Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prince George's favorite toy is a wooden fire truck, created by a small company in London, Ontario and given to him by his great-grandmother. Seeing

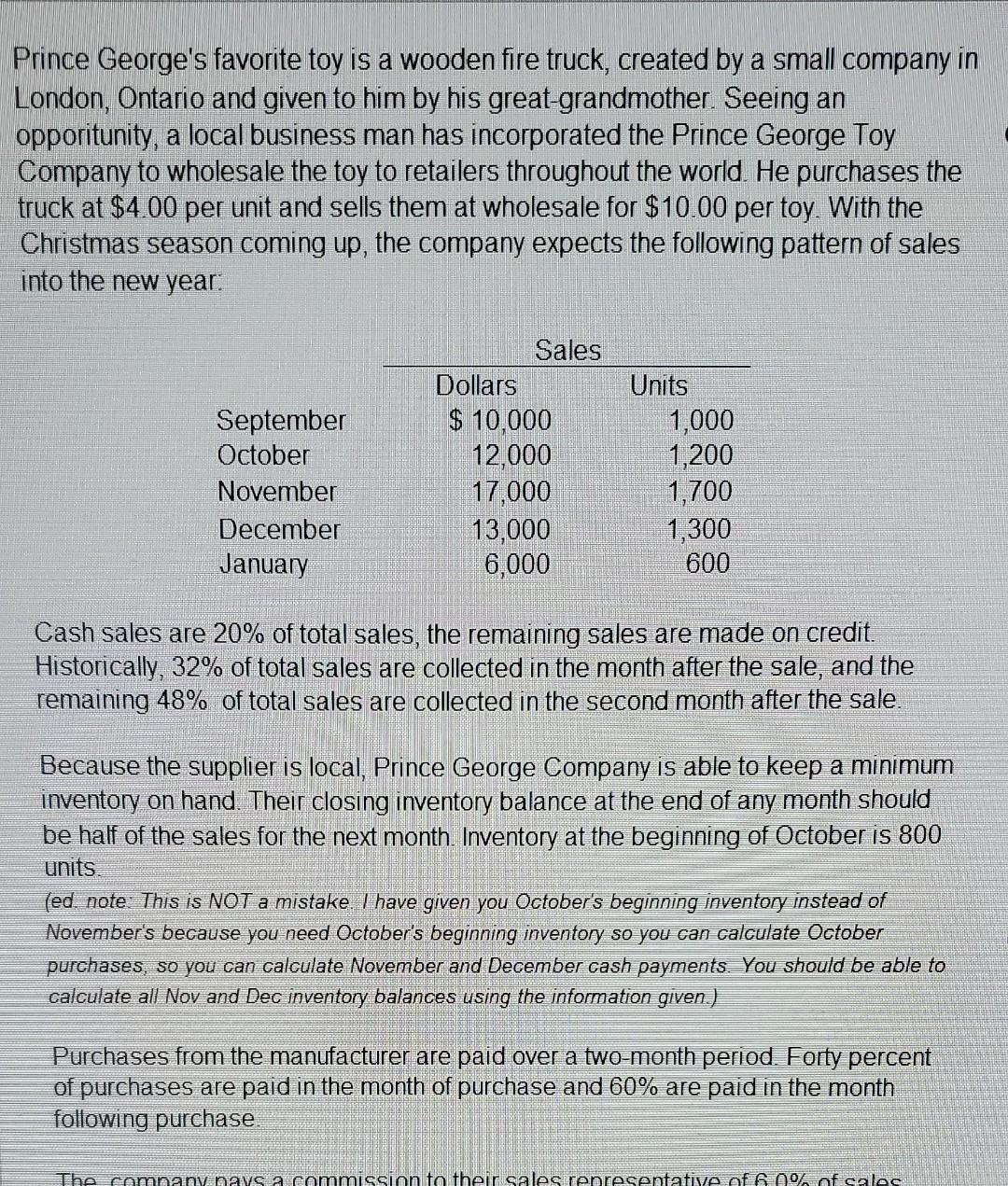

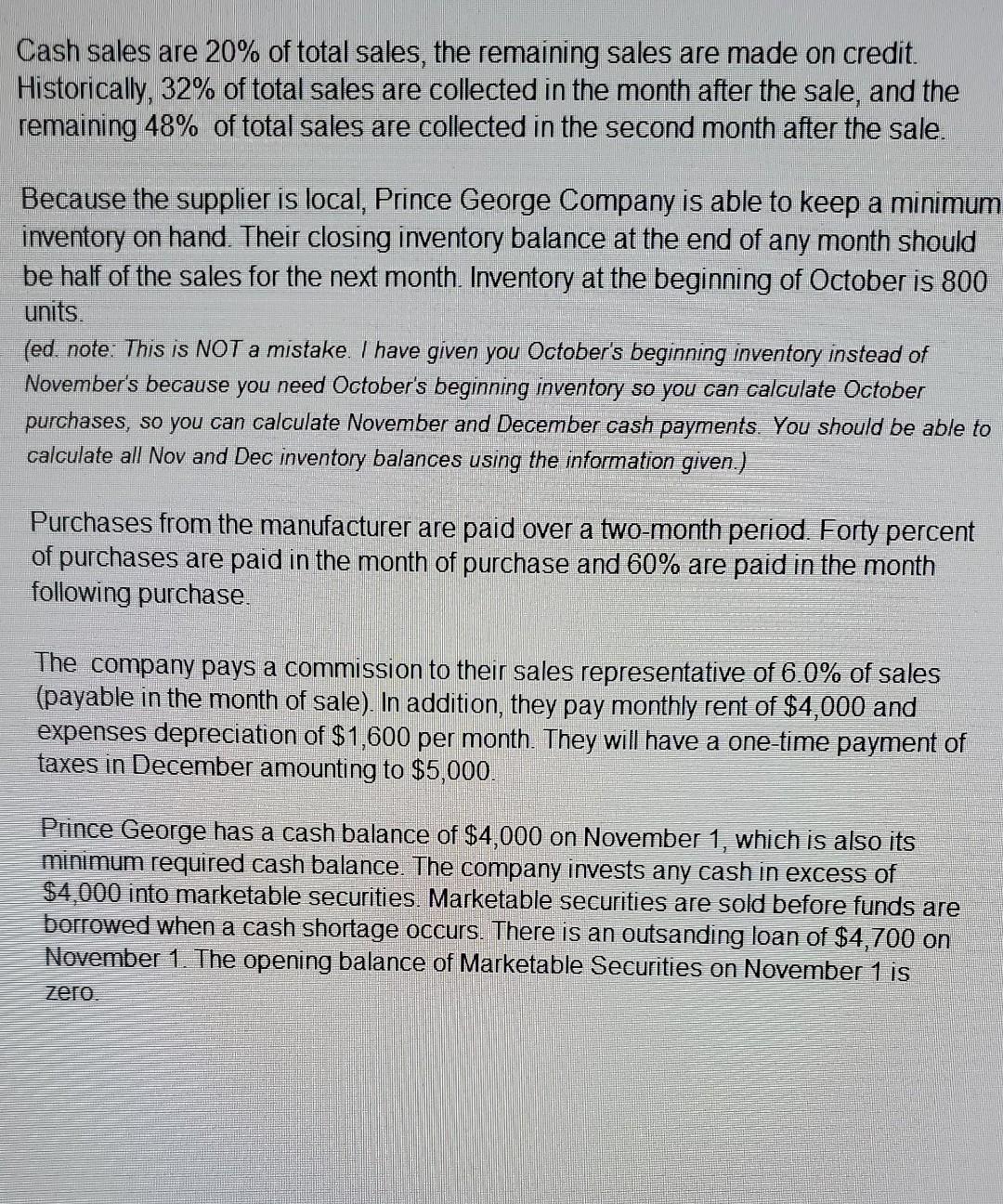

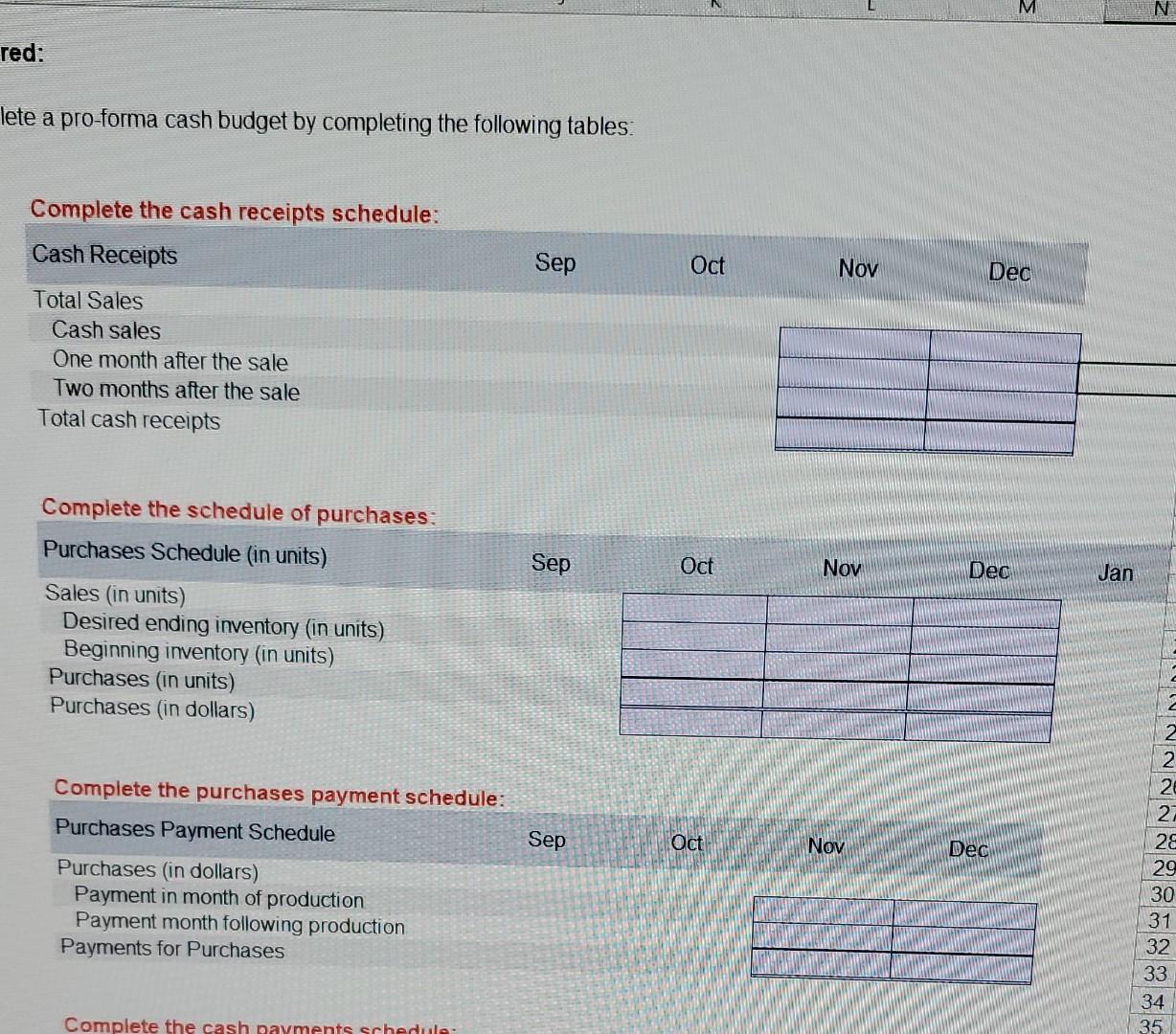

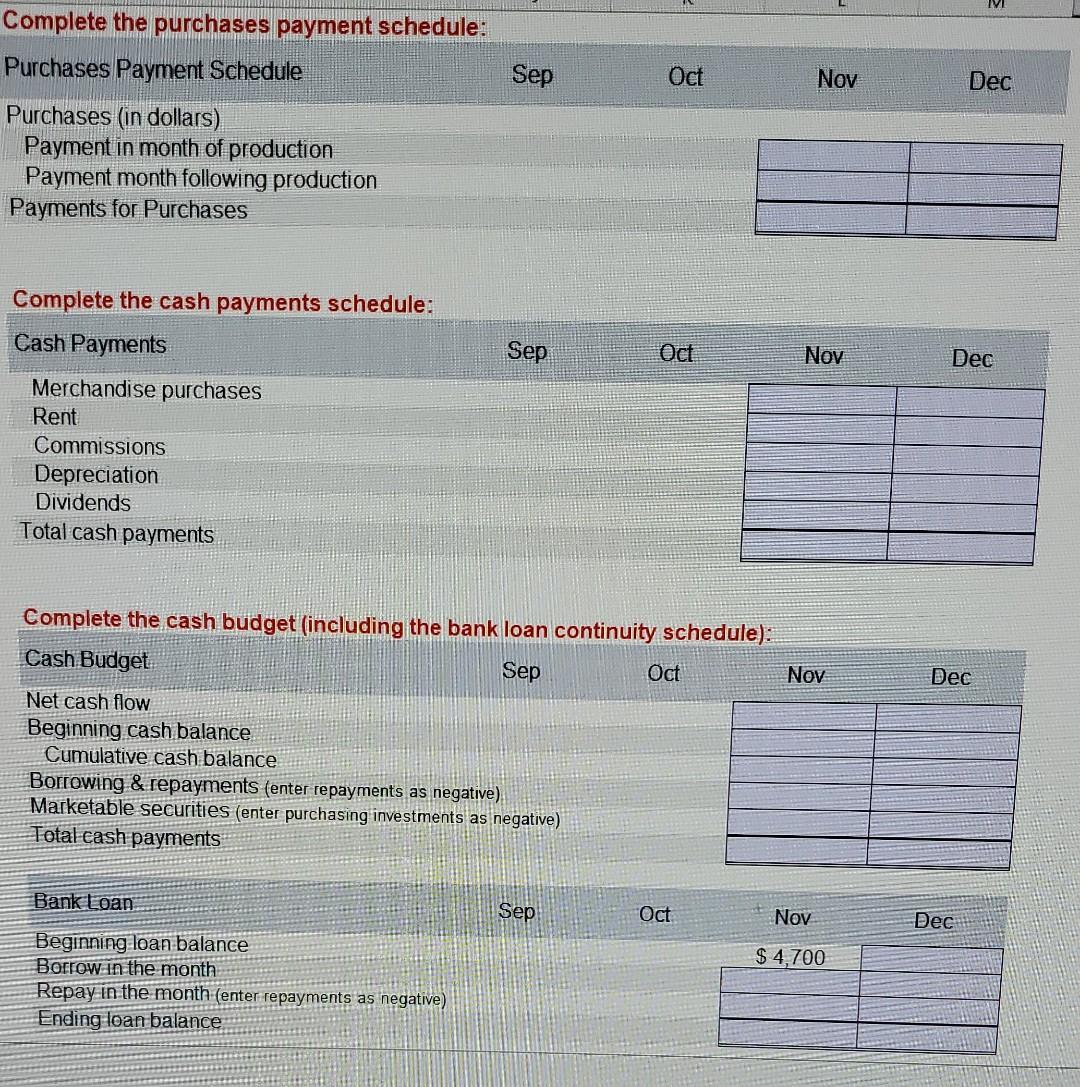

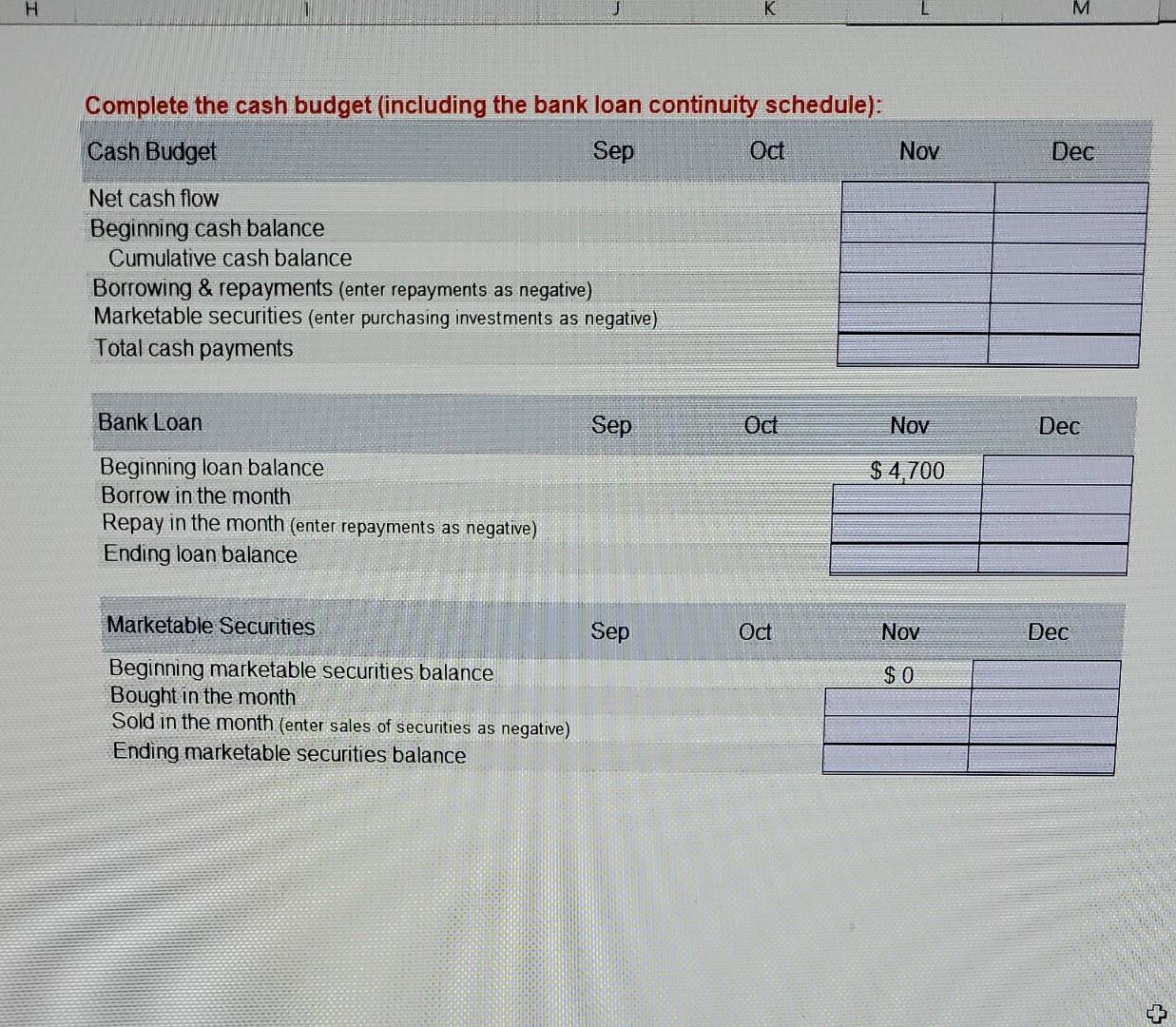

Prince George's favorite toy is a wooden fire truck, created by a small company in London, Ontario and given to him by his great-grandmother. Seeing an opporitunity, a local business man has incorporated the Prince George Toy Company to wholesale the toy to retailers throughout the world. He purchases the truck at $4.00 per unit and sells them at wholesale for $10.00 per toy. With the Christmas season coming up, the company expects the following pattern of sales into the new year. September October November December January Dollars Sales $10,000 12,000 107 17,000 13,000 6,000 Units 1,000 1,200 1,700 1,300 600 Cash sales are 20% of total sales, the remaining sales are made on credit. Historically, 32% of total sales are collected in the month after the sale, and the remaining 48% of total sales are collected in the second month after the sale. Because the supplier is local, Prince George Company is able to keep a minimum inventory on hand. Their closing inventory balance at the end of any month should be half of the sales for the next month. Inventory at the beginning of October is 800 units. (ed. note: This is NOT a mistake. I have given you October's beginning inventory instead of November's because you need October's beginning inventory so you can calculate October purchases, so you can calculate November and December cash payments. You should be able to calculate all Nov and Dec inventory balances using the information given.) Purchases from the manufacturer are paid over a two-month period. Forty percent of purchases are paid in the month of purchase and 60% are paid in the month following purchase. The company pays a commission to their sales representative of 6.0% of sales Cash sales are 20% of total sales, the remaining sales are made on credit. Historically, 32% of total sales are collected in the month after the sale, and the remaining 48% of total sales are collected in the second month after the sale. Because the supplier is local, Prince George Company is able to keep a minimum inventory on hand. Their closing inventory balance at the end of any month should be half of the sales for the next month. Inventory at the beginning of October is 800 units. (ed. note: This is NOT a mistake. I have given you October's beginning inventory instead of November's because you need October's beginning inventory so you can calculate October purchases, so you can calculate November and December cash payments. You should be able to calculate all Nov and Dec inventory balances using the information given.) Purchases from the manufacturer are paid over a two-month period. Forty percent of purchases are paid in the month of purchase and 60% are paid in the month following purchase. The company pays a commission to their sales representative of 6.0% of sales (payable in the month of sale). In addition, they pay monthly rent of $4,000 and expenses depreciation of $1,600 per month. They will have a one-time payment of taxes in December amounting to $5,000. Prince George has a cash balance of $4,000 on November 1, which is also its minimum required cash balance. The company invests any cash in excess of $4,000 into marketable securities. Marketable securities are sold before funds are borrowed when a cash shortage occurs. There is an outsanding loan of $4,700 on November 1. The opening balance of Marketable Securities on November 1 is zero. red: lete a pro-forma cash budget by completing the following tables: Complete the cash receipts schedule: Cash Receipts Total Sales Cash sales One month after the sale Two months after the sale Total cash receipts Complete the schedule of purchases: Purchases Schedule (in units) Sales (in units) Desired ending inventory (in units) Beginning inventory (in units) Purchases (in units) Purchases (in dollars) Complete the purchases payment schedule: Purchases Payment Schedule Purchases (in dollars) Payment in month of production Payment month following production Payments for Purchases Complete the cash payments schedule: Sep Sep Sep Oct Oct Oct Nov Nov Nov Dec Dec M Dec Jan N 2 26 27 28 29 30 31 32 33. 34 35 Complete the purchases payment schedule: Purchases Payment Schedule Purchases (in dollars) Payment in month of production Payment month following production Payments for Purchases Complete the cash payments schedule: Cash Payments Merchandise purchases Rent Commissions Depreciation Dividends Total cash payments Sep Bank Loan Beginning loan balance Borrow in the month Repay in the month (enter repayments as negative) Ending loan balance Sep Oct Complete the cash budget (including the bank loan continuity schedule): Cash Budget Sep Net cash flow Beginning cash balance Cumulative cash balance Borrowing & repayments (enter repayments as negative) Marketable securities (enter purchasing investments as negative) Total cash payments Sep Oct Oct Oct Nov Nov Nov Nov $4,700 Dec Dec Dec Dec H Complete the cash budget (including the bank loan continuity schedule): Cash Budget Sep Net cash flow Beginning cash balance Cumulative cash balance Borrowing & repayments (enter repayments as negative) Marketable securities (enter purchasing investments as negative) Total cash payments Bank Loan Beginning loan balance Borrow in the month Repay in the month (enter repayments as negative) Ending loan balance Marketable Securities Beginning marketable securities balance Bought in the month Sold in the month (enter sales of securities as negative) Ending marketable securities balance Sep K Sep Oct Oct Oct Nov Nov $4,700 Nov $0 M Dec Dec Dec $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started