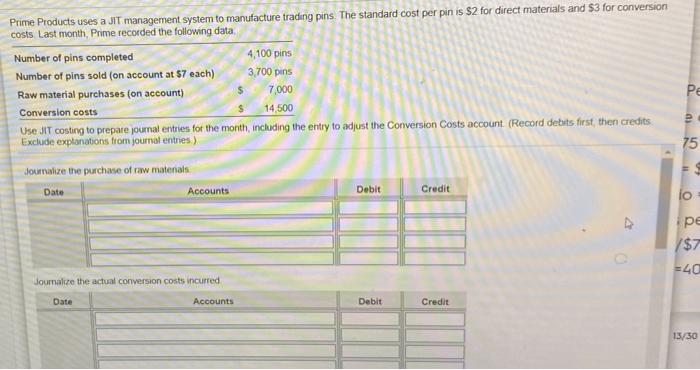

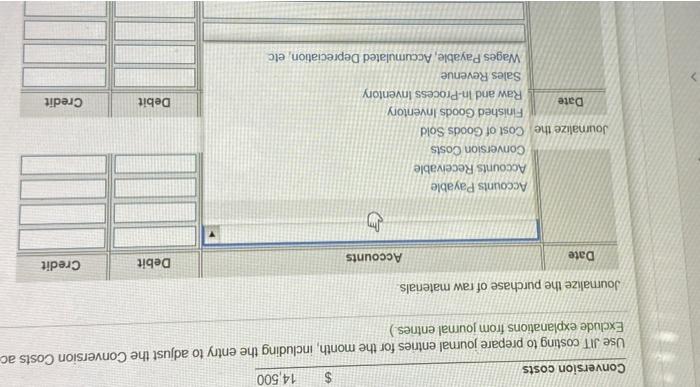

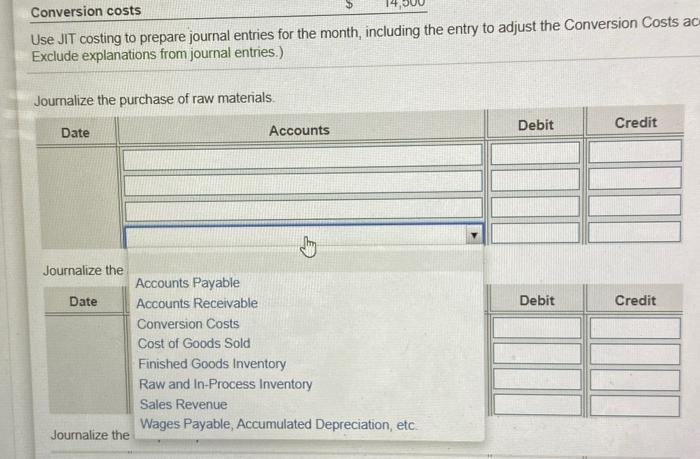

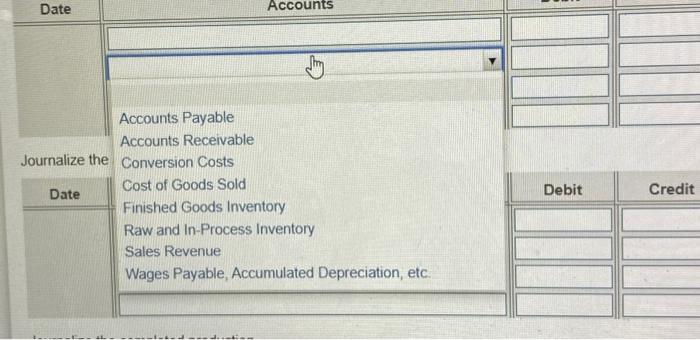

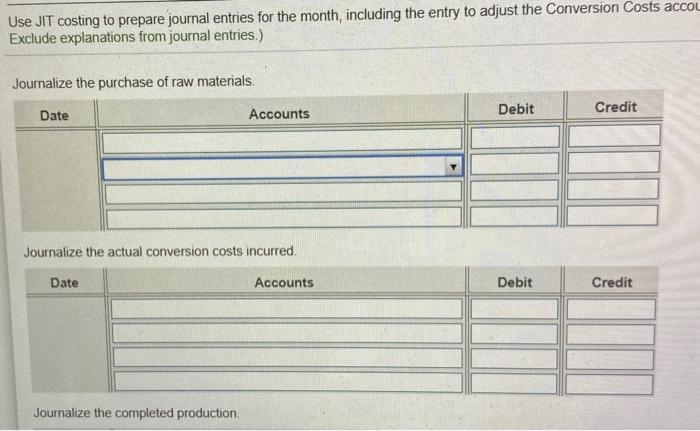

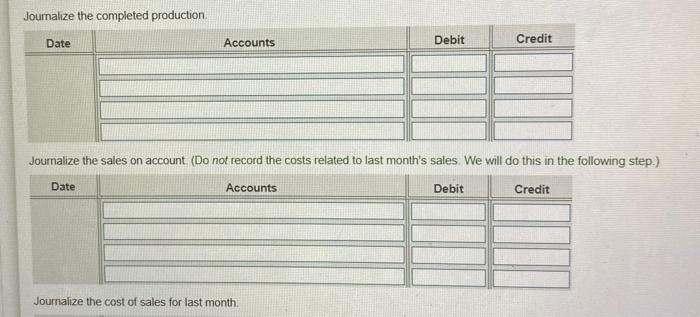

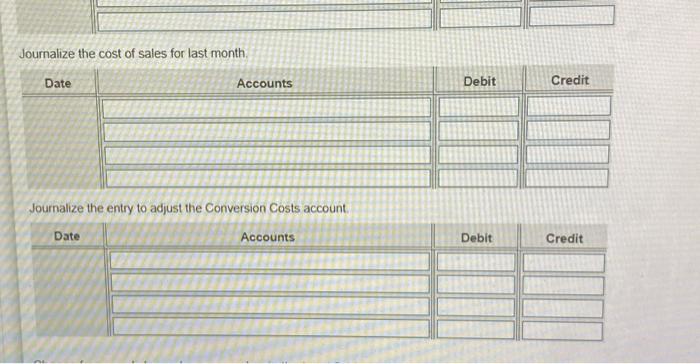

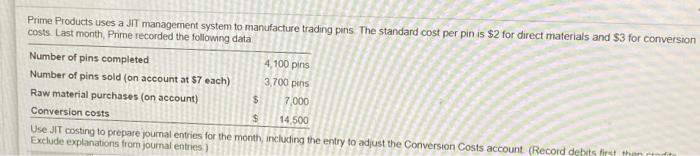

Prime Products uses a JIT management system to manufacture trading pins. The standard cost per pin is $2 for direct materials and $3 for conversion costs Last month Prime recorded the following data Number of pins completed 4,100 pins Number of pins sold (on account at $7 each) 3,700 pins Raw material purchases (on account) 7,000 Conversion costs 14 500 Use JIT costing to prepare journal entries for the month, including the entry to adjust the Conversion Costs account. (Record debits first, then credits Exclude explanations from journal entries) S Pe $ e 75 Journalize the purchase of raw materials Date Accounts Debit Credit lo pe /$7 =40 Journalize the actual conversion costs incurred Date Accounts Debit Credit 13/30 Conversion costs $ 14,500 Use JIT costing to prepare journal entries for the month, including the entry to adjust the Conversion Costs ac Exclude explanations from journal entries Journalize the purchase of raw materials Credit Debit Accounts Date Accounts Payable Accounts Receivable Conversion Costs Journalize the cost of Goods Sold Finished Goods Inventory Date Raw and In-Process Inventory Sales Revenue Wages Payable, Accumulated Depreciation etc Debit Credit Conversion costs Use JIT costing to prepare journal entries for the month, including the entry to adjust the Conversion Costs ac Exclude explanations from journal entries.) Journalize the purchase of raw materials Date Credit Accounts Debit Debit Credit Journalize the Accounts Payable Date Accounts Receivable Conversion Costs Cost of Goods Sold Finished Goods Inventory Raw and In-Process Inventory Sales Revenue Wages Payable, Accumulated Depreciation, etc Journalize the Date Accounts Accounts Payable Accounts Receivable Journalize the Conversion Costs Cost of Goods Sold Date Finished Goods Inventory Raw and In-Process Inventory Sales Revenue Wages Payable, Accumulated Depreciation, etc. Debit Credit Use JIT costing to prepare journal entries for the month, including the entry to adjust the Conversion Costs accou Exclude explanations from journal entries.) Journalize the purchase of raw materials Debit Credit Date Accounts Journalize the actual conversion costs incurred Date Accounts Debit Credit Journalize the completed production Journalize the completed production Date Accounts Debit Credit Journalize the sales on account (Do not record the costs related to last month's sales. We will do this in the following step.) Date Accounts Debit Credit Journalize the cost of sales for last month Journalize the cost of sales for last month, Date Accounts Debit Debit Credit Journalize the entry to adjust the Conversion Costs account Date Accounts Debit Credit Prime Products uses a JIT management system to manufacture trading pins The standard cost per pin is $2 for direct materials and $3 for conversion costs Last month Prime recorded the following data Number of pins completed 4,100 pins Number of pins sold (on account at S7 each) 3.700 pins Raw material purchases (on account) $ 7,000 Conversion costs $ 14.500 Use JIT costing to prepare journal entries for the month, including the entry to adjust the Conversion Costs account. (Record debits first then it Exclude explanations from journal entries