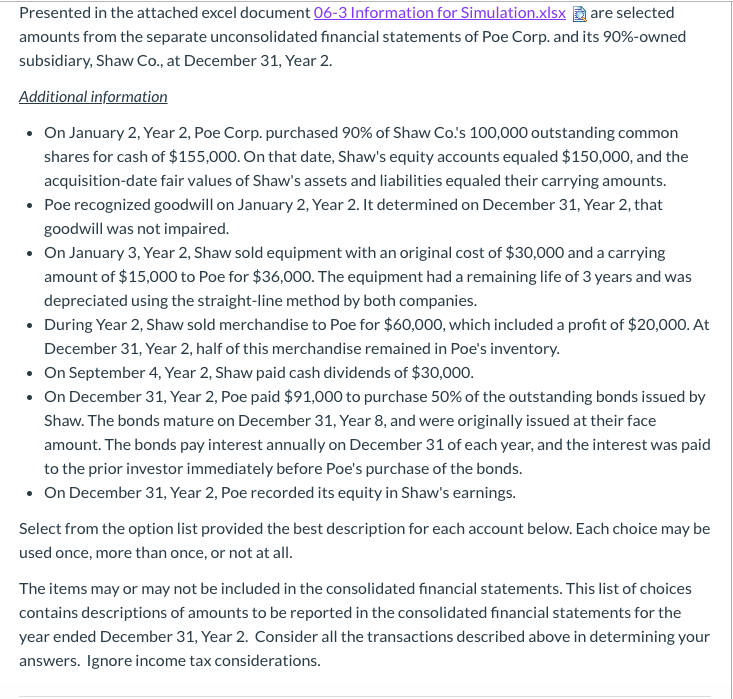

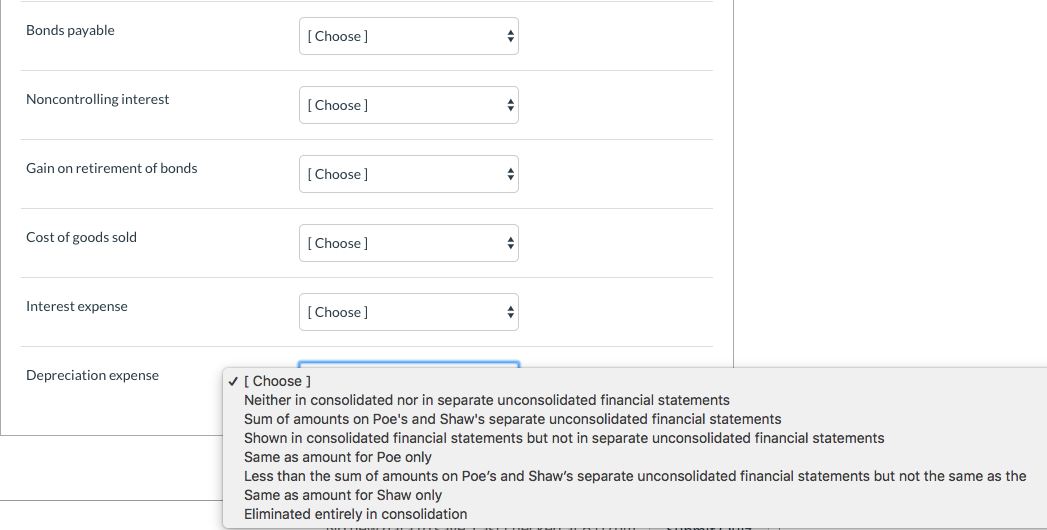

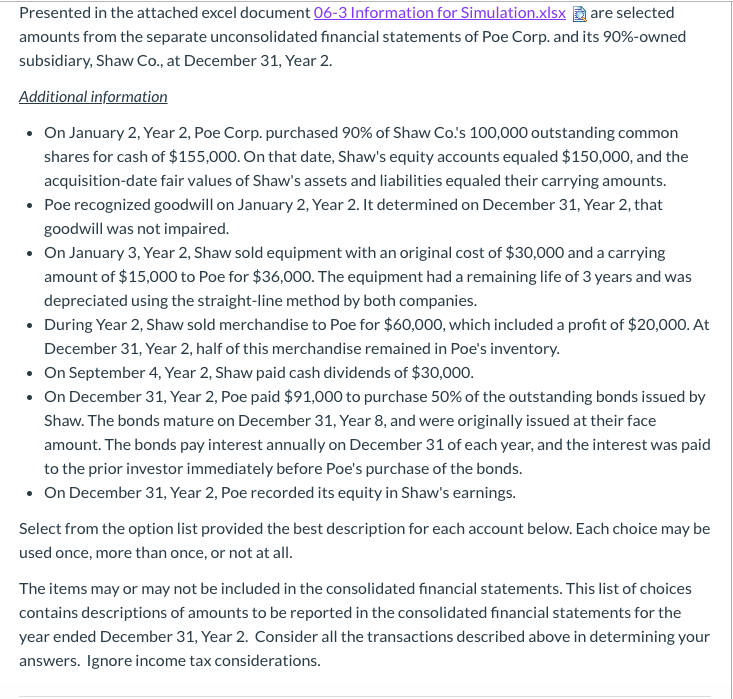

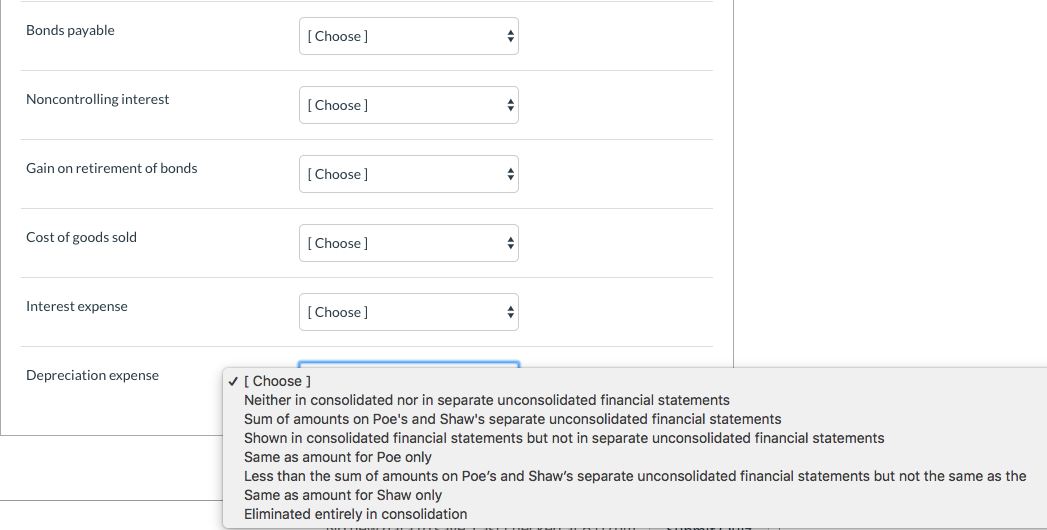

Presented in the attached excel document 06-3 Information for Simulation.xlsx bare selected amounts from the separate unconsolidated financial statements of Poe Corp. and its 90%-owned subsidiary, Shaw Co., at December 31, Year 2. Additional information On January 2, Year 2, Poe Corp. purchased 90% of Shaw Co.'s 100,000 outstanding common shares for cash of $155,000. On that date, Shaw's equity accounts equaled $150,000, and the acquisition date fair values of Shaw's assets and liabilities equaled their carrying amounts. Poe recognized goodwill on January 2, Year 2. It determined on December 31, Year 2, that goodwill was not impaired. . On January 3, Year 2, Shaw sold equipment with an original cost of $30,000 and a carrying amount of $15,000 to Poe for $36,000. The equipment had a remaining life of 3 years and was depreciated using the straight-line method by both companies. During Year 2, Shaw sold merchandise to Poe for $60,000, which included a profit of $20,000. At December 31, Year 2, half of this merchandise remained in Poe's inventory. On September 4, Year 2, Shaw paid cash dividends of $30,000. On December 31, Year 2, Poe paid $91,000 to purchase 50% of the outstanding bonds issued by Shaw. The bonds mature on December 31, Year 8, and were originally issued at their face amount. The bonds pay interest annually on December 31 of each year, and the interest was paid to the prior investor immediately before Poe's purchase of the bonds. On December 31, Year 2, Poe recorded its equity in Shaw's earnings. Select from the option list provided the best description for each account below. Each choice may be used once, more than once, or not at all. The items may or may not be included in the consolidated financial statements. This list of choices contains descriptions of amounts to be reported in the consolidated financial statements for the year ended December 31, Year 2. Consider all the transactions described above in determining your answers. Ignore income tax considerations. Bonds payable [Choose ] Noncontrolling interest [Choose ] Gain on retirement of bonds [Choose] Cost of goods sold [Choose] Interest expense [Choose] Depreciation expense [Choose ] Neither in consolidated nor in separate unconsolidated financial statements Sum of amounts on Poe's and Shaw's separate unconsolidated financial statements Shown in consolidated financial statements but not in separate unconsolidated financial statements Same as amount for Poe only Less than the sum of amounts on Poe's and Shaw's separate unconsolidated financial statements but not the same as the Same as amount for Shaw only Eliminated entirely in consolidation Presented in the attached excel document 06-3 Information for Simulation.xlsx bare selected amounts from the separate unconsolidated financial statements of Poe Corp. and its 90%-owned subsidiary, Shaw Co., at December 31, Year 2. Additional information On January 2, Year 2, Poe Corp. purchased 90% of Shaw Co.'s 100,000 outstanding common shares for cash of $155,000. On that date, Shaw's equity accounts equaled $150,000, and the acquisition date fair values of Shaw's assets and liabilities equaled their carrying amounts. Poe recognized goodwill on January 2, Year 2. It determined on December 31, Year 2, that goodwill was not impaired. . On January 3, Year 2, Shaw sold equipment with an original cost of $30,000 and a carrying amount of $15,000 to Poe for $36,000. The equipment had a remaining life of 3 years and was depreciated using the straight-line method by both companies. During Year 2, Shaw sold merchandise to Poe for $60,000, which included a profit of $20,000. At December 31, Year 2, half of this merchandise remained in Poe's inventory. On September 4, Year 2, Shaw paid cash dividends of $30,000. On December 31, Year 2, Poe paid $91,000 to purchase 50% of the outstanding bonds issued by Shaw. The bonds mature on December 31, Year 8, and were originally issued at their face amount. The bonds pay interest annually on December 31 of each year, and the interest was paid to the prior investor immediately before Poe's purchase of the bonds. On December 31, Year 2, Poe recorded its equity in Shaw's earnings. Select from the option list provided the best description for each account below. Each choice may be used once, more than once, or not at all. The items may or may not be included in the consolidated financial statements. This list of choices contains descriptions of amounts to be reported in the consolidated financial statements for the year ended December 31, Year 2. Consider all the transactions described above in determining your answers. Ignore income tax considerations. Bonds payable [Choose ] Noncontrolling interest [Choose ] Gain on retirement of bonds [Choose] Cost of goods sold [Choose] Interest expense [Choose] Depreciation expense [Choose ] Neither in consolidated nor in separate unconsolidated financial statements Sum of amounts on Poe's and Shaw's separate unconsolidated financial statements Shown in consolidated financial statements but not in separate unconsolidated financial statements Same as amount for Poe only Less than the sum of amounts on Poe's and Shaw's separate unconsolidated financial statements but not the same as the Same as amount for Shaw only Eliminated entirely in consolidation