previous problem

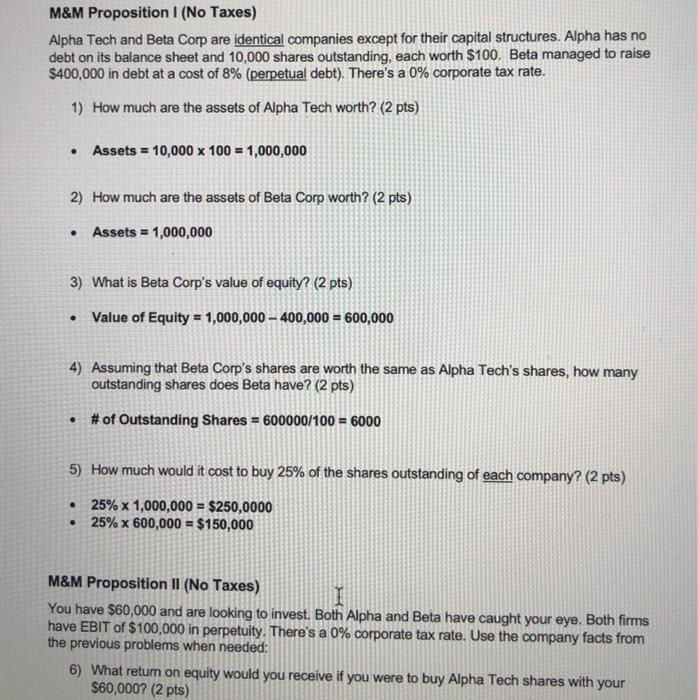

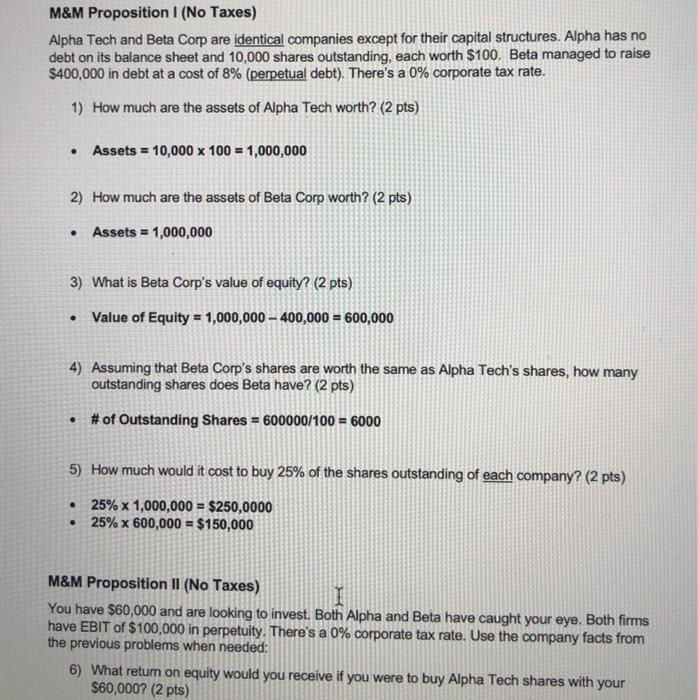

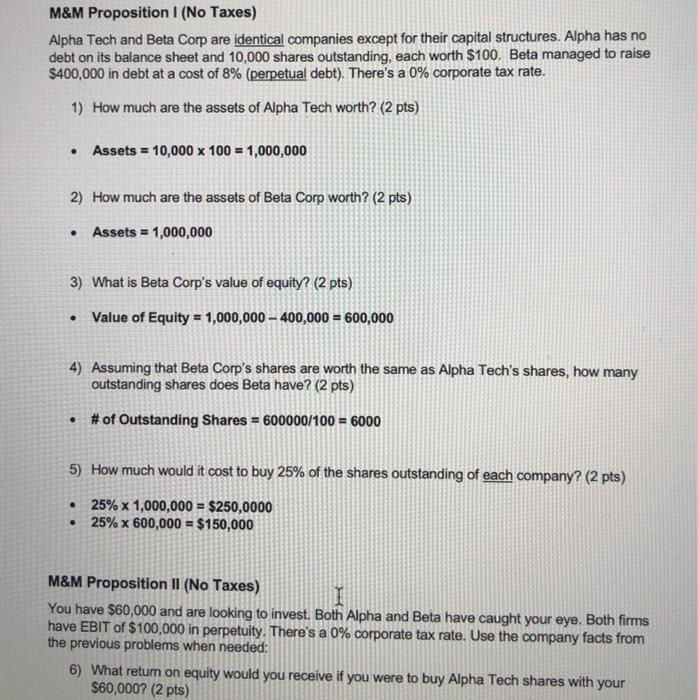

M&M Proposition II (No Taxes) You have $60,000 and are looking to invest. Both Alpha and Beta have caught your eye. Both firms have EBIT of $100,000 in perpetuity. There's a 0% corporate tax rate. Use the company facts from the previous problems when needed: 6) What return on equity would you receive if you were to buy Alpha Tech shares with your $60,000? (2 pts) 7) What return on equity would you receive if you were to buy Beta Corp shares with your $60,000? (Assume that Beta has perpetual debt). (2 pts) 8) Which return is higher and why? (2 pts) M&M Proposition 1 (No Taxes) Alpha Tech and Beta Corp are identical companies except for their capital structures. Alpha has no debt on its balance sheet and 10,000 shares outstanding, each worth $100. Beta managed to raise $400,000 in debt at a cost of 8% (perpetual debt). There's a 0% corporate tax rate. 1) How much are the assets of Alpha Tech worth? (2 pts) Assets = 10,000 x 100 = 1,000,000 2) How much are the assets of Beta Corp worth? (2 pts) . Assets = 1,000,000 3) What is Beta Corp's value of equity? (2 pts) Value of Equity = 1,000,000 -- 400,000 = 600,000 4) Assuming that Beta Corp's shares are worth the same as Alpha Tech's shares, how many outstanding shares does Beta have? (2 pts) # of Outstanding Shares = 600000/100 = 6000 5) How much would it cost to buy 25% of the shares outstanding of each company? (2 pts) 25% x 1,000,000 = $250,0000 25% x 600,000 = $150,000 M&M Proposition II (No Taxes) You have $60,000 and are looking to invest. Both Alpha and Beta have caught your eye. Both firms have EBIT of $100,000 in perpetuity. There's a 0% corporate tax rate. Use the company facts from the previous problems when needed: 6) What retum on equity would you receive if you were to buy Alpha Tech shares with your $60,000? (2 pts) M&M Proposition II (No Taxes) You have $60,000 and are looking to invest. Both Alpha and Beta have caught your eye. Both firms have EBIT of $100,000 in perpetuity. There's a 0% corporate tax rate. Use the company facts from the previous problems when needed: 6) What return on equity would you receive if you were to buy Alpha Tech shares with your $60,000? (2 pts) 7) What return on equity would you receive if you were to buy Beta Corp shares with your $60,000? (Assume that Beta has perpetual debt). (2 pts) 8) Which return is higher and why? (2 pts) M&M Proposition 1 (No Taxes) Alpha Tech and Beta Corp are identical companies except for their capital structures. Alpha has no debt on its balance sheet and 10,000 shares outstanding, each worth $100. Beta managed to raise $400,000 in debt at a cost of 8% (perpetual debt). There's a 0% corporate tax rate. 1) How much are the assets of Alpha Tech worth? (2 pts) Assets = 10,000 x 100 = 1,000,000 2) How much are the assets of Beta Corp worth? (2 pts) . Assets = 1,000,000 3) What is Beta Corp's value of equity? (2 pts) Value of Equity = 1,000,000 -- 400,000 = 600,000 4) Assuming that Beta Corp's shares are worth the same as Alpha Tech's shares, how many outstanding shares does Beta have? (2 pts) # of Outstanding Shares = 600000/100 = 6000 5) How much would it cost to buy 25% of the shares outstanding of each company? (2 pts) 25% x 1,000,000 = $250,0000 25% x 600,000 = $150,000 M&M Proposition II (No Taxes) You have $60,000 and are looking to invest. Both Alpha and Beta have caught your eye. Both firms have EBIT of $100,000 in perpetuity. There's a 0% corporate tax rate. Use the company facts from the previous problems when needed: 6) What retum on equity would you receive if you were to buy Alpha Tech shares with your $60,000? (2 pts)