Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Princess and Division is a firm of professional accountants. The firm consists of 10 partners, 30 associates, and 25 staff members. The firm provides

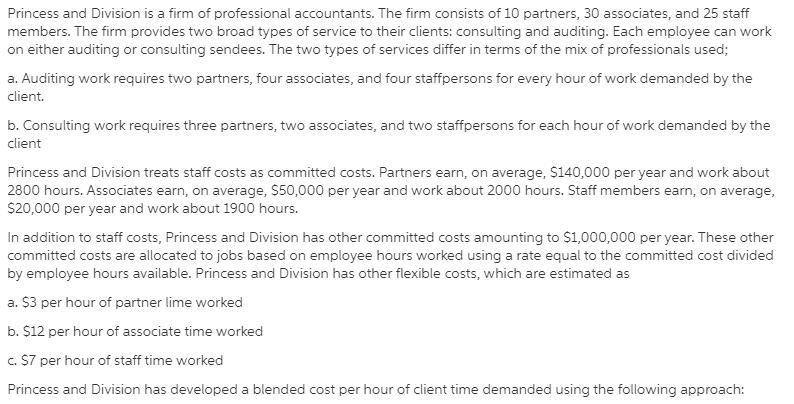

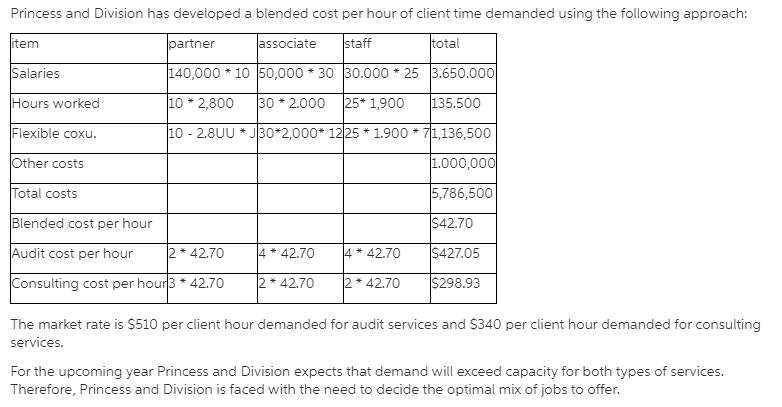

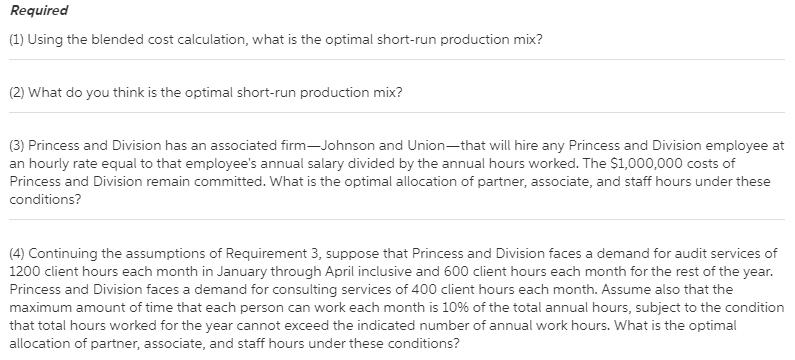

Princess and Division is a firm of professional accountants. The firm consists of 10 partners, 30 associates, and 25 staff members. The firm provides two broad types of service to their clients: consulting and auditing. Each employee can work on either auditing or consulting sendees. The two types of services differ in terms of the mix of professionals used; a. Auditing work requires two partners, four associates, and four staffpersons for every hour of work demanded by the client. b. Consulting work requires three partners, two associates, and two staffpersons for each hour of work demanded by the client Princess and Division treats staff costs as committed costs. Partners earn, on average, $140,000 per year and work about 2800 hours. Associates earn, on average, $50,000 per year and work about 2000 hours. Staff members earn, on average, $20,000 per year and work about 1900 hours. In addition to staff costs, Princess and Division has other committed costs amounting to $1,000,000 per year. These other committed costs are allocated to jobs based on employee hours worked using a rate equal to the committed cost divided by employee hours available. Princess and Division has other flexible costs, which are estimated as a. $3 per hour of partner lime worked b. $12 per hour of associate time worked c. S7 per hour of staff time worked Princess and Division has developed a blended cost per hour of client time demanded using the following approach: Princess and Division has developed a blended cost per hour of client time demanded using the following approach: item partner associate staff total Salaries 140,000 * 10 50,000 * 30 30.000 * 25 3.650.000 Hours worked 10 * 2,800 30 * 2.000 25* 1,900 135.500 Flexible coxu. 10 - 2.8UU * J30*2,000* 1225 * 1.900 * 71,136,500 Other costs 1.000,000 Total costs 5,786,500 Blended cost per hour $42.70 Audit cost per hour 2* 42.70 4 * 42.70 4 * 42.70 $427.05 Consulting cost per hour3 * 42.70 2* 42.70 2* 42.70 $298.93 The market rate is $510 per client hour demanded for audit services and S340 per client hour demanded for consulting services. For the upcoming year Princess and Division expects that demand will exceed capacity for both types of services. Therefore, Princess and Division is faced with the need to decide the optimal mix of jobs to offer. Required (1) Using the blended cost calculation, what is the optimal short-run production mix? (2) What do you think is the optimal short-run production mix? (3) Princess and Division has an associated firm-Johnson and Union-that will hire any Princess and Division employee at an hourly rate equal to that employee's annual salary divided by the annual hours worked. The $1,000,000 costs of Princess and Division remain committed. What is the optimal allocation of partner, associate, and staff hours under these conditions? (4) Continuing the assumptions of Requirement 3, suppose that Princess and Division faces a demand for audit services of 1200 client hours each month in January through April inclusive and 600 client hours each month for the rest of the year. Princess and Division faces a demand for consulting services of 400 client hours each month. Assume also that the maximum amount of time that each person can work each month is 10% of the total annual hours, subject to the condition that total hours worked for the year cannot exceed the indicated number of annual work hours. What is the optimal allocation of partner, associate, and staff hours under these conditions?

Step by Step Solution

★★★★★

3.57 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Using the blended cost calculation the optimal shortrun production mix is to have 10 partners 30 associates and 25 staff members working on b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started