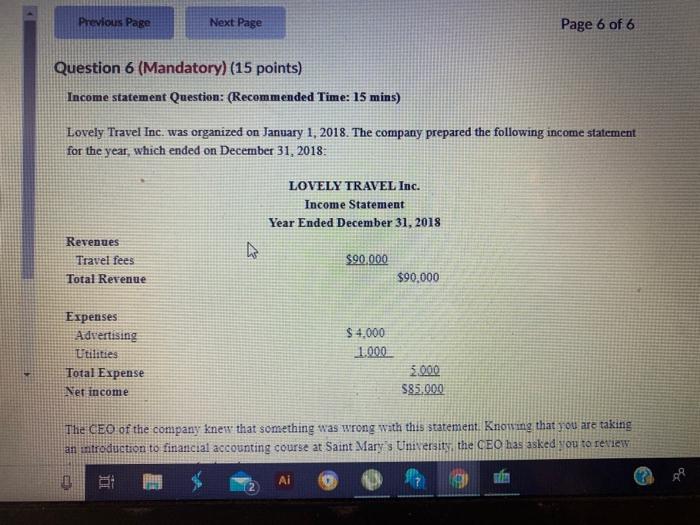

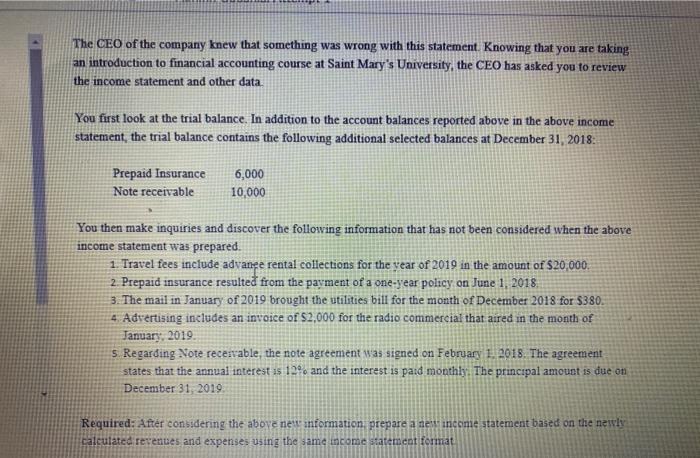

Previous Page Next Page Page 6 of 6 Question 6 (Mandatory) (15 points) Income statement Question: (Recommended Time: 15 mins) Lovely Travel Inc. was organized on January 1, 2018. The company prepared the following income statement for the year, which ended on December 31, 2018 LOVELY TRAVEL Inc. Income Statement Year Ended December 31, 2018 Revenues Travel fees Total Revenue $90.000 $90,000 Expenses Advertising Utilities Total Expense Net income $ 4,000 1.000 5.000 $85.000 The CEO of the company knew that something was wrong wath this statement Knowing that you are taking an introduction to financial accounting course at Saint Mary's University, the CEO has asked you to review Ai 2 The CEO of the company knew that something was wrong with this statement. Knowing that you are taking an introduction to financial accounting course at Saint Mary's University, the CEO has asked you to review the income statement and other data You first look at the trial balance. In addition to the account balances reported above in the above income statement, the trial balance contains the following additional selected balances at December 31, 2018 Prepaid Insurance Note receivable 6,000 10,000 You then make inquiries and discover the following information that has not been considered when the above income statement was prepared 1. Travel fees include advance rental collections for the year of 2019 in the amount of $20,000. 2. Prepaid insurance resulted from the payment of a one-year policy on June 1, 2018 3. The mail in January of 2019 brought the utilities bill for the month of December 2018 for $380. 4 Advertising includes an invoice of $2,000 for the radio commercial that aired in the month of January, 2019 5. Regarding Note recerrable, the note agreement was signed on February 1. 2018. The agreement states that the annual interest as 10%. and the interest is paid monthly. The principal amount is due on December 31, 2019 Required: After considering the above nes information prepare a ne income statement based on the newly calculated rerences and expenses using the same income statement format Previous Page Next Page Page 6 of 6 Question 6 (Mandatory) (15 points) Income statement Question: (Recommended Time: 15 mins) Lovely Travel Inc. was organized on January 1, 2018. The company prepared the following income statement for the year, which ended on December 31, 2018 LOVELY TRAVEL Inc. Income Statement Year Ended December 31, 2018 Revenues Travel fees Total Revenue $90.000 $90,000 Expenses Advertising Utilities Total Expense Net income $ 4,000 1.000 5.000 $85.000 The CEO of the company knew that something was wrong wath this statement Knowing that you are taking an introduction to financial accounting course at Saint Mary's University, the CEO has asked you to review Ai 2 The CEO of the company knew that something was wrong with this statement. Knowing that you are taking an introduction to financial accounting course at Saint Mary's University, the CEO has asked you to review the income statement and other data You first look at the trial balance. In addition to the account balances reported above in the above income statement, the trial balance contains the following additional selected balances at December 31, 2018 Prepaid Insurance Note receivable 6,000 10,000 You then make inquiries and discover the following information that has not been considered when the above income statement was prepared 1. Travel fees include advance rental collections for the year of 2019 in the amount of $20,000. 2. Prepaid insurance resulted from the payment of a one-year policy on June 1, 2018 3. The mail in January of 2019 brought the utilities bill for the month of December 2018 for $380. 4 Advertising includes an invoice of $2,000 for the radio commercial that aired in the month of January, 2019 5. Regarding Note recerrable, the note agreement was signed on February 1. 2018. The agreement states that the annual interest as 10%. and the interest is paid monthly. The principal amount is due on December 31, 2019 Required: After considering the above nes information prepare a ne income statement based on the newly calculated rerences and expenses using the same income statement format