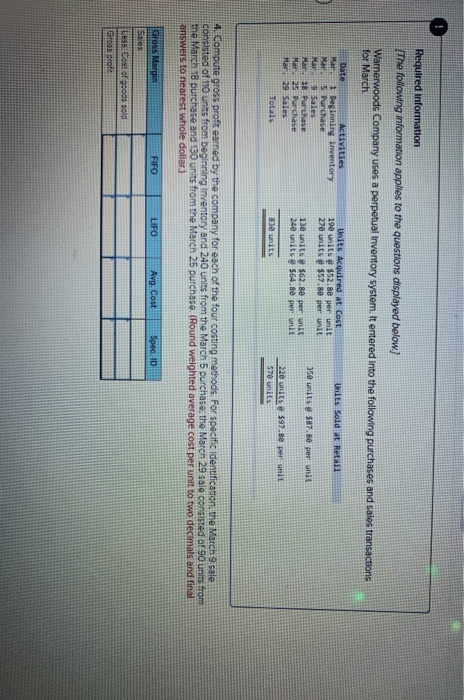

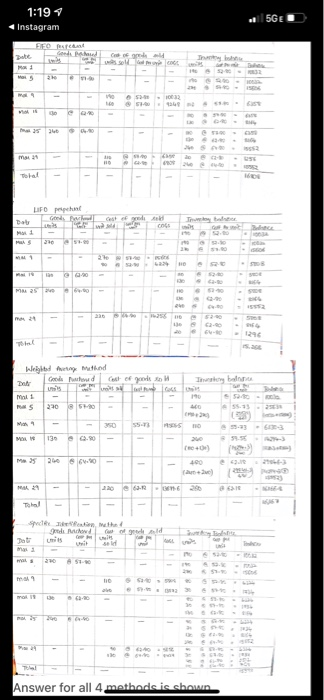

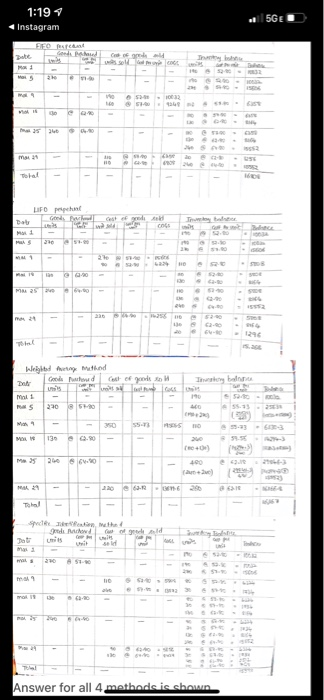

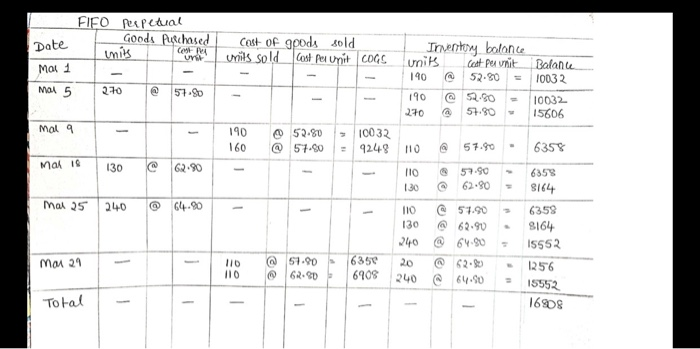

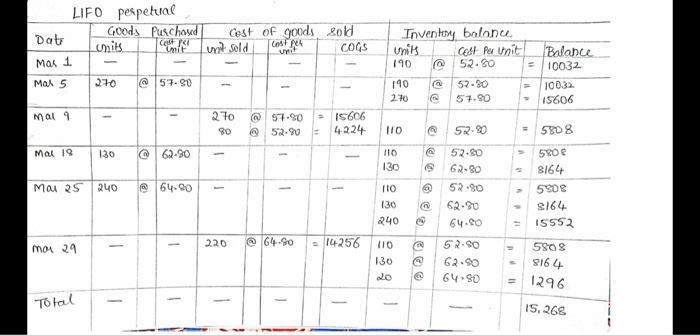

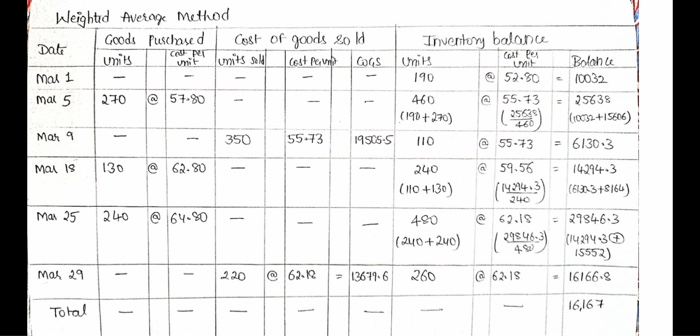

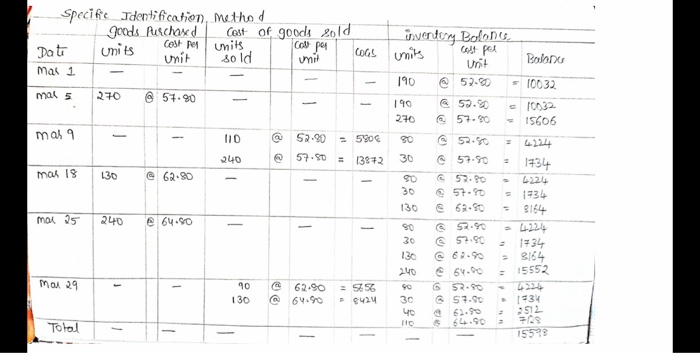

Required information The following information applies to the questions displayed below.) Warnerwoods Company uses a perpetual Inventory system. It entered into the following purchases and sales transactions for March Units sold at Retail Units Acquired at Cost 190 units 552.88 per unit 270 units 357.80 per unit Date Activities Mar 1 Deginning inventory Mar 5 Purchase Mar 9 Sales Mar. 18 Purchase Mar. 25 Purchase Mar 29 Sales Totals 350 units 587.se per unit 130 units $62.88 per unit 240 units $64.80 per unit 830 units 220 units $97.80 per unit 578 units 4. Compute gross proft earned by the company for each of the four costing methods. For specific identification, the March 9 sale consisted of 110 units from beginning inventory and 240 units from the March 5 purchase the March 29 sala consisted of 90 units from the March 18 purchase and 130 units from the March 25 purchase. (Round weighted average cost per unit to two decimals and final answers to nearest whole dollar.) FIFO Gross Margin ses LIFO Avg. Cost Spec ID Le cost of goods sold Gross roft 1:19 Instagram 5GE FO Goedd GN Co of 4 os 30 5-12 20 - - Total LIFO Da God M1 Cet Cs BA MM 25 60 S. We hy Method Natard Cost of goods Uns Mali OS 2200 350 110 MO IN 400 See the de hond Gold 51 110 Answer for all 4 methods is shown Date FIFO perpenal Goods Purchased units COPA Uvir MOL 1 270 @ 57.80 Cost of goods sold units sold cost per unit COGS Inventory balonce unik Cost per unit 190 52.80 190 @ 52.80 270 57.90 mai 5 - Balance 10032 10032 15606 1 Mal 9 190 160 52.80 > 10032 @ 57-80 = 9248 110 57.90 6358 Mal 16 130 - 110 130 57.90 62.80 Mal 25 240 @ - 1 1 110 130 @ 51.90 62.90 @ 64.90 62.90 @ 64.90 6358 8164 6358 8164 I5552 1256 15552 16908 mai 29 - 110 @ 57.90 62.80 6350 6908 110 20 240 Total 1 1 LIFO perpetual Goods Purchased Units unit Dati Cost Cost of goods sold unt sold Gol COGS 1 Inventowy balonu unik Cost Per Unit 190 @ 52.80 190 52.80 270 57.90 Balance 10032 1003) 15606 Mal 5 270 @ 57.80 - Mal 9 - 270 80 57.80 52.90 15606 4224 110 520 Mar 19 130 @ 62-90 1 1 110 130 > = 5808 500 e 8164 5908 $164 = 15552 240 @ 64.90 Mai 25 1 - 1 52.80 62-90 52.80 62-30 64.80 110 130 240 1 220 - @ 64.90 [ moi 29 14256 5808 110 130 20 52.50 62.90 64.90 $164 1296 1 Total - 1 IS, 268 Mal 1 Weighted Average Method Goods Puschased Cost of goods sold Date Tnventory balance COUNT units unit Cat per lumits sold Cost Perum Gos Units unit Bolante 190 52-80 10032 mat 5 270 @ 57.80 460 @ 55.73 25638 (190+270) 256381 (10032 +15606) Man 9 350 55.73 195065 110 @ 55.73 = 61303 Mai 18 130 @ 62-80 240 @ 59.56 14294-3 (110+130) (EU 3+816) Mai 25 240 @ 64-80 490 @ 69.15 = 29846-3 (240+240) (142943 15552) Mar 29 220 @ 62.2 - 13619-6 260 @ 6215 - 161668 240 - --- 4.99 - Total - 16,167 Specific Identification method goods Peschard Cost of goods 2010 Dat units Cest Pop units COGS Unit sold Unit mal 1 Copa inventory Bolones units Colt pel Unit 190 @ 52.00 Balono 10032 mal 5 270 @ 51.90 190 270 57.80 10032 15606 mal 9 110 52.90 - 5806 240 57.50 13872 30 57.90 - mar 18 130 @ 62-80 - - 90 30 130 4.224 1734 4224 1934 3164 57.90 max 95 240 e 64.90 - - SO 30 52.90 57.90 1234 3164 15552 240 - Mo 29 1 90 130 62.90 64.90 64.00 G 52.90 $7.90 = 5656 424 @ 1934 30 40 TO 352 Tolol $64.90 15572