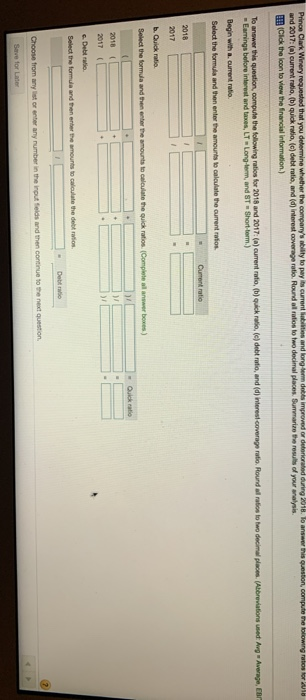

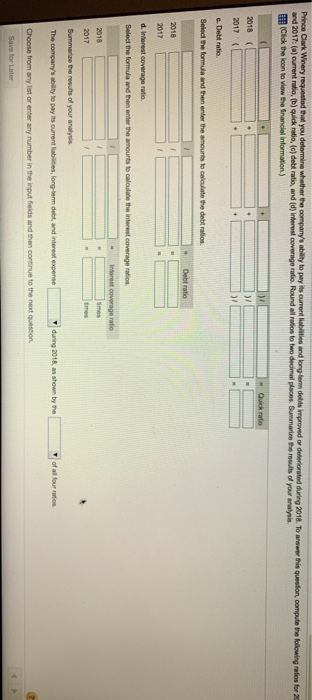

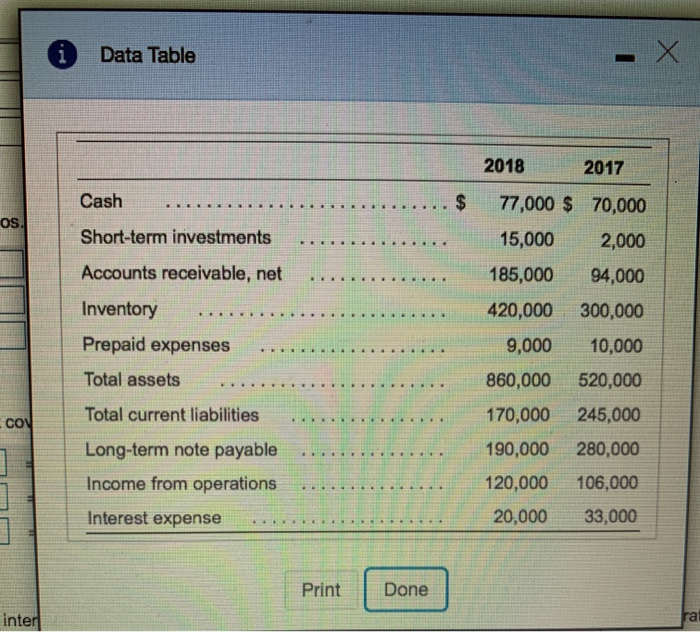

Prince Clark Winery requested that you determine whether the company's ability to pay its current iabiities and long-dem debts improved or deteriorated during 2018. To answer this question, compute the lolowing ratos tor le and 2017: (a) current ratio, (b) quick ratio, (c) debt ratio, and (d) interest coverage ratio. Round all ratios to two decimal places. Summarize the results of your analysis. (Cick the lcon to view the fnancial information.) To answer this question, compute the following ratios for 2018 and 2017: (a) cument ratio, (b) quick ratio, (e) debt ratio, and (d) interest coverage ratio. Round all ratios to two decimal places. (Abbreviations used Avg Earmrings before interest and taxes, LT Long-term, and BT Short-term.) Average, EB Begin with a. current ratio. Select the formula and then enter the amounts to calculate the ourent ratios Curent ratio 2018 2017 b. Quick ratio. Select the formula and then enter the amounts to calculate the quick ratios. (Complete all answer boxes) -Quick ratio 2018 2017 ( c Debt ratio Select the formula and then enter the amounts to calculate the debt ratios. Debt ratio Choose from any list or enter any number in the input felds and then continue to the next question. Save for Later Prince Clark Winery requested that you determine whether the company's ability to pay its ourent liabiltien and long-tem debts improved or deteriorated during 2018. To answer this question, compute the following retios for 2c and 2017: (a) ourrent ratio, (b) quick ratio, (c) debt ratio, and (d) interest covernge ratio. Round all ratios to two decimal places. Summarize the results of your analysis. (Click the loon to view the fnancial information) - Quick ratio 2018 ( 2017 ( e. Debt ratio. Select the formula and then enter the amounts to caloulate the debt ratios Debt ratio 2018 2017 d. Interest coverage ratio. Select the formula and then enter the amounts to calculate the interest coverage ratios. Interest coverage ratio Smes 2018 2017 imes Summarize the results of your analysis during 2018, as shown by the of all four ratios. The company's ability to pay its current liabilities, long-term debt, and interest expense Choose from any list or enter any number in the input fields and then continue to the next question. Save for Later i Data Table %3D 2018 2017 Cash 77,000 $ 70,000 os. Short-term investments 15,000 2,000 ..... Accounts receivable, net 185,000 94,000 Inventory 420,000 300,000 Prepaid expenses 9,000 10,000 .... .. Total assets 520,000 860,000 ... EINES Total current liabilities 170,000 245,000 Co ..... ...... ..... ... 190,000 280,000 Long-term note payable 106,000 Income from operations 120,000 .... Interest expense 20,000 33,000 Done Print inter rat %24