Answered step by step

Verified Expert Solution

Question

1 Approved Answer

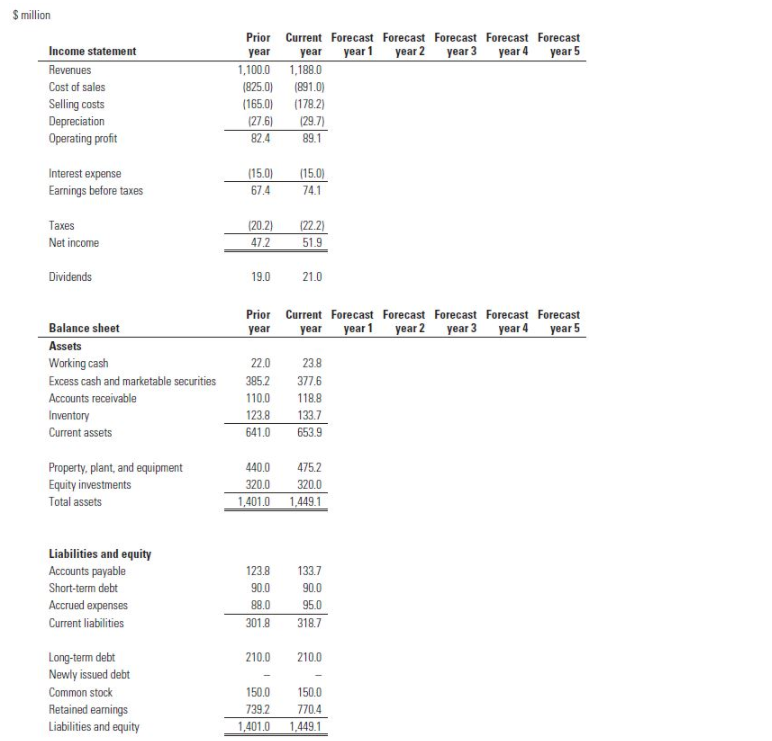

Presented is the income statement and balance sheet for PartsCo, a $1.2 billion supplier of machinery parts. The company is expected to increase revenues by

Presented is the income statement and balance sheet for PartsCo, a $1.2 billion supplier of machinery parts. The company is expected to increase revenues by 8 percent annually for the next five years. Forecast the next five years of income statements for PartsCo. Assume that the next five years forecast ratios are identical to this years ratios. Forecast depreciation as a percentage of the prior years property, plant, and equipment. Forecast interest as a percentage of the prior years total debt.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started