Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tom Limited ('Tom') is an entity that manufactures canned food for cats. The products are all part of the Jerry brand name. Tom has a

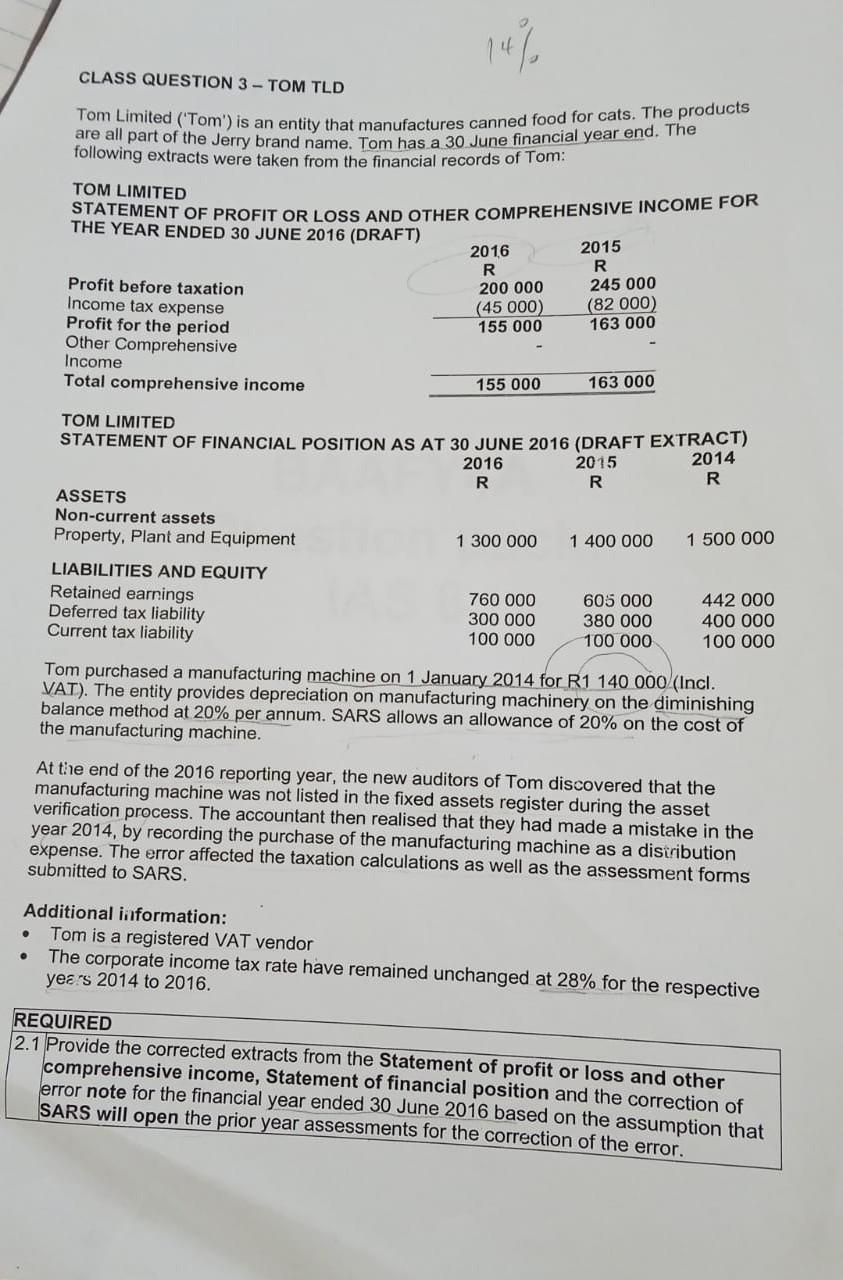

Tom Limited ('Tom') is an entity that manufactures canned food for cats. The products are all part of the Jerry brand name. Tom has a 30 June financial year end. The following extracts were taken from the financial records of Tom: TOM LIMITED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE 2016 (DRAFT) TOM LIMITED STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2016 (DRAFT EXTRACT) Tom purchased a manufacturing machine on 1 January 2014 for R1 140000 (Incl. VAT). The entity provides depreciation on manufacturing machinery on the diminishing balance method at 20% per annum. SARS allows an allowance of 20% on the cost of the manufacturing machine. At the end of the 2016 reporting year, the new auditors of Tom discovered that the manufacturing machine was not listed in the fixed assets register during the asset verification process. The accountant then realised that they had made a mistake in the year 2014, by recording the purchase of the manufacturing machine as a disiribution expense. The error affected the taxation calculations as well as the assessment forms submitted to SARS. Additional iiformation: - Tom is a registered VAT vendor - The corporate income tax rate have remained unchanged at 28% for the respective years 2014 to 2016. REQUIRED 2.1 Provide the corrected extracts from the Statement of profit or loss and other comprehensive income, Statement of financial position and the correction of error note for the financial year ended 30 June 2016 based on the assumption that SARS will open the prior year assessments for the correction of the error

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started