Question

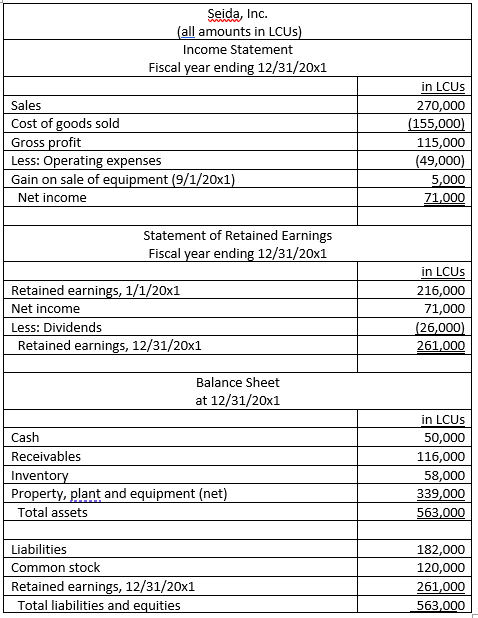

Preston Company is a U.S. corporation that maintains a 100% investment in Seida, Inc., a non-US company. Seidas financial statements are on the page following

Preston Company is a U.S. corporation that maintains a 100% investment in Seida, Inc., a non-US company.

Seidas financial statements are on the page following this page.

At 12/31/20x1, Preston Company will prepare consolidated financial statements that include Seida, Inc.

Therefore, they will have to convert Seidas financials from local currency amounts to U.S. dollar amounts. Below are the relevant exchange rates and some additional information:

| Relevant Exchange Rates and additional information | |

| Exchange rate for when common stock issued | $ 2.08 |

| Exchange rate for when property, plant, and equipment acquired | $ 1.98 |

| Retained earnings translated as of Jan. 1, 20x1 | $ 396,520 |

| Inventory acquired evenly throughout the year |

|

| Dividends were declared on Apr. 1, 20x1 |

|

|

|

|

| Relevant currency exchange rates: |

|

| January 1, 20x1 | $ 1.67 |

| April 1, 20x1 | $ 1.59 |

| September 1, 20x1 | $ 1.63 |

| December 31, 20x1 | $ 1.60 |

| Weighted average rate for 20x1 | $ 1.62 |

Additional information:

The gain on sale was associated with a 9/1/20x1 transaction.

The 12/31/20x0 financial statements reported an adjustment to convert the subsidiarys financial statements for consolidation was $85,000.

Following are the 12/31/20x1 account balances for Seida, Inc. in its currency, the LCU:

Required

A) Assuming the LCU is Seidas functional currency, prepare a schedule in which you apply the appropriate rate to convert Seidas financials into the U.S. dollar amounts. (Note: Please use an Excel schedule for this item with the formulas shown)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started