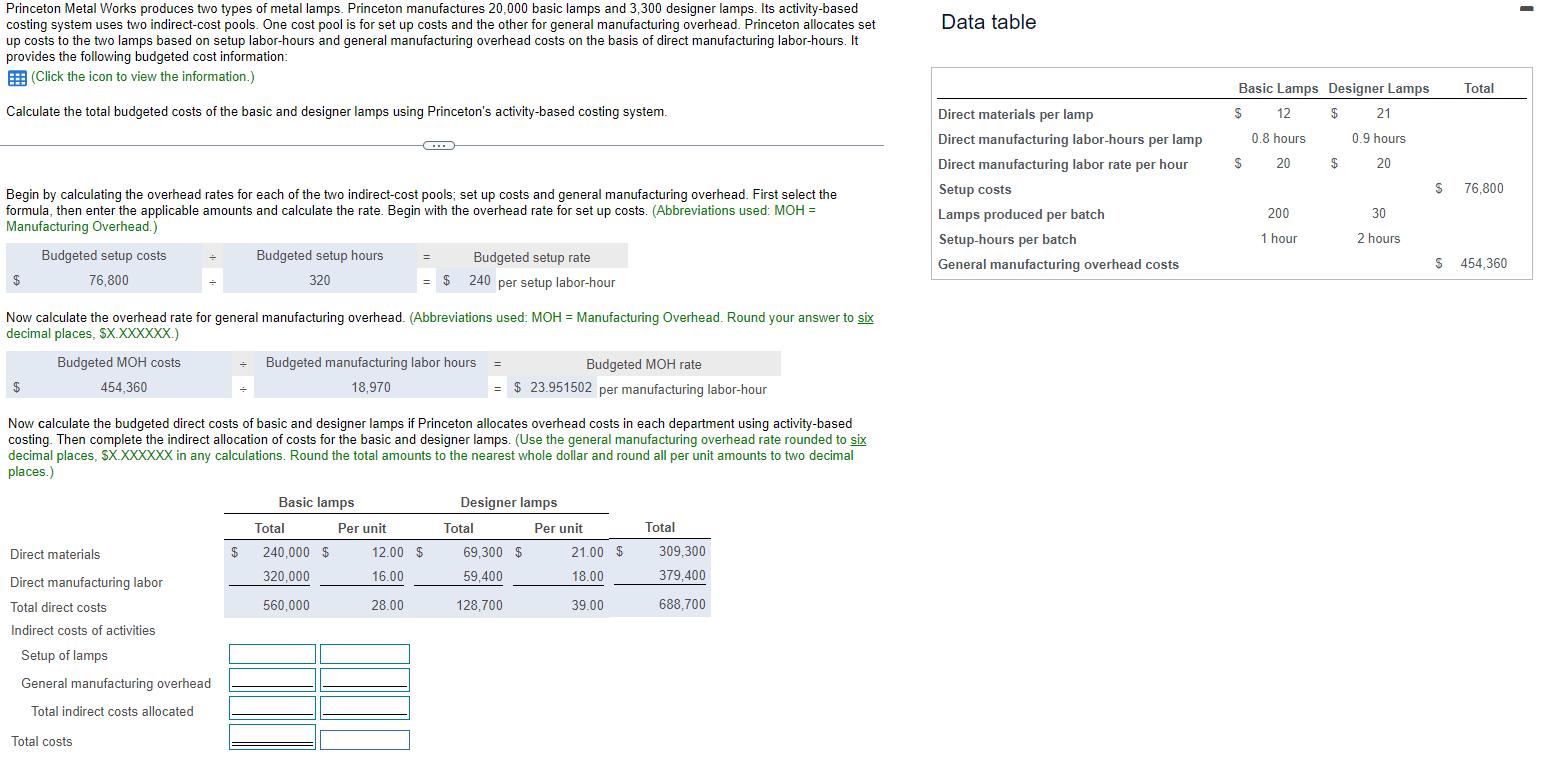

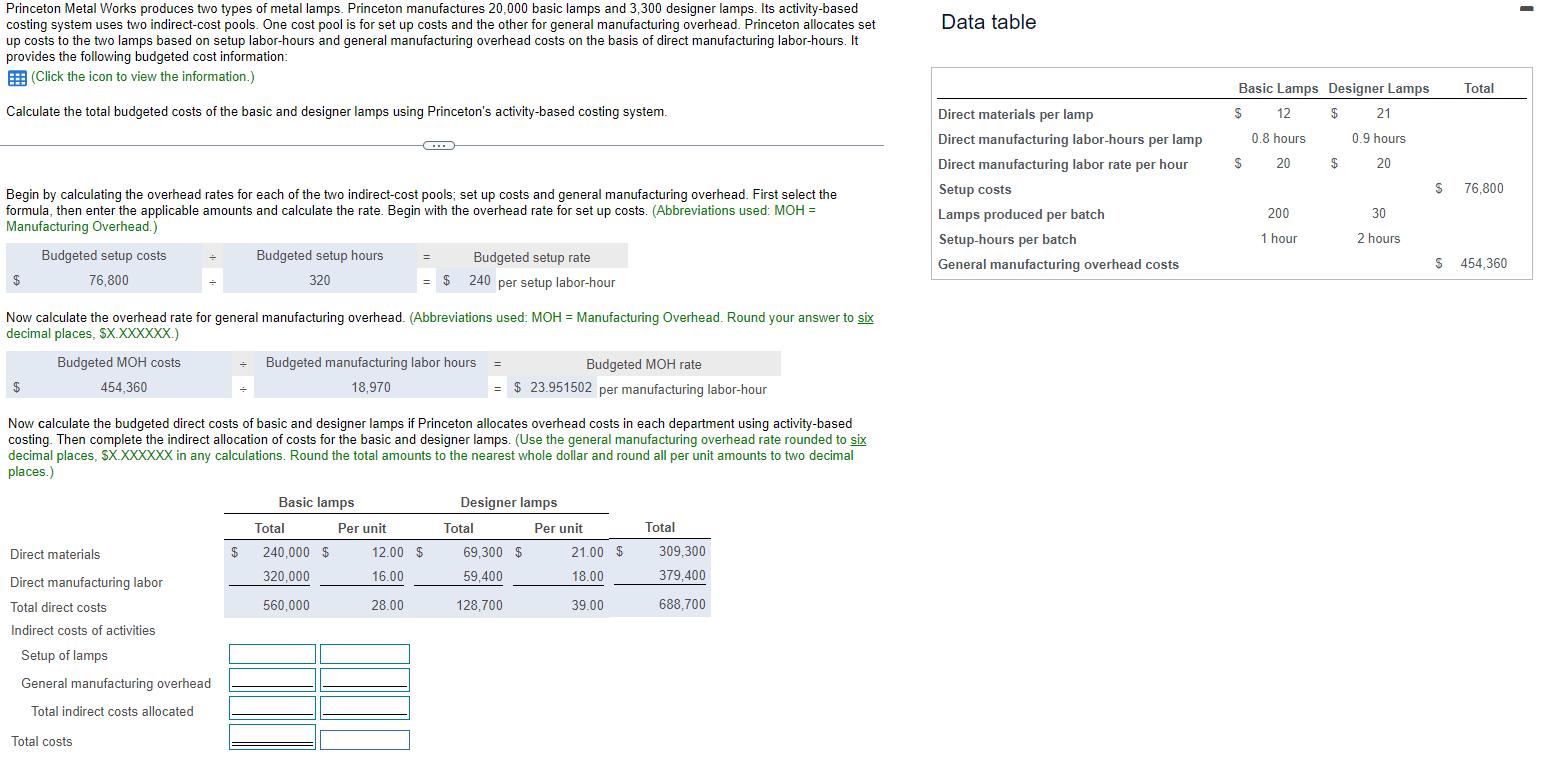

Princeton Metal Works produces two types of metal lamps. Princeton manufactures 20,000 basic lamps and 3,300 designer lamps. Its activity-based costing system uses two indirect-cost pools. One cost pool is for set up costs and the other for general manufacturing overhead. Princeton allocates set table up costs to the two lamps based on setup labor-hours and general manufacturing overhead costs on the basis of direct manufacturing labor-hours. It provides the following budgeted cost information: (Click the icon to view the information.) Calculate the total budgeted costs of the basic and designer lamps using Princeton's activity-based costing system. Begin by calculating the overhead rates for each of the two indirect-cost pools; set up costs and general manufacturing overhead. First select the formula, then enter the applicable amounts and calculate the rate. Begin with the overhead rate for set up costs. (Abbreviations used: MOH = Manufacturing Overhead.) Now calculate the overhead rate for general manufacturing overhead. (Abbreviations used: MOH= Manufacturing Overhead. Round your answer to six decimal places, $X.XXXXXX. Now calculate the budgeted direct costs of basic and designer lamps if Princeton allocates overhead costs in each department using activity-based costing. Then complete the indirect allocation of costs for the basic and designer lamps. (Use the general manufacturing overhead rate rounded to six decimal places, $X.XXXXXX in any calculations. Round the total amounts to the nearest whole dollar and round all per unit amounts to two decimal places.) Princeton Metal Works produces two types of metal lamps. Princeton manufactures 20,000 basic lamps and 3,300 designer lamps. Its activity-based costing system uses two indirect-cost pools. One cost pool is for set up costs and the other for general manufacturing overhead. Princeton allocates set table up costs to the two lamps based on setup labor-hours and general manufacturing overhead costs on the basis of direct manufacturing labor-hours. It provides the following budgeted cost information: (Click the icon to view the information.) Calculate the total budgeted costs of the basic and designer lamps using Princeton's activity-based costing system. Begin by calculating the overhead rates for each of the two indirect-cost pools; set up costs and general manufacturing overhead. First select the formula, then enter the applicable amounts and calculate the rate. Begin with the overhead rate for set up costs. (Abbreviations used: MOH = Manufacturing Overhead.) Now calculate the overhead rate for general manufacturing overhead. (Abbreviations used: MOH= Manufacturing Overhead. Round your answer to six decimal places, $X.XXXXXX. Now calculate the budgeted direct costs of basic and designer lamps if Princeton allocates overhead costs in each department using activity-based costing. Then complete the indirect allocation of costs for the basic and designer lamps. (Use the general manufacturing overhead rate rounded to six decimal places, $X.XXXXXX in any calculations. Round the total amounts to the nearest whole dollar and round all per unit amounts to two decimal places.)