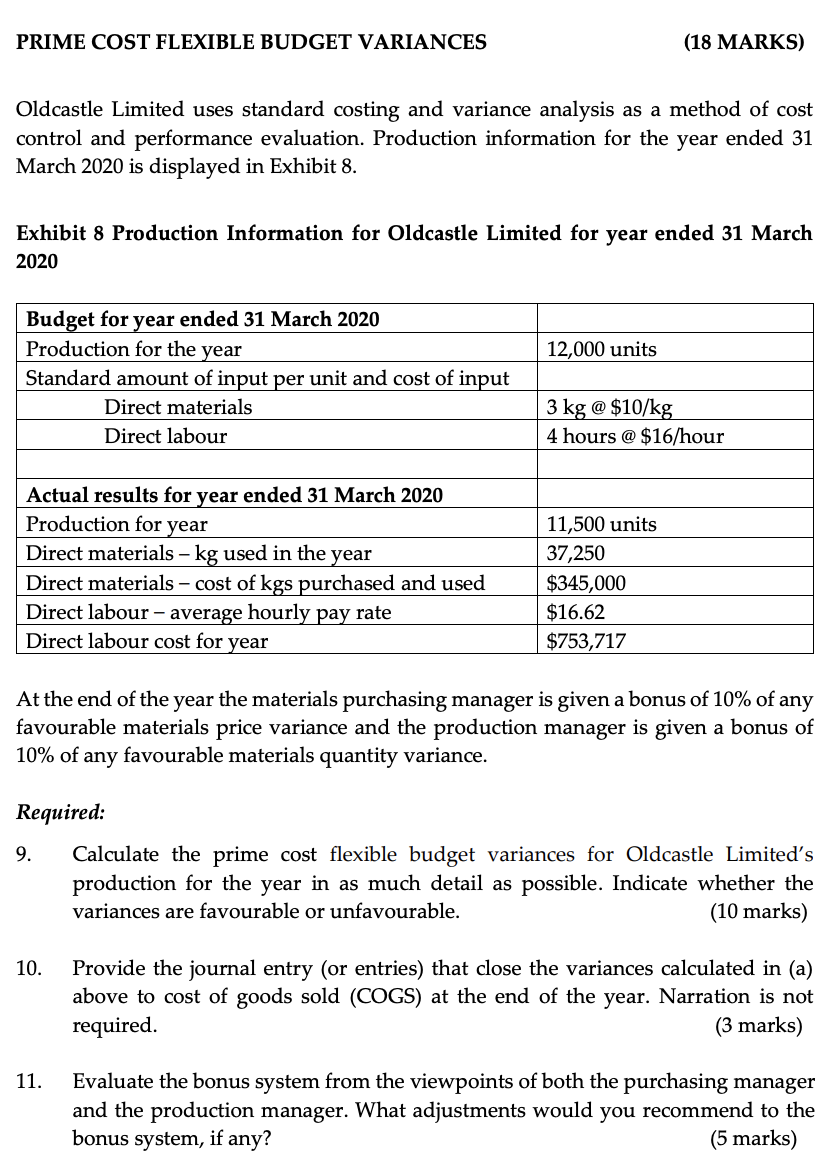

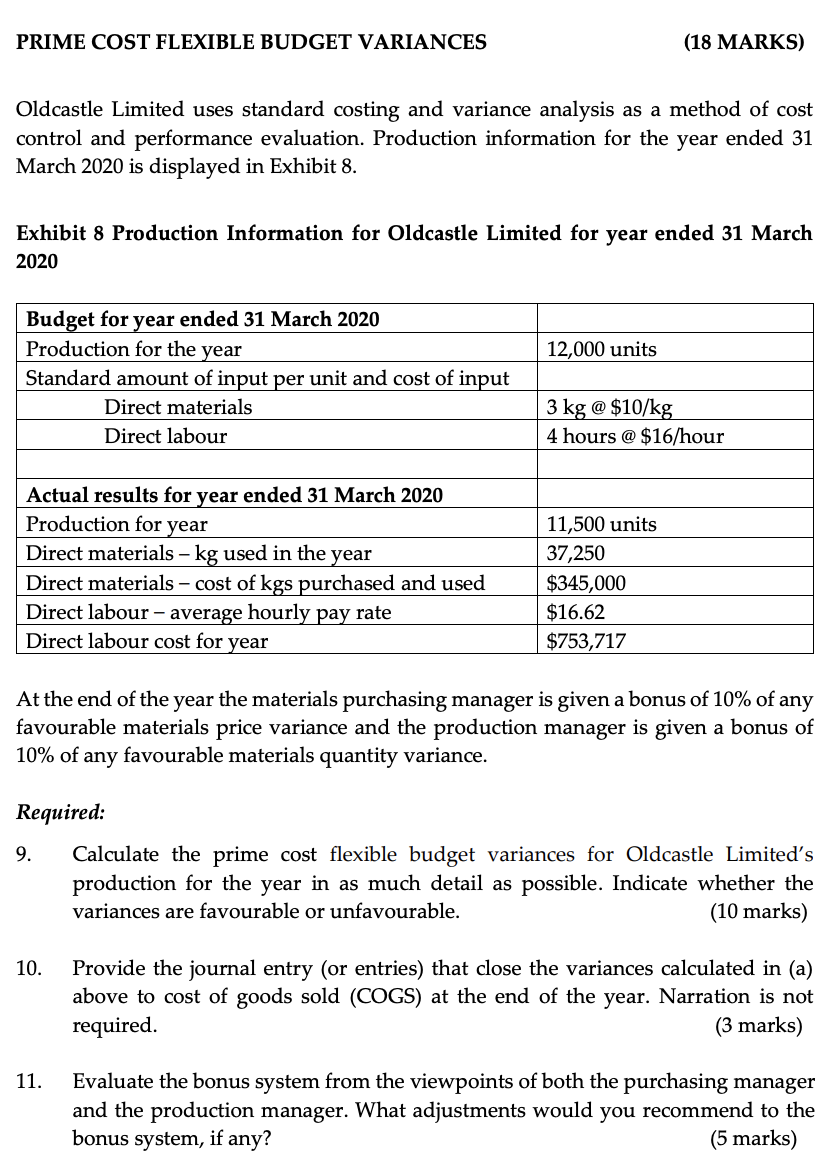

PRIME COST FLEXIBLE BUDGET VARIANCES (18 MARKS) Oldcastle Limited uses standard costing and variance analysis as a method of cost control and performance evaluation. Production information for the year ended 31 March 2020 is displayed in Exhibit 8. Exhibit 8 Production Information for Oldcastle Limited for year ended 31 March 2020 12,000 units Budget for year ended 31 March 2020 Production for the year Standard amount of input per unit and cost of input Direct materials Direct labour 3 kg @ $10/kg 4 hours @ $16/hour Actual results for year ended 31 March 2020 Production for year Direct materials - kg used in the year Direct materials - cost of kgs purchased and used Direct labour - average hourly pay rate Direct labour cost for year 11,500 units 37,250 $345,000 $16.62 $753,717 At the end of the year the materials purchasing manager is given a bonus of 10% of any favourable materials price variance and the production manager is given a bonus of 10% of any favourable materials quantity variance. Required: 9. Calculate the prime cost flexible budget variances for Oldcastle Limited's production for the year in as much detail as possible. Indicate whether the variances are favourable or unfavourable. (10 marks) 10. Provide the journal entry (or entries) that close the variances calculated in (a) above to cost of goods sold (COGS) at the end of the year. Narration is not required. (3 marks) 11. Evaluate the bonus system from the viewpoints of both the purchasing manager and the production manager. What adjustments would you recommend to the bonus system, if any? (5 marks) PRIME COST FLEXIBLE BUDGET VARIANCES (18 MARKS) Oldcastle Limited uses standard costing and variance analysis as a method of cost control and performance evaluation. Production information for the year ended 31 March 2020 is displayed in Exhibit 8. Exhibit 8 Production Information for Oldcastle Limited for year ended 31 March 2020 12,000 units Budget for year ended 31 March 2020 Production for the year Standard amount of input per unit and cost of input Direct materials Direct labour 3 kg @ $10/kg 4 hours @ $16/hour Actual results for year ended 31 March 2020 Production for year Direct materials - kg used in the year Direct materials - cost of kgs purchased and used Direct labour - average hourly pay rate Direct labour cost for year 11,500 units 37,250 $345,000 $16.62 $753,717 At the end of the year the materials purchasing manager is given a bonus of 10% of any favourable materials price variance and the production manager is given a bonus of 10% of any favourable materials quantity variance. Required: 9. Calculate the prime cost flexible budget variances for Oldcastle Limited's production for the year in as much detail as possible. Indicate whether the variances are favourable or unfavourable. (10 marks) 10. Provide the journal entry (or entries) that close the variances calculated in (a) above to cost of goods sold (COGS) at the end of the year. Narration is not required. (3 marks) 11. Evaluate the bonus system from the viewpoints of both the purchasing manager and the production manager. What adjustments would you recommend to the bonus system, if any