Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Preston, an employee of Ace Electric, Inc., has gross salary for March of $4,100. The entire amount is under the OASDI limit of $118,500 and

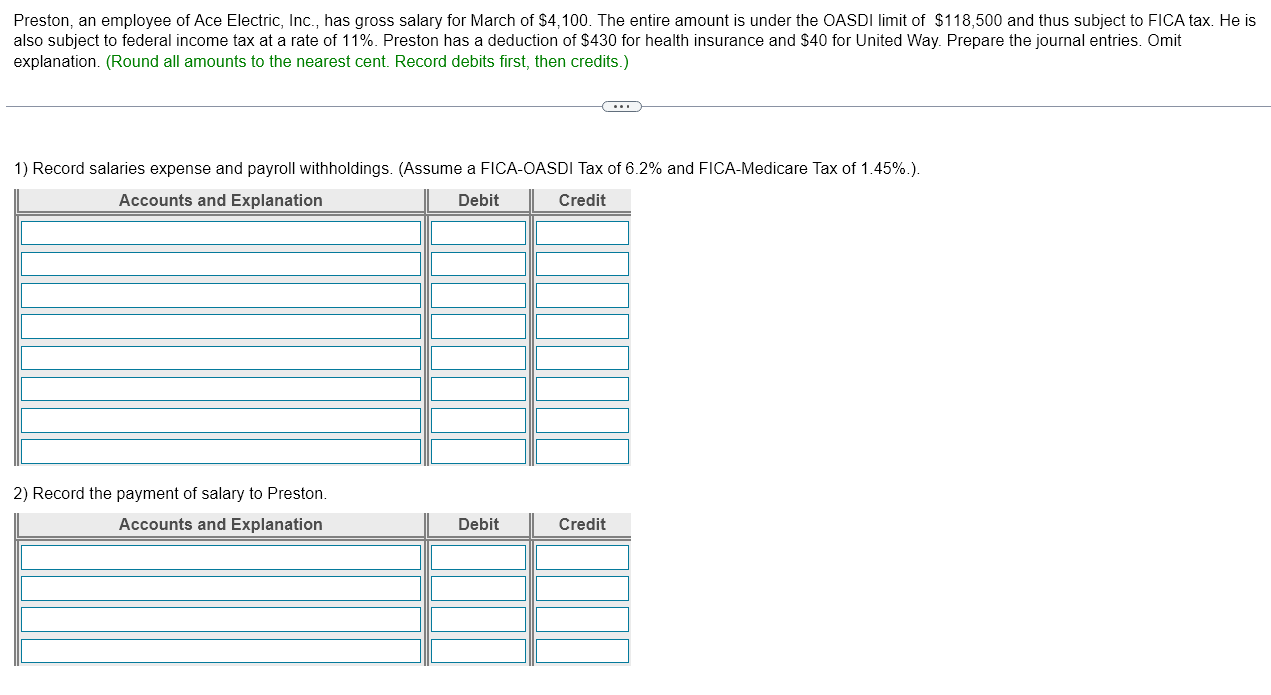

Preston, an employee of Ace Electric, Inc., has gross salary for March of $4,100. The entire amount is under the OASDI limit of $118,500 and thus subject to FICA tax. He is also subject to federal income tax at a rate of 11%. Preston has a deduction of $430 for health insurance and $40 for United Way. Prepare the journal entries. Omit explanation. (Round all amounts to the nearest cent. Record debits first, then credits.)

Preston, an employee of Ace Electric, Inc., has gross salary for March of $4,100. The entire amount is under the OASDI limit of $118,500 and thus subject to FICA tax. He is also subject to federal income tax at a rate of 11%. Preston has a deduction of $430 for health insurance and $40 for United Way. Prepare the journal entries. Omit explanation. (Round all amounts to the nearest cent. Record debits first, then credits.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started