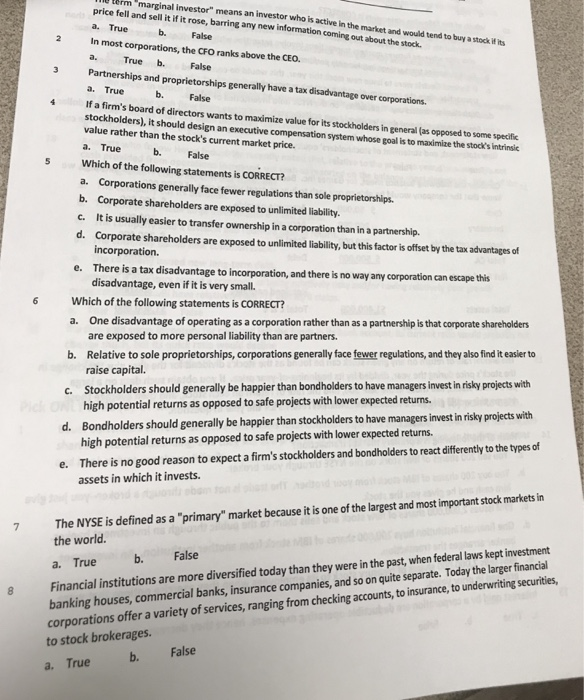

price fell and sell it if it rose, barring any new information coming out about the stock a. True b.False l term marginal investor" means an investor who is active in the market and would tend to buy a stock if its 2 In most corporations, the CFO ranks above the CEO. a. True . False 3 Partnerships and proprietorships generally have a tax disadvantage over corporations a. True b. False If a firm's board of directors wants to maximize value for its stockholders in general (as opposed to some specific stockholders), it should design an executive compensation system whose goal is to maximize the stock's intrinsic value rather than the stock's current market price. a. True False Which of the following statements is CORRECT? a. Corporations generally face fewer regulations than sole proprietorships b. Corporate shareholders are exposed to unlimited liability c. It is usually easier to transfer ownership in a corporation than in a partnership. d. Corporate shareholders are exposed to unlimited liability, but this factor is offset by the tax advantages of 5 incorporation. e. There is a tax disadvantage to incorporation, and there is no way any corporation can escape this disadvantage, even if it is very small. 6 Which of the following statements is CORRECT? One disadvantage of operating as a corporation rather than as a partnership is that corporate shareholders are exposed to more personal liability than are partners. Relative to sole proprietorships, corporations generally face fewer regulations, and they also find it easler to raise capital. a. b. c. Stockholders should generally be happier than bondholders to have managers invest i risky projects with high potential returns as opposed to safe projects with lower expected returns. Bondholders should generally be happier than stockholders to have managers invest in risky projects with d. high potential returns as opposed to safe projects with lower expected returns. There is no good reason to expect a firm's stockholders and bondholders to react differently to the types of e. assets in which it invests. The NYSE is defined as a "primary" market because it is one of the largest and most important stock markets in the world 7 a. True . False banking houses, commercial banks, insurance companies, and so on quite separate. Today the larger financial corporations offer a variety of services, ranging from checking accounts, to insurance, to underwriting securities, to stock brokerages. a. True b. False 8 Financial institutions are more diversified today than they were in the past, when federal laws kept investment