Answered step by step

Verified Expert Solution

Question

1 Approved Answer

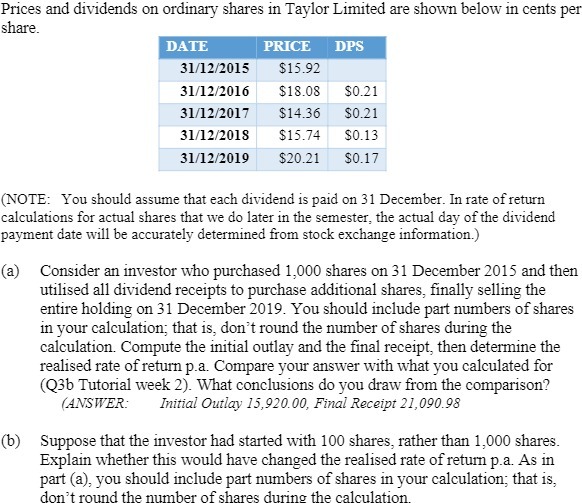

Prices and dividends on ordinary shares in Taylor Limited are shown below in cents per share. DATE 31/12/2015 $15.92 31/12/2016 $18.08 $0.21 31/12/2017 $14.36

Prices and dividends on ordinary shares in Taylor Limited are shown below in cents per share. DATE 31/12/2015 $15.92 31/12/2016 $18.08 $0.21 31/12/2017 $14.36 $0.21 31/12/2018 $15.74 $0.13 $20.21 $0.17 31/12/2019 PRICE DPS (NOTE: You should assume that each dividend is paid on 31 December. In rate of return calculations for actual shares that we do later in the semester, the actual day of the dividend payment date will be accurately determined from stock exchange information.) (a) Consider an investor who purchased 1,000 shares on 31 December 2015 and then utilised all dividend receipts to purchase additional shares, finally selling the entire holding on 31 December 2019. You should include part numbers of shares in your calculation; that is, don't round the number of shares during the calculation. Compute the initial outlay and the final receipt, then determine the realised rate of return p.a. Compare your answer with what you calculated for (Q3b Tutorial week 2). What conclusions do you draw from the comparison? (ANSWER: Initial Outlay 15,920.00, Final Receipt 21,090.98 (b) Suppose that the investor had started with 100 shares, rather than 1,000 shares. Explain whether this would have changed the realised rate of return p.a. As in part (a), you should include part numbers of shares in your calculation; that is, don't round the number of shares during the calculation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculation for 1000 shares Initial outlay Number of shares Purchase price Initial outlay 1000 159...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started