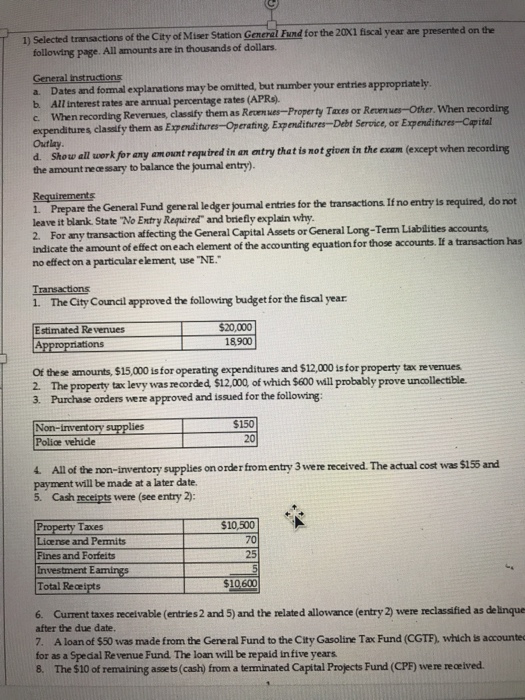

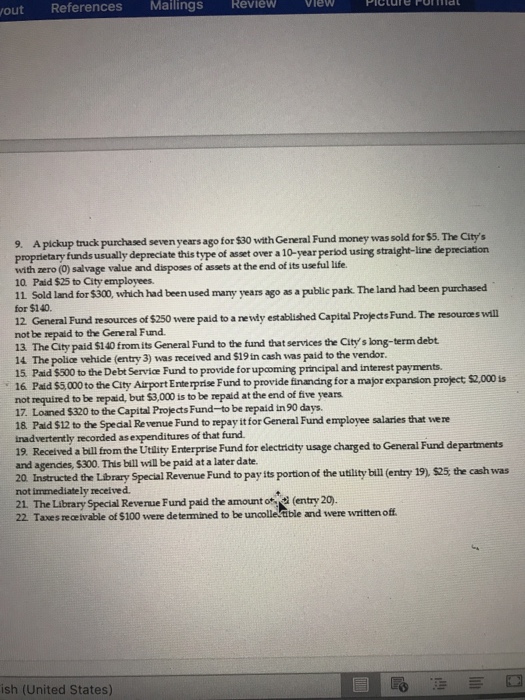

presented on the 1) Selected transactions of the City of Miser Station Generel Fund for the 20X1 fiscal year are following page. All amounts are in thousands of dollars General instructions a. Dates and formal explanat b All interest rates are annual percentage rates (APRs). tions may be omitted, but number your entries appropriately c. When recording Reverues, classity them as Revenes-Property Taxes or Revenues Other. When recording expenditures classfy them as Expendi Outlay teres-Operating Expenditures-Debt Service, or Expenditores- Capital d. Show all work fer any amount roqu tred in an antry that i not given tn the exam (except when recording the amount nece ssary to balance the joumal entry) Requirements 1. Prepare the General Fund general ledger joumal entries for the transactions If no entry is required, do not leave it blank State "No Entry Reqpared and briefly explatn why 2. For any transaction affecting the General Capital Assets or General Long-Term Liablities accounts indicate the amount of effect on each element of the accounting equation for those accounts. If a transaction has no effect on a particular element use "NE. Transactions 1. The City Council approved the following budget for the fiscal year Estimated Revenues $20,000 18,900 Of the se amounts, $15,000 is for operating expenditures and $12,000 is for property tax revenues 2. The property tax levy was re corded $12,000 of which $600 will probably prove uncollectible. 3. Purchase orders were approved and issued for the following Non-inventory supplies Police vehide $150 20 4. Allof the non-inventory supplies ononder from entry 3 were received. The actual cont was $155 and payment will be made at a later date. 5. Cash receipts were (see entry 2) $10,500 70 25 License and Permits Fines and Forfeits Investment E Total Receipts 6. Current taxes receivable (entries 2 and 5) and the relate d allowance (entry 2) were reclassified as delinque after the due date. 7. A loan of $50 was made from the Gene ral Fund to the City Gasoline Tax Fund (CGTF), which is accounte for as a Spedal Revenue Fund The loan will be repaid infive years 8. The $10 of remaining assets (cash) from a terminated Capital Projects Fund (CPF) were recrived. presented on the 1) Selected transactions of the City of Miser Station Generel Fund for the 20X1 fiscal year are following page. All amounts are in thousands of dollars General instructions a. Dates and formal explanat b All interest rates are annual percentage rates (APRs). tions may be omitted, but number your entries appropriately c. When recording Reverues, classity them as Revenes-Property Taxes or Revenues Other. When recording expenditures classfy them as Expendi Outlay teres-Operating Expenditures-Debt Service, or Expenditores- Capital d. Show all work fer any amount roqu tred in an antry that i not given tn the exam (except when recording the amount nece ssary to balance the joumal entry) Requirements 1. Prepare the General Fund general ledger joumal entries for the transactions If no entry is required, do not leave it blank State "No Entry Reqpared and briefly explatn why 2. For any transaction affecting the General Capital Assets or General Long-Term Liablities accounts indicate the amount of effect on each element of the accounting equation for those accounts. If a transaction has no effect on a particular element use "NE. Transactions 1. The City Council approved the following budget for the fiscal year Estimated Revenues $20,000 18,900 Of the se amounts, $15,000 is for operating expenditures and $12,000 is for property tax revenues 2. The property tax levy was re corded $12,000 of which $600 will probably prove uncollectible. 3. Purchase orders were approved and issued for the following Non-inventory supplies Police vehide $150 20 4. Allof the non-inventory supplies ononder from entry 3 were received. The actual cont was $155 and payment will be made at a later date. 5. Cash receipts were (see entry 2) $10,500 70 25 License and Permits Fines and Forfeits Investment E Total Receipts 6. Current taxes receivable (entries 2 and 5) and the relate d allowance (entry 2) were reclassified as delinque after the due date. 7. A loan of $50 was made from the Gene ral Fund to the City Gasoline Tax Fund (CGTF), which is accounte for as a Spedal Revenue Fund The loan will be repaid infive years 8. The $10 of remaining assets (cash) from a terminated Capital Projects Fund (CPF) were recrived