Answered step by step

Verified Expert Solution

Question

1 Approved Answer

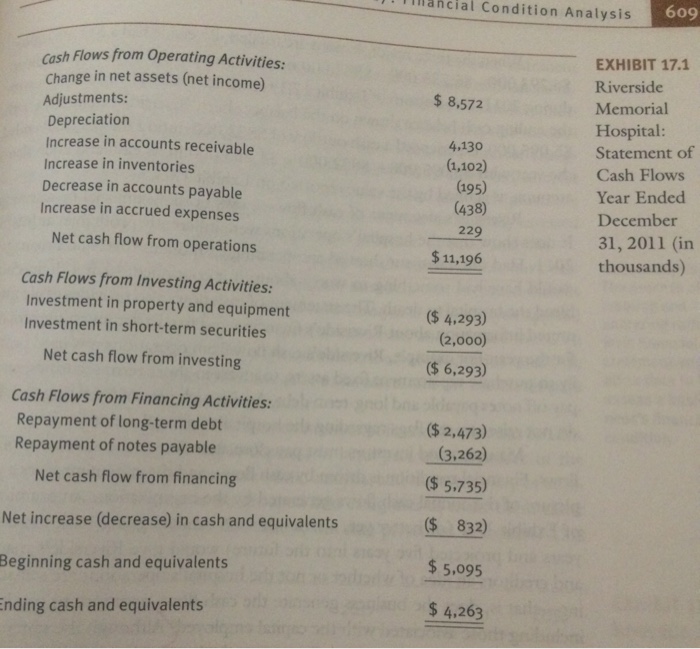

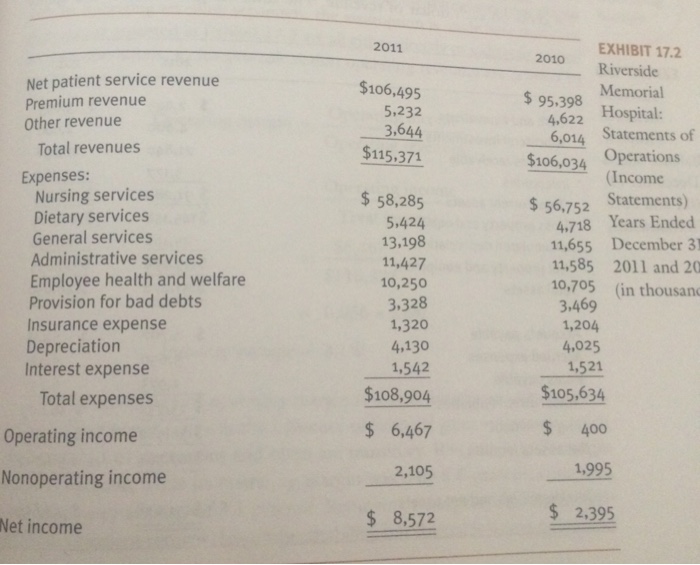

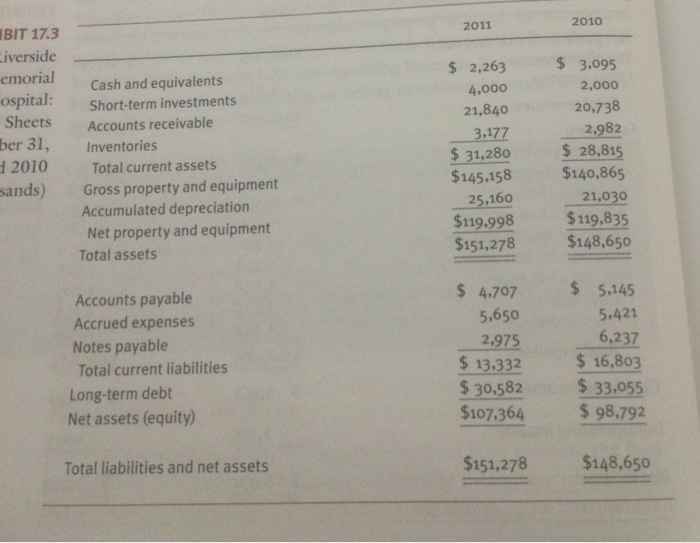

Primary Financial statements are prsented in exhibits 17.1, 17.2 and 17.3 (attached) A. Calculate riversids financial ratios for 2010, assume that riverside had $1,000,000 in

Primary Financial statements are prsented in exhibits 17.1, 17.2 and 17.3 (attached)

A. Calculate riversids financial ratios for 2010, assume that riverside had $1,000,000 in lease payments and 1,400,000 in debt principal repyments in 2010.

B. Interpret the ratios. Use both trend and comparative anaylyses. for the comparative analysis assume that the industry average data prsented in the book is valild for both 2010 and 2011.

from the Health care finance: an introduction to accounting and fianacial managment 5th edition by louis c. gapenski

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started