange the preceding income statement to the contribution margin format. b. If sales increase by 15%, what will be the firm's operating income (or loss)? c. Calculate the amount of revenue required for Big Sky to break even.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Rearranging the income statement to the contribution margin format Contributio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Accounting

Authors: Fred Phillips, Robert Libby, Patricia Libby, Brandy Mackintosh

4th Canadian edition

978-1259269868, 978-1259103292

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App