Question

Price-weighted Index versus Value-weighted Index Company Serenity Incorporated. Thrawn Enterprises Beratna Corporation Beginning Price $100 $75 $180 Ending Price $115 $84 $165 Shares Outstanding

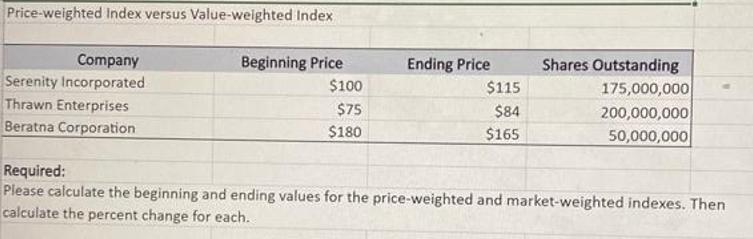

Price-weighted Index versus Value-weighted Index Company Serenity Incorporated. Thrawn Enterprises Beratna Corporation Beginning Price $100 $75 $180 Ending Price $115 $84 $165 Shares Outstanding 175,000,000 200,000,000 50,000,000 Required: Please calculate the beginning and ending values for the price-weighted and market-weighted indexes. Then calculate the percent change for each.

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

A priceweighted index is computed as the average of the prices of the companies list...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Gail Fayerman

1st Canadian Edition

9781118774113, 1118774116, 111803791X, 978-1118037911

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App