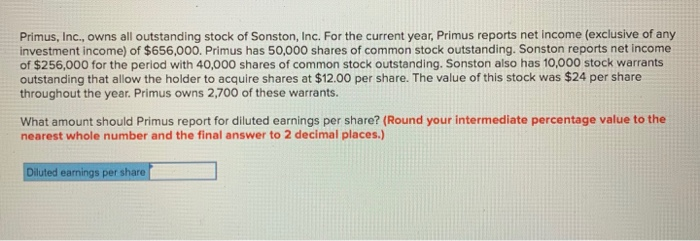

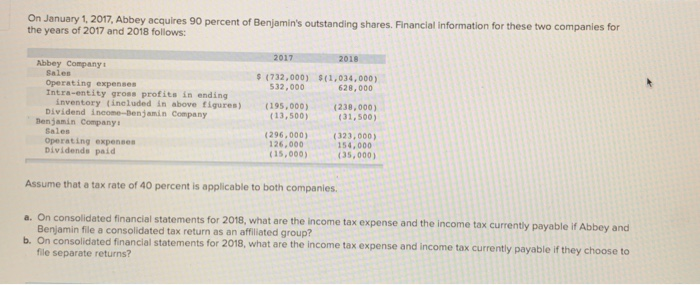

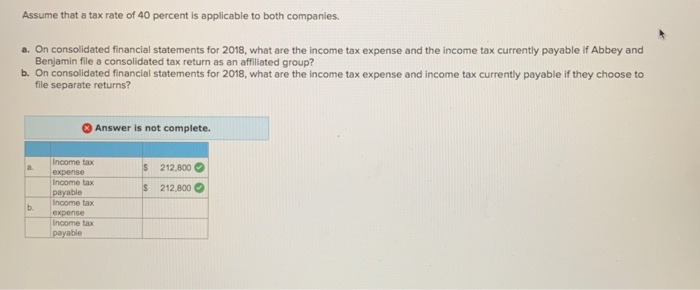

Primus, Inc., owns all outstanding stock of Sonston, Inc. For the current year, Primus reports net income (exclusive of any investment income) of $656,000. Primus has 50,000 shares of common stock outstanding. Sonston reports net income of $256,000 for the period with 40,000 shares of common stock outstanding. Sonston also has 10,000 stock warrants outstanding that allow the holder to acquire shares at $12.00 per share. The value of this stock was $24 per share throughout the year. Primus owns 2,700 of these warrants. What amount should Primus report for diluted earnings per share? (Round your intermediate percentage value to the nearest whole number and the final answer to 2 decimal places.) Diluted earnings per share On January 1, 2017, Abbey acquires 90 percent of Benjamin's outstanding shares. Financial information for these two companies for the years of 2017 and 2018 follows: 2017 2018 $ (732,000) $(1,034,000) 532,000 628,000 Abbey Company Sales Operating expenses Intra-entity gross profits in ending inventory (included in above figures) Dividend income-Benjamin Company Benjamin Company. Sales Operating expenses Dividends paid (195,000) (13,500) (238,000) (31,500) (296,000) 126,000 (15,000) (323,000) 154,000 (35,000) Assume that a tax rate of 40 percent is applicable to both companies. a. On consolidated financial statements for 2018, what are the income tax expense and the income tax currently payable if Abbey and Benjamin file a consolidated tax return as an affiliated group? b. On consolidated financial statements for 2018, what are the income tax expense and income tax currently payable if they choose to file separate returns? Assume that a tax rate of 40 percent is applicable to both companies. a. On consolidated financial statements for 2018, what are the income tax expense and the income tax currently payable if Abbey and Benjamin file a consolidated tax return as an affiliated group? b. On consolidated financial statements for 2018, what are the income tax expense and income tax currently payable if they choose to file separate returns? Answer is not complete. $ 212,800 $ 212.800 Income tax expense Income tax payable Income tax expense Income tax payable b