Question

Prince Rupert is hardly the place one would expect to find an international gateway that's weathering the Covid storm better than any other Pacific port

Prince Rupert is hardly the place one would expect to find an international gateway that's weathering the Covid storm better than any other Pacific port in North America. There's just one bakery in the town of 12,000 people tucked away in a misty corner of western Canada. The local Walmart outlet is affectionately known as "Smallmart." Shuttered storefronts on its main street are obstinate reminders of the collapse of its pulp and fishing industries more than a decade ago.

Yet this rainy outpost in British Columbia is the continent's fastest-growing port for trans-Pacific trade. In the first half of 2020, Prince Rupert's container volumes surged by 12 per cent from the same period last year, more than any other major gateway for Asian trade in the U.S., Canada or Mexico. Investment in the area because of the port is over $1 billion, with a $25 billion LNG plant under construction in nearby Kitimat as well as the $17 billion Eagle Sprit pipeline and oil loading facility planned at Grassy Point in Prince Rupert.

Maksim Mihic, head of Canada for Dubai-based marine operator DP World Ltd., revealed that DP World paid Cdn$530 million to buy the container port called Fairview, Prince Rupert's upstart container terminal. In addition to the purchase price, DP World spent an additional Cdn$200 million for an expansion that readied Fairview to accept the largest vessels at sea, which are increasingly favored by shippers seeking to load more containers to reduce costs. Therefore, DP World's total investment was Cdn$730 million ($530 million purchase price +$200 million expansion cost).

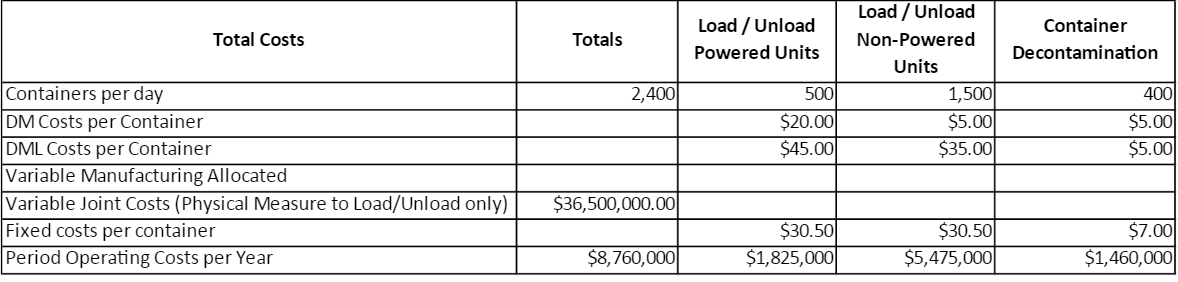

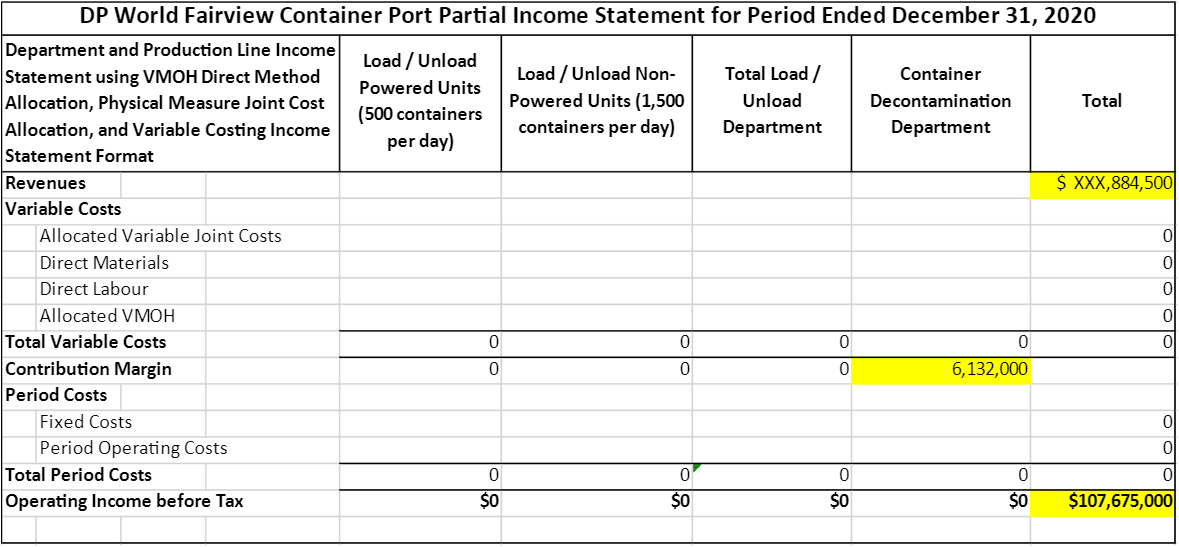

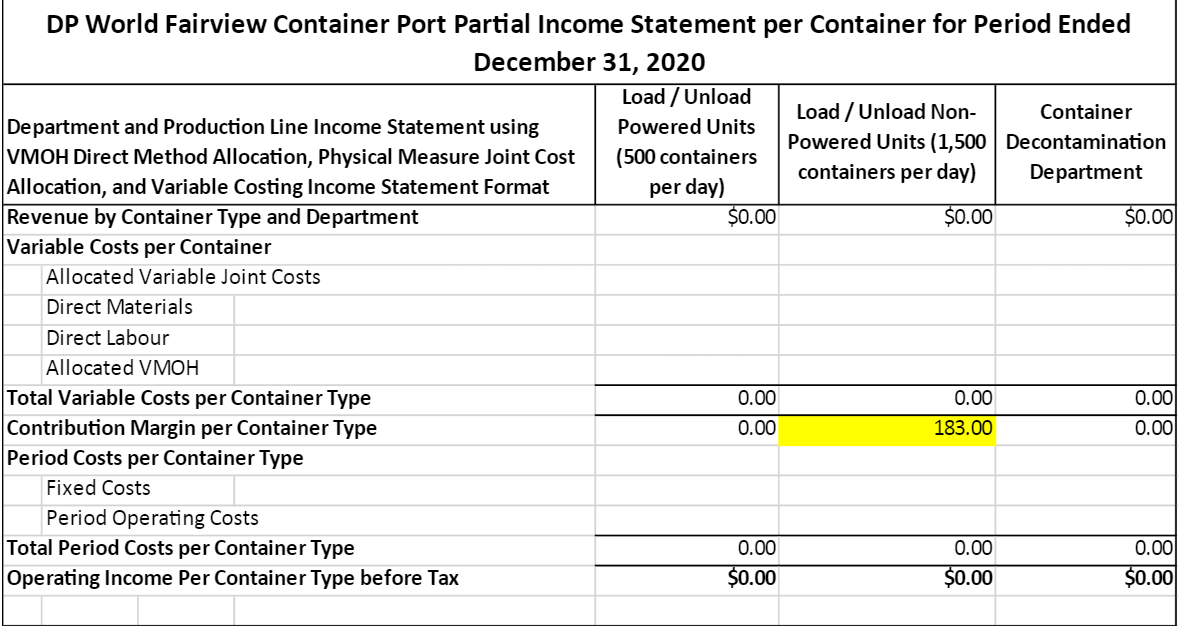

DP World creates revenues through two operating departments, the loading/unloading department, and the storage container decontamination department. The loading/unloading department makes its revenues by 1) unloading the containers from the ship and then sorting them into containers that need to have power supplies for refrigeration or heating, and containers that can be transported without power. All of the containers are either transported by rail throughout North America, or by truck if the container is going somewhere locally. Some of the containers that are deemed agricultural orenvironmental risks are passed on to the decontamination department. Once the containers are sorted (or decontaminated), they are loaded onto the trucks or rail cars for delivery. The second revenue stream for the loading/unloading department is created by taking containers from railcars and trucks and loading them onto waiting container ships for distribution throughout the world.

The container decontamination department makes money by taking overseas containers that are deemed an agriculture or environmental risk (risk include molds, mildews, insects, vermin, and other environmental pests) and decontaminating them so that they can be shipped throughout North America. This department is a less profitable department.

Of the $730 million invested by DP World into the Fairview container port, 95 percent ($693.5 million) was invested in the loading/unloading department assets and 5 percent ($36.5 million) was invested in the container decontamination department assets. The company expects the loading/unloading department to generate an ROI of 15% before tax over the planned 20-year life of the current equipment and expects the container decontamination department to generate an ROI of 10% before tax over the planned 25-year life of the current equipment. The methodology that DP World uses to price its services for its shipping customers is to arrive at a cost that includes the ROI plus all applicable costs. Therefore, the total cost per container that is charged to a customer includes total costs plus the required ROI per container.

The loading/unloading department incurs variable joint costs for both power and non-powered containers when the containers are unloaded. The loading/unloading variable joint costs are allocated to each separate container type by the Physical Measure method. The splitoff point is when the containers are put onto or taken off of the dock and are sorted into powered or non-powered units. The total joint variable costs for loading/unloading in 2020 was $36.5 million.

The container terminal has been snatching market share from rival ports like Vancouver, Seattle-Tacoma, and Los Angeles, and will soon surpass Montreal as Canada's second largest port (Vancouver is Canada's largest port by volume). Shippers have discovered Prince Rupert is often the quickest, most reliable, and cheapest route to get everything from Nike sneakers, Samsung televisions and electronics, Microsoft computers and John Deere tractor parts from Asian factories into the U.S. heartland. Customers are recommending the shipping route to many of their suppliers including the big three automakers who use the port to transfer auto parts. Empty containers on the return trip, in turn, create an opportunity for Canadian lumber and grain producers to expand exports to the world's fastest-growing markets by filling empty containers with product and shipping them to Asia, saving huge transportation costs. Because of the curvature of the earth at more northerly locations, Prince Rupert is closer to Asia that any other rail line terminus port (450 nautical miles closer than Vancouver, and 1,168 nautical miles closer than Los Angeles) , therefore creating a built-in advantage ? up to 40 hours closer by sea than any other North American gateway ? which for ships traversing the route can mean roughly up to three additional round-trip voyages a year.

In 2020, the loading/unloading department for DP World's Prince Rupert facilities handled on average 2,000 of the 45-foot containers per day. In 2020, the container decontamination department for DP World's Prince Rupert facilities handled on average 400 of the 45-foot containers per day. "In 2020, despite the challenges of the pandemic, the Port of Prince Rupert delivered a record year, moving 32.4 million tonnes of cargo. This achievement is a testament to the hard work of the more than 6,200 people across Northern B.C., whose jobs both directly and indirectly support our gateway," says Shaun Stevenson, President and CEO, Prince Rupert Port Authority. Because of this increase in moving cargo, DP World's share prices increased by 32 per cent in one year. Pinnacle Renewable Energy's Westview Wood Pellet Terminal which is close the DP World terminal set its own record last year, as continued demand for biofuels as an energy source in Asia and Europe drove their volumes up 19 percent over 2019. AltaGas' Prince Rupert's Propane Export Terminal marked its first full year of operation last May and safely shipped nearly 1.16 million tonnes of propane on 27 vessels by the end of 2020, providing Canadian energy to homes and businesses in Japan. Prince Rupert Ridley Coal Terminals also had an outstanding performance, with coal exports up 26% from 2019, supporting steel-making and other industries in Korea and China. By year end, other terminals such as Prince Rupert Grain also were able to report expanded volumes compared to 2019.

All cargo handled at the Port of Prince Rupert represents the energy and commitment of the men and women who made it happen," Stevenson says. "From forestry and mill workers to truck drivers and railway operators, many people play a part in the process of moving an estimated $60 billion in trade. This year has proven that our strategy to continue diversifying our cargoes and services is the best possible way to protect and grow long-term jobs in our region."

DP World's $200 million expansion readied Fairview to accept the largest vessels at sea, which are increasingly favored by shippers seeking to load more containers to reduce costs. DP World has been able to make container handling very affordable for shippers, as it has one of the lowest container handling charges in North America. DP World has two operating departments, with the first department called loading/unloading and the second department called container storage. DP World operates 24/7 and is open 365 days per year. The following costs are related to each department:

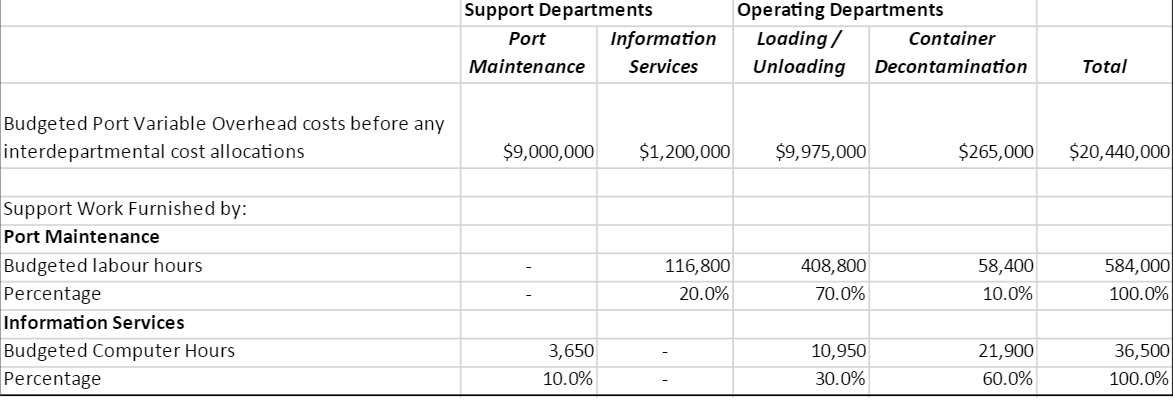

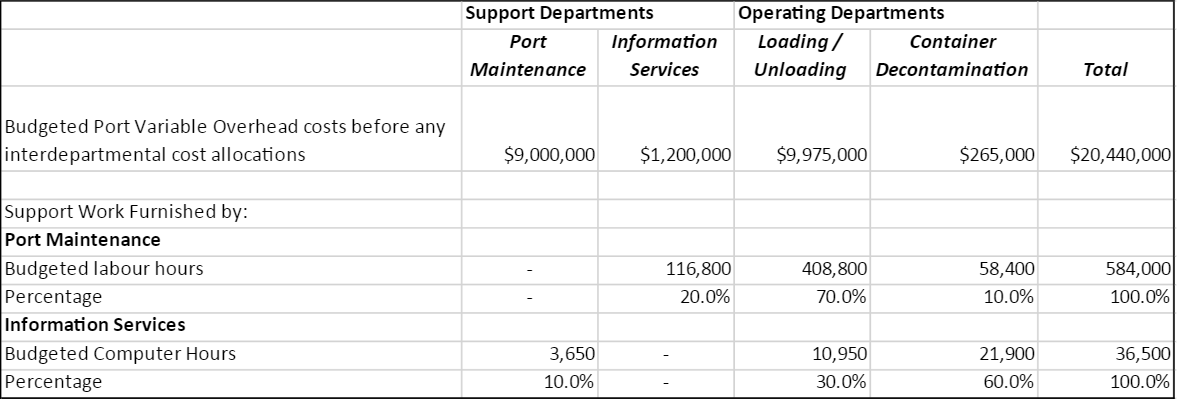

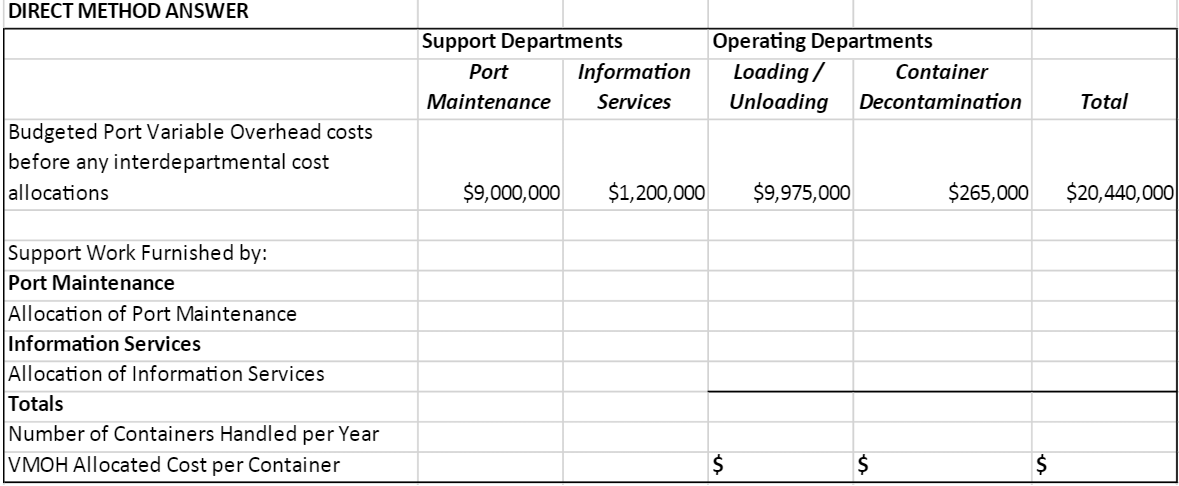

DP World has the following container variable overhead costs:

Budgeted Port Variable Overhead costs before any interdepartmental cost allocations Support Departments Port Maintenance Operating Departments Information Services Loading/ Container Unloading Decontamination Total $9,000,000 $1,200,000 $9,975,000 $265,000 $20,440,000 Support Work Furnished by: Port Maintenance Budgeted labour hours 116,800 408,800 58,400 584,000 Percentage 20.0% 70.0% 10.0% 100.0% Information Services Budgeted Computer Hours 3,650 10,950 21,900 36,500 Percentage 10.0% 30.0% 60.0% 100.0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started