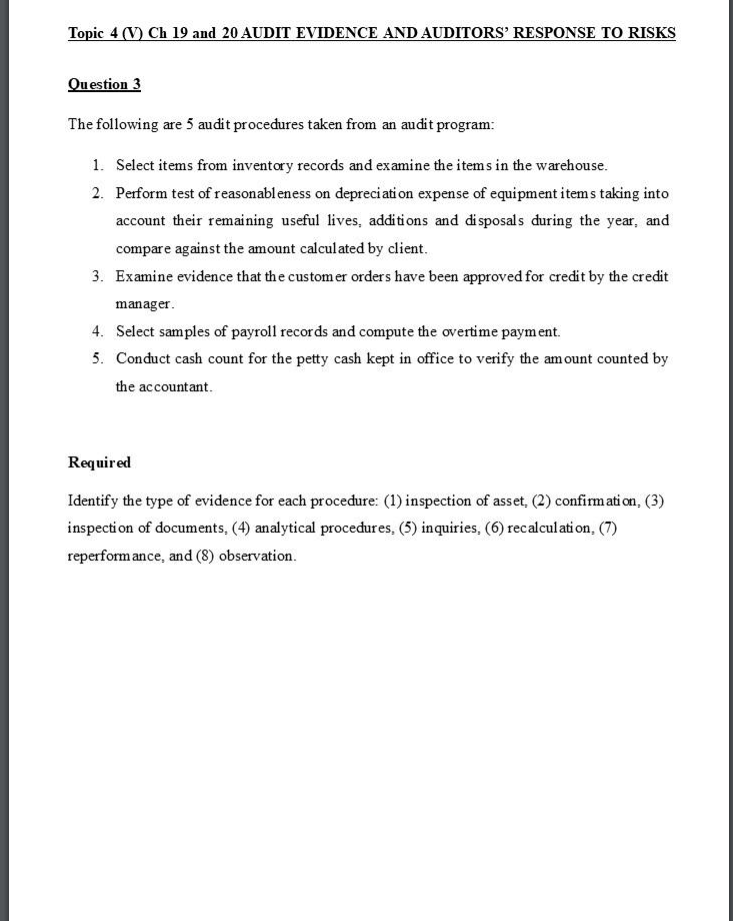

Principles of Auditing 2019/20 Semester 2 Home Exercise Topic 4 (III and IV) Ch 16 and 17 INTERNAL CONTROLS AND AUDIT RISKS Question 1 The following are internal controls related to various cycles: 1. Cheques are signed by the company president 2. Sales invoices are matched with shipping documents by the computer system and an exception report is generated. 3. Receiving reports are prenumbered. 4. Sales invoices are independently verified before being sent to customers. 5. Payments by cheque are received in the mail by the receptionist, who lists the cheques and restrictively endorses them Required a. For each internal control, identify the type of specific control activity to which it applies (such as proper authorization and information processing) For each internal control, identify one assertion to which it applies. b. Question 2 The following are misstatements that have occurred in a trading company: 1. A purchase clerk regularly orders goods for personal use. These orders always cost less than $3,000. The company requires authorization only for purchase orders above $3,000. The finance director only approves the total amount of payments to be made from a list of payees, some of whom are fictitious. The sales ledger clerk takes a vacation during Christmas. Upon returning in January, she enters all the unrecorded sales that were pending from December as January's sales for the sake of convenience. Required a. b. c. Identify one type of control that were absent. Identify the assertion impacted. Suggest a control that may have prevented or detected the misstatement. Topic 4 V) Ch 19 and 20 AUDIT EVIDENCE AND AUDITORS' RESPONSE TO RISKS Question 3 The following are 5 audit procedures taken from an audit program: 1. Select items from inventory records and examine the items in the warehouse. 2. Perform test of reasonableness on depreciation expense of equipment items taking into account their remaining useful lives, additions and disposals during the year, and compare against the amount calculated by client. 3. Examine evidence that the customer orders have been approved for credit by the credit manager 4. Select samples of payroll records and compute the overtime payment. 5. Conduct cash count for the petty cash kept in office to verify the amount counted by the accountant. Required Identify the type of evidence for each procedure: (1) inspection of asset (2) confirmation, (3) inspection of documents, (4) analytical procedures, (5) inquiries, (6) recalculation. (7) reperformance, and (8) observation. Topic 4 (IV and V) Ch 17 and 20 AUDIT RISKS and AUDITORS' RESPONSE TO RISKS Question 4 CC Co (CC) manufactures electronic products and the accounting year end is 30 June 20X8. You are an audit manager of a CPA firm and are currently planning the audit of CC. The following information was obtained in the planning meeting with the audit engagement partner and finance director of CC: CC's trading results have been strong this year and the company is forecasting revenue of $40 million, which is an increase from the previous year. The company has invested significantly in the production process at the factory. This resulted in expenditure of $2 million on updating, repairing and replacing a significant amount of the machinery used in the production process. As the level of production has increased, the company has expanded the number of warehouses it uses to store inventory. It now utilises & warehouses; some are owned by CC and some are rented from third parties. There will be inventory counts taking place at all 8 of these sites at the year end. Required Identify at least TWO audit risks and the auditor's response to each risk, in planning the audit. Audit risk (Ch 17) Auditor's response (Ch 20)