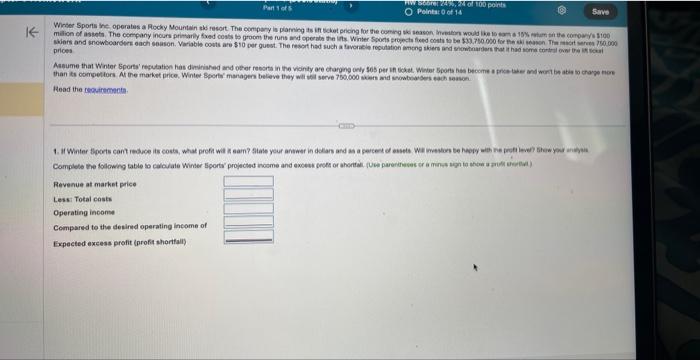

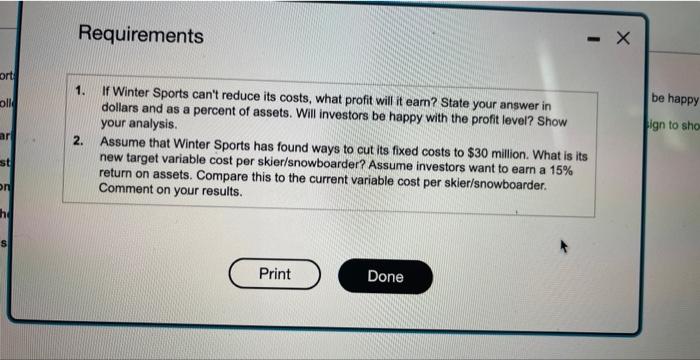

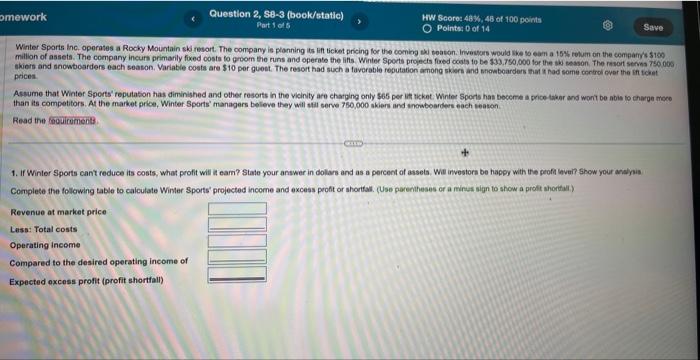

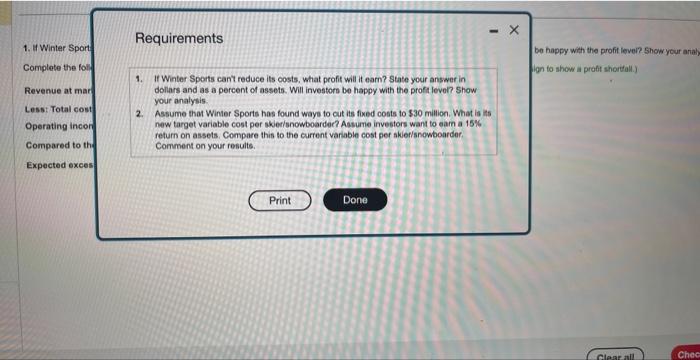

prices Aead the resuirtmenta. Requirements 1. If Winter Sports can't reduce its costs, what profit will it earn? State your answer in dollars and as a percent of assets. Will investors be happy with the profit level? Show your analysis. 2. Assume that Winter Sports has found ways to cut its fixed costs to $30 million. What is its new target variable cost per skier/snowboarder? Assume investors want to earn a 15% return on assets. Compare this to the current variable cost per skier/snowboarder. Comment on your results. Winter Sports inc. operates a Rocky Mountain ski resort. The company is planning its lift lickot pricing for the coming sej peaten. invesurs would kike to eam a 15% relum on the cempanrs sise prices. Assume that Winter Sperts' reputation has diminished and other pesorts in the vieinity are charging only 565 per int ticket. Winter 5p0r s has beceme a price taker and wont be abis bo charge moce than its competitors. At the market price, Winter. Sports' managers beleve they will stal serve 750,000 akiers and inowbearders each weaton. Read the fociicuments. 1. If Winter Sports cant reduce its costs, what profit witl it eam? State your anawer in dolass and as a percent of assets. Wit investors be happy with the peofe invir show your aralyis Complete the folowing table to calculate Winter Sports' projected income and excess profft or shorttal. (Use parenitheses or a miniss sign to show a proit ahorttul) Requirements be happy with the profit lever? Show your araby len to show a probt shoridall.) 1. If Winter Sperts cant reduce its costs, what profit will it earn? State your answer in dollars and as a percent of assets. Will investors be happy with the profit levol? Show your analysis. 2. Assume that Winter Sports has found waye to cut its fixed costs to $30 million. What is is new target variable cost per skeetisnowboarder? Assume investors want to aam a 15% return on assets. Compare this to the current variable cost per akierisnowboarder. Comment on your resulte