Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Principal Company is a U.S.-based company that prepares its consolidated financial statements in accordance with U.S. GAAP. Principal reported net income of $ 2,600,000

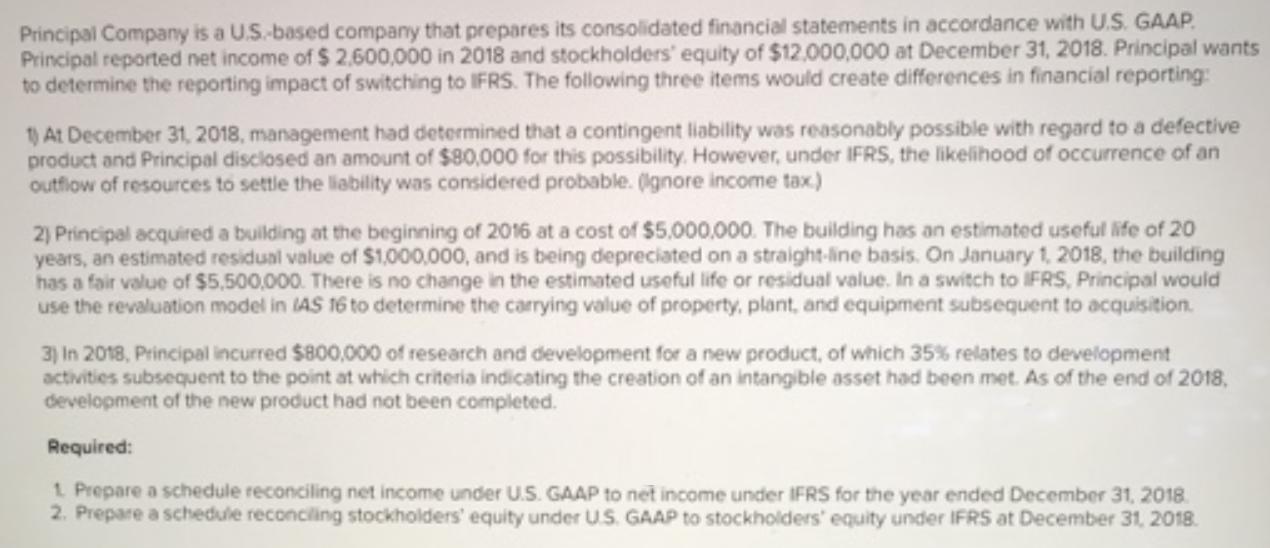

Principal Company is a U.S.-based company that prepares its consolidated financial statements in accordance with U.S. GAAP. Principal reported net income of $ 2,600,000 in 2018 and stockholders' equity of $12.000,000 at December 31, 2018. Principal wants to determine the reporting impact of switching to IFRS. The following three items would create differences in financial reporting: 1) At December 31, 2018, management had determined that a contingent liability was reasonably possible with regard to a defective product and Principal disclosed an amount of $80,000 for this possibility. However, under IFRS, the likelihood of occurrence of an outflow of resources to settle the liability was considered probable. (Ignore income tax) 2) Principal acquired a building at the beginning of 2016 at a cost of $5.000,000. The building has an estimated useful life of 20 years, an estimated residual value of $1,000,000, and is being depreciated on a straight-line basis. On January 1, 2018, the building has a fair value of $5.500,000. There is no change in the estimated useful life or residual value. In a switch to IFRS, Principal would use the revaluation model in IAS 16 to determine the carrying value of property, plant, and equipment subsequent to acquisition. 3) In 2018, Principal incurred $800,000 of research and development for a new product, of which 35% relates to development activities subsequent to the point at which criteria indicating the creation of an intangible asset had been met. As of the end of 2018, development of the new product had not been completed. Required: 1. Prepare a schedule reconciling net income under U.S. GAAP to net income under IFRS for the year ended December 31, 2018. 2. Prepare a schedule reconciling stockholders' equity under U.S. GAAP to stockholders' equity under IFRS at December 31, 2018.

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

luooreut Year ended Dec 312018 26 000 00 sreconeiliation g Net Inl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started